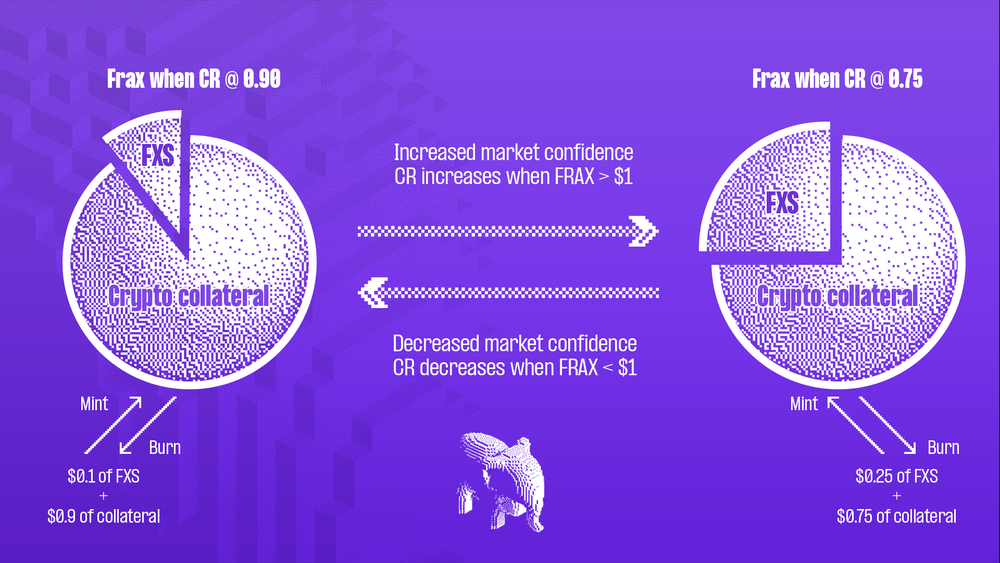

In mid-February, FIP-188 proposal was opened which invited the Frax Finance community to vote for or against abandoning the algorithmic element of a stable coin in favour of switching to a fully secured token scheme.

“This is a significant change to the protocol that over time effectively retires the algorithmic backing of Frax. It has become clear to many active in the community that this is the best path forward. The intention of this proposal is to coordinate the community on increasing the CR to 100% permanently.”- the proposal says.

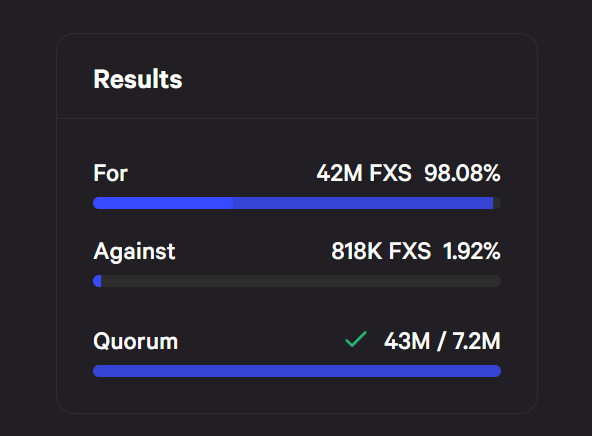

As a result of the vote, 98% of the community voted to abandon the algorithmic part of the stablecoin and set the target security coefficient equal to 100%.

The proposal contained three main points on how to achieve 100% collateral ratio:

- To increase the reserves, it is proposed to retain the profit from the protocol. They emphasized that it cannot be done instantly, so it is a long-term prospect.

- The protocol will not create additional FXS to fund this move, FXS buybacks will also be paused.

- Put a cap of $3 million per month of frxETH buyout. frxETH is similar to a stablecoin, but tied to Ether. It was launched a few months ago and aimed to facilitate the transfer of ether liquidity in the Frax ecosystem.

This decision is probably due to the fact that algorithmic stablecoins have been crashing lately.

“Frax has always approached the algorithmic backing of FRAX conservatively. Even before launch, it was clear that relying on FXS to back the algorithmic portion of FRAX required locked liquidity to ensure smooth functioning of the protocol. Unfortunately, we have now seen many projects that didn’t understand this and failed.” - the proposal says.

In addition to the infamous UST algorithmic coin, the collapse of which had a dramatic impact on the entire crypto market, there were other unsuccessful examples. USN, the stablecoin of the NEAR ecosystem stopped working after experiencing a lack of security a few months after abandoning the algorithmic mechanism for supporting stablecoin.

Let's hope that Frax will not experience problems like USN and the rejection of the algorithmic mechanism of stablecoin support will be successful and will have a positive impact. We will continue our observations and inform you about the news!