Kaiko Research. Does Binance Push TrueUSD?

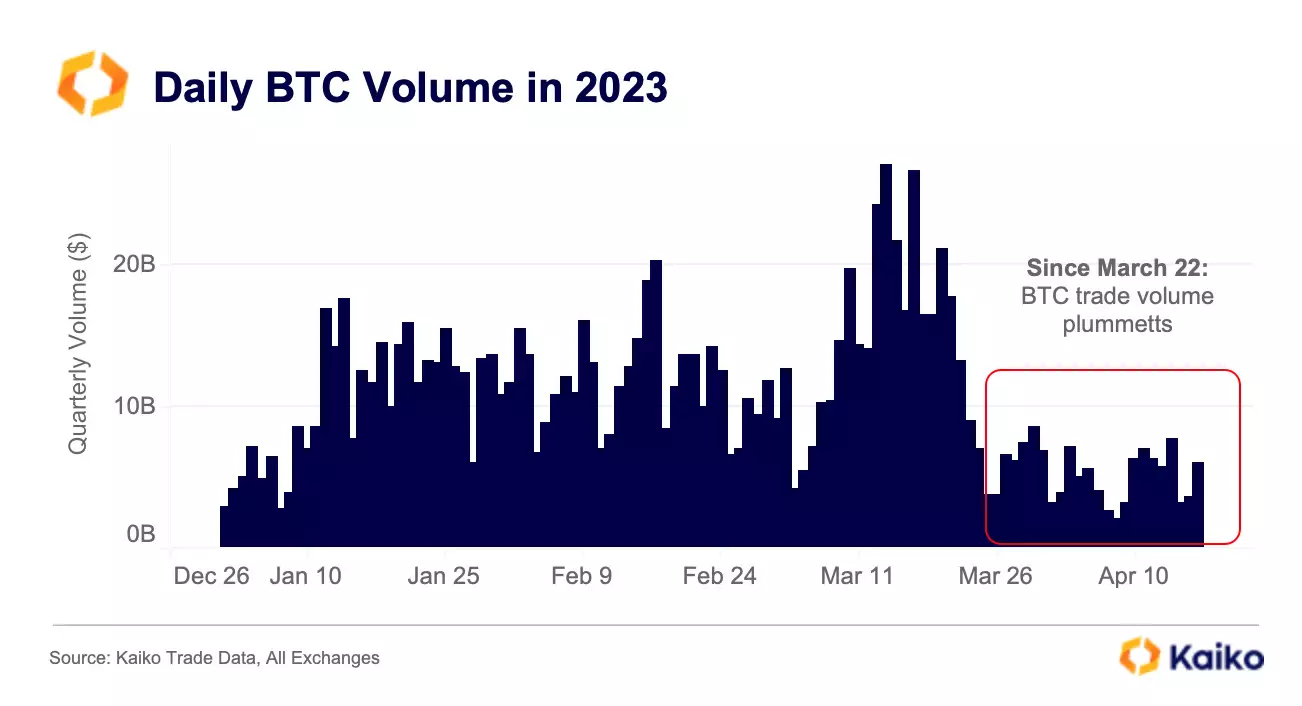

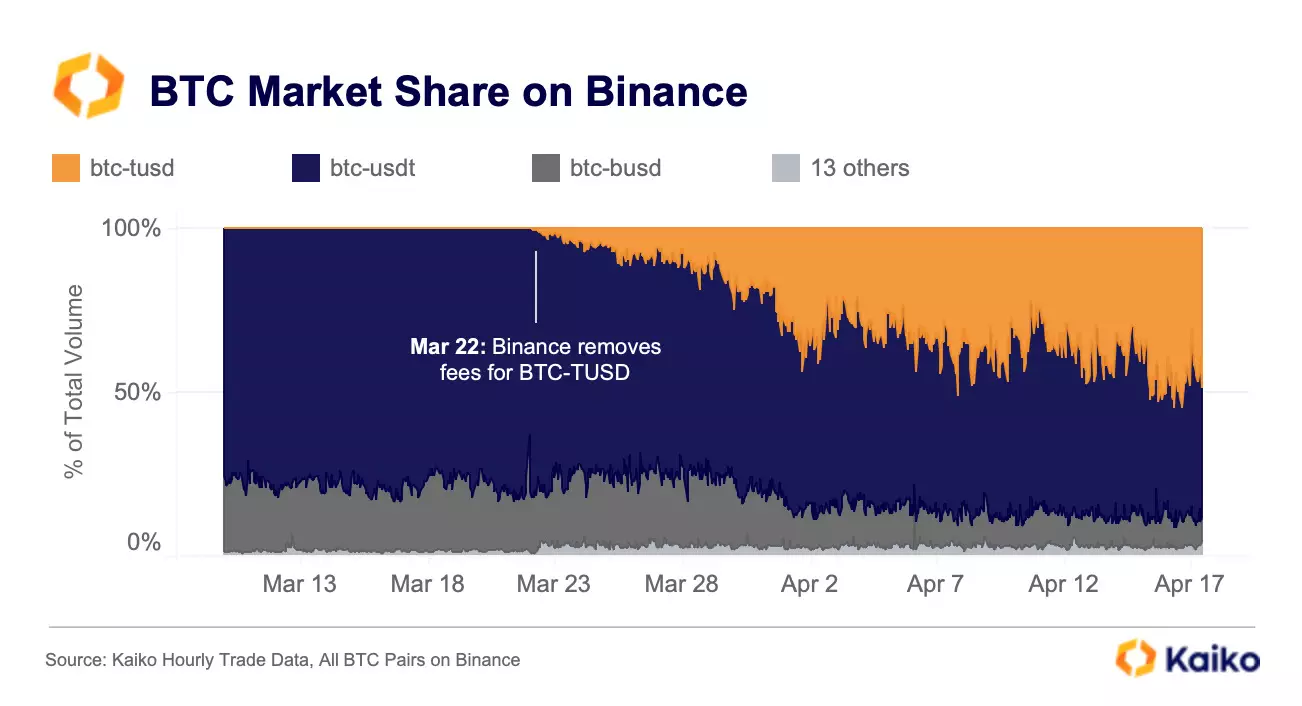

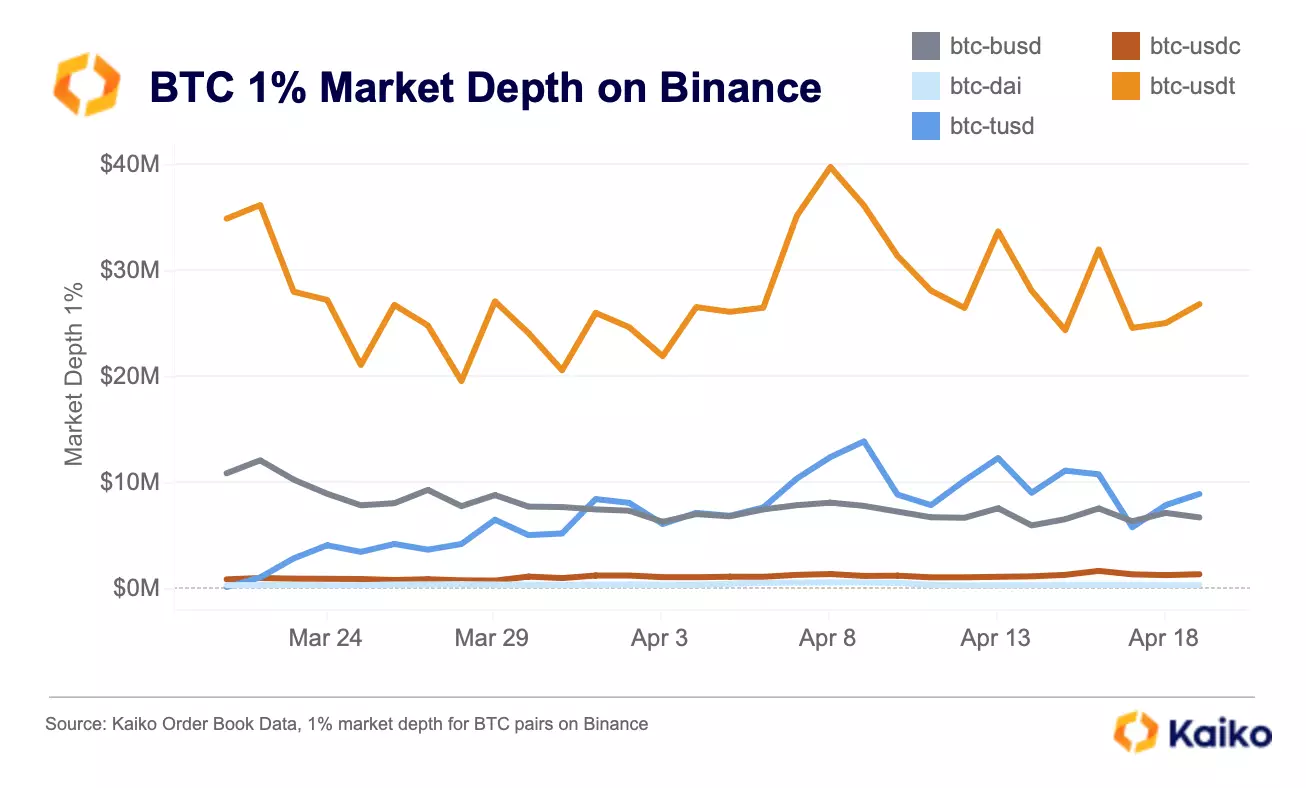

The leading information provider about the crypto market, Kaiko, released the report "The Binance Effect" on March 20. The report describes in detail how the exchange's actions affect the growth of the TrueUSD stablecoin and why the TUSD-BTC trading pair has become the most popular.