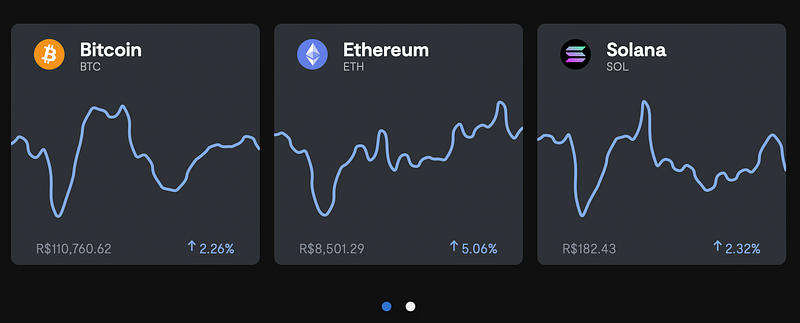

The platform called Mynt by BTG Pactual allows users to trade BTC, ETH, SOL, DOT and ADA with a minimum investment of 100 Brazilian reals (around 20 USD) and is available only to locals.

This is not the first crypto project by BTG: in 2019, the bank issued ReitBZ, an investment token backed by real estate, in 2021 it launched a bitcoin fund, the first managed by a financial institution in the country, and later opened a fund based on ether.

BTG is not the only one in Brazil diving into crypto. Among other important examples are:

- XP, the largest Brazilian brokerage by market value, has just launched a crypto trading platform XTAGE for BTC and ETH in cooperation with Nasdaq (and plans to add 10 other coins by the end of the year).

- Mercado Libre, Latin America’s largest e-commerce company by market value, allowed users in Brazil to buy, sell and hold cryptocurrