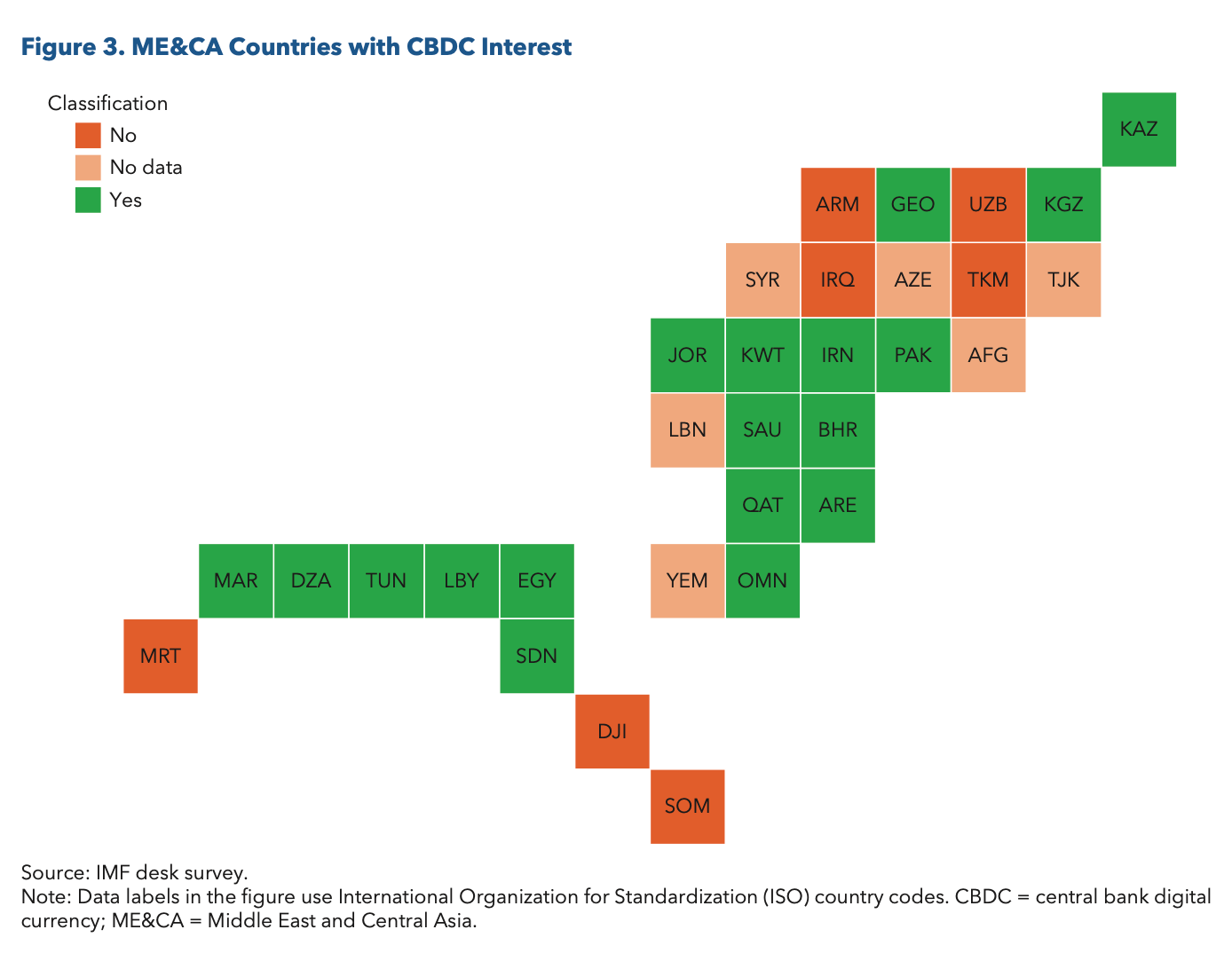

New research shows 19 countries in the Middle East and Central Asia are now exploring whether to launch central bank digital currencies — with the International Monetary Fund declaring they "could promote financial inclusion if they address the inherent inefficiencies of the payment system."

