Coin Metrics has unveiled version 2.1 of its Trusted Exchange Framework, designed to evaluate the “quality of exchanges across diverse use cases.” Interestingly, the exchanges with the highest volume didn't secure the top ratings.

Source: coinmetrics.io

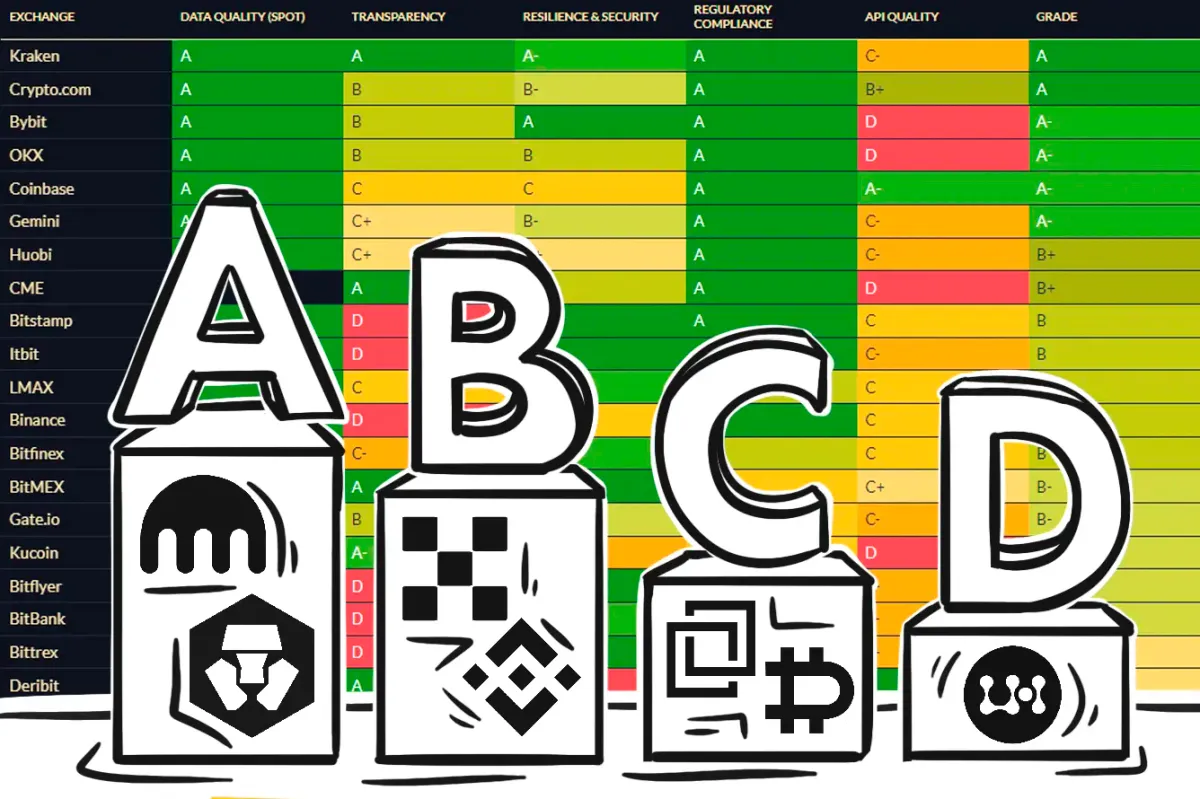

The overall rating ranks the top 30 centralized crypto exchanges, giving them an “A-D” grade based on several criteria:

- The Data Quality score checks if an exchange's reported trades are real, using methods like number pattern analysis to detect fake volumes.

- The Transparency score rates how well an exchange shares its information publicly. It's based on checks like whether an exchange can prove what assets and liabilities it has and if it is being checked by auditors regularly.

- The Resilience & Security score rates an exchange's user protection based on its adherence to security standards and its history of handling major incidents and breaches.

- The Regulatory Compliance score checks how well an exchange meets legal standards based on its location, registrations, and extra steps it takes to comply with regulations.

- The API Quality score rates an exchange’s API usability, and how well it supports automated actions like data reading or trade execution.

Based on the above criteria, the only two exchanges that have received an “A” grade are Kraken and Crypto.com. According to the rating methodology, “A” grade exchanges excel in most or all assessed factors, boasting top-quality data and efficient markets. Notably, both of these exchanges hold only around a 3% market share each in the total trading volume.

The top exchanges by volume did not secure the highest ratings. Binance, despite holding a 38.5% market share of monthly exchange volume, received only a “B” grade. According to methodology, exchanges in this tier are of good quality but face minor penalties in Data Quality, Regulatory Compliance, Transparency, and Resilience and Security, preventing them from reaching the A tier.

Binance received a notably low Transparency score, which seems justified.

Source: theblock.co

Nevertheless, Binance earned an “A” grade for Data Quality, indicating that the exchange boasts solid liquidity and does not fake its trading volume.

In contrast, Upbit holds the second spot in monthly exchange volume with a 13.9% market share. However, Coin Metrics suggests that a considerable portion of this volume might be fake, which has led to a “D” grade for Upbit’s Data Quality.

Interestingly, within the top 15 exchanges listed, Coinbase offers the highest API quality, highlighting their emphasis on catering to institutional traders.

While ratings from sources like Coin Metrics can be good indicators of an exchange's overall quality, they should not be the sole factor in choosing an exchange for trading. Moreover, unforeseen “black swan” events, as seen with FTX, can occur, and no rating can predict such events.

Therefore, it is highly advisable not to store your funds on a centralized exchange. Remember not your keys, not your crypto!