After Paxos received Wells' notification regarding BUSD, difficult times began for the stablecoin: the market capitalization rapidly went down, and Coinbase announced the termination of its trading. What does the head of Binance, CZ think about this? Let's look at all these events in more detail.

130 million TrueUSD for Binance.

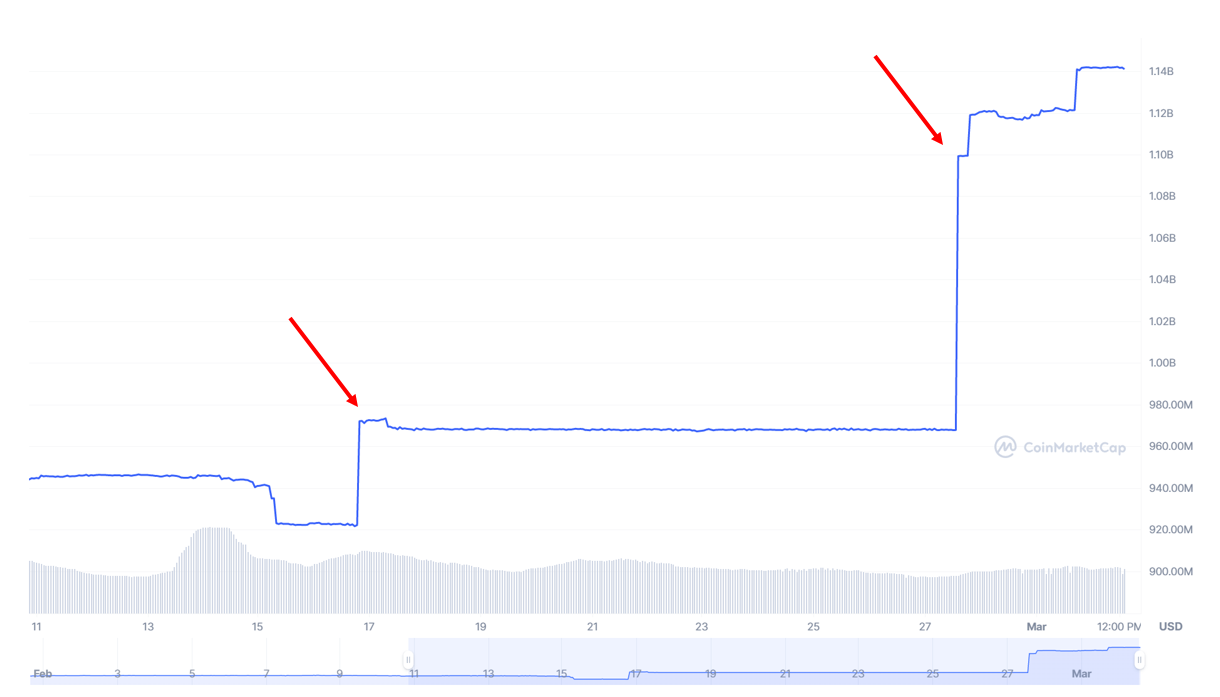

After the BUSD stablecoin problems with the SEC, the head of Binance announced that the exchange would diversify its assets held in stablecoins in order to completely abandon its own BUSD over time. A couple of days later, on 16 February, 50 million TrueUSD were released for Binance.

On Twitter, users immediately noted that this action had a profound impact on TrueUSD. The price of the token soared by 200 percent.

50M #TUSD minted at #Binance and the price of $TRU increased by 200%.

— Lookonchain (@lookonchain) February 16, 2023

On-chain data shows that #Alameda and #justinsun are the two largest minters of $TUSD.#Alameda minted a total of 1.64B $TUSD in history.#justinsun minted a total of 889M $TUSD in history. pic.twitter.com/N1tUjFQm5U

However, this was not the only acquisition of TUSD by the exchange. On February 27, Binance added another $80 million to its assets. Providing the second jump in the price and market capitalization of TUSD in a week.

Thanks to these actions, the Binance exchange issued 130 million TUSD in a week, ensuring TUSD's rise to the fifth place among all stablecoins, overtaking Frax Finance (FRX). To date, the market capitalization of the stablecoin, according to coinmarketcap, is $1.14 billion.

Coinbase Suspends BUSD Trading.

One of the largest cryptocurrency exchanges, Coinbase, informed users on February 27 that it would stop trading BUSD on March 13 due to the non-compliance of the stablecoin with the requirements of the exchange's listing standards.

We regularly monitor the assets on our exchange to ensure they meet our listing standards. Based on our most recent reviews, Coinbase will suspend trading for Binance USD (BUSD) on March 13, 2023, on or around 12pm ET.

— Coinbase Assets (@CoinbaseAssets) February 27, 2023

In their Twitter account, Coinbase clarified that despite the suspension of BUSD trading, users will be able to withdraw their stablecoins at any time.

Trading will be suspended on https://t.co/Zkd27RUMRo (Simple and Advanced Trade), Coinbase Pro, Coinbase Exchange, and Coinbase Prime.

— Coinbase Assets (@CoinbaseAssets) February 27, 2023

Your BUSD funds will remain accessible to you, and you will continue to have the ability to withdraw your funds at any time.

CZ about BUSD and future of stablecoins.

Answering questions during his Twitter Spaces speech, CZ told the audience that the exchange hadn’t placed big bets on the success of BUSD and it was ready to fail.

“To be honest BUSD was never a big business for us, when we started I actually thought the BUSD project may fail, so we actually don’t have very good economics on that collaboration.” – said CZ.

You probably remember how the Binance exchange launched the automatic conversion of a number of stablecoins into its own BUSD. This allowed BUSD to quickly expand its influence among stablecoins, while stablecoins subject to automatic conversion on the exchange suffered losses. It looked like a deliberate strategy for the development and strengthening of the BUSD market. That's probably why the statement from the head of the CZ exchange looks a little contradictory.

He also stressed that the actions of regulators may lead to stablecoins which are pegged to the dollar becoming less popular than coins pegged to other currencies. And perhaps there might be a transition to algorithmic stablecoins. In this scenario, the exchange will look at stablecoins tied to the euro and the Japanese yen.

“I think with the current stances taken by the regulators on the U.S. dollar-based stablecoin, the industry will probably move away to a non-U.S. dollar-based stablecoin, back to algorithmic stablecoins.” - said CZ.

Today we can observe that BUSD's affairs are getting complicated. The stablecoin is excluded from the listing of a major exchange, its market capitalization continues to fall, but it all seems to suit its owners. How soon will BUSD lose its position among stablecoins? How will this affect the stablecoin market? While we do not have answers to these questions, we will continue our observations and share with you the most interesting!