The IMF says access to bank accounts in the region is below the global average, and CBDCs that can operate offline will be crucial if they're to be successfully used in low-income areas with little internet access, or conflict-affected economies.

While the population is "digitally savvy," data within the study suggests that encouraging consumers to switch to a CBDC may be an uphill struggle. Just 40% of payments in the Middle East and Central Asia were made digitally in 2021, with "underdeveloped systems and high informality" leading to a reliance on cash.

The region lags behind East Asia as well as Latin America and the Caribbean in this regard. A greater proportion of digital payments are also made in sub-Saharan Africa, where mobile money services are especially popular.

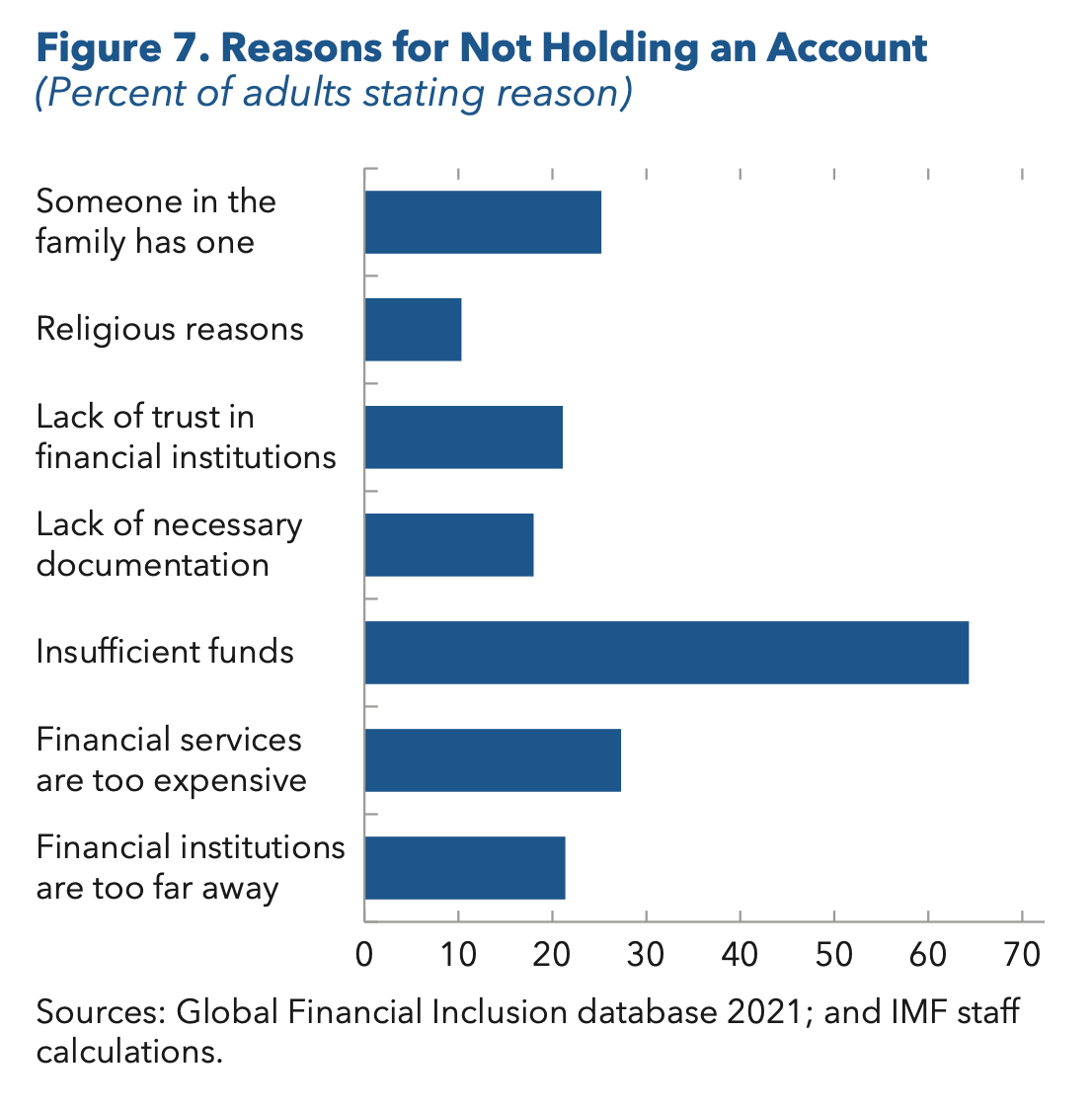

There could be other factors that affect the uptake of CBDCs too, as this table shows:

IMF economists warn that such digital assets should not be treated as "a panacea" for the economic challenges, adding:

"CBDCs may also not be able to overcome existing barriers to financial inclusion, such as those due to limited identification and financial literacy, low wealth, and high informality."

Proposed workarounds to the issue of limited identification include "a tiered selection of wallets with different limits for holding balances and transactions, allowing for greater anonymity for lower limits."

Nonetheless, another area of opportunity highlighted by the report centers on remittances, with flows to ME&CA nations hitting $447 billion in 2021. Cash is the main instrument used when foreign workers are sending funds home to their loved ones — and although the cost of using banks and money transfer operators is below the global average, fees still stand at about 5%.

That means families lose $10 for every $200 they receive — a figure that could be lowered considerably through a CBDC. If the $447 billion is taken as a whole, that's $22 billion that could be injected into local economies.

As the IMF explains in its report:

"CBDCs have the potential to advance financial inclusion by creating more competition for consumers and allowing for transactions to be settled more directly through reduced intermediation, thereby lowering the cost of financial services and making them more accessible. Unlike commercial banks, the lack of a profit motive by the central bank can also help keep costs lower."

As 19 countries across the Middle East and Central Asia pursue the development of CBDCs, one key question is this: what technology are they turning to?

A recurring theme in the region relates to whether countries should build their own infrastructure internally, or depend on open-source or private alternatives. According to the International Monetary Fund, permissioned DLT platforms are proving popular, as they allow central banks to retain key controls.

Iran has little choice but to use open-source platforms, as the U.S. has been aggressive in sanctioning businesses involved in exporting American technology to the state's central bank.

The digital rial runs on a permissioned DLT called Borna that's been built using open-source Hyperledger Fabric — and there's little to stop this from happening.

Meanwhile, Egypt has opted to join a global blockchain initiative led by R3 as it tries to address the technological challenges brought up by its CBDC's design.

The deep-pocketed United Arab Emirates has been outsourcing specific elements of its central bank digital currency to select partners. It says R3's Corda platform is "an ideal foundational technology" for issuing and distributing CBDCs, with the local firm G42 Cloud also tapped to "play a critical role in the successful deployment and adoption" of the digital dirham.

IMF authors were especially complimentary about Ripple Labs — noting its "cutting-edge" platform has been used to establish a live pilot in Georgia. This country's previously said its main motivation for a digital lari is to foster financial inclusion.

But there's a wider issue that needs to be discussed.

While the IMF notes that existing cross-border payment systems are prone to friction — primarily due to fragmented data and a lack of interoperability between platforms — there is a risk of history repeating itself as CBDCs go live. Careful attention must be paid to ensuring that shiny, new permissioned DLTs can talk to each other, with funds moving from one jurisdiction to another seamlessly.

The report concludes that countries in the Middle East and Central Asia have the potential to "become leaders and pioneers in CBDC technology."

But given that blockchains and distributed ledger technology remain relatively new solutions — and there are "limited innovators that the region can look to for comparison and guidance" — the IMF believes that decisions made in the earliest stages of a pilot project could determine how successful a digital currency turns out to be:

"The choice of CBDC technologies could have far-reaching implications for the efficiency, security, and resilience of the payment system centered around the digital currency

Overall, the report strikes an optimistic but cautious tone over the prospect of CBDCs in the Middle East and Central Asia. Key questions left unanswered include whether the benefits would outweigh the costs, whether such assets could jeopardize existing financial institutions, and whether the same results could be achieved by "adopting or improving other digital payment systems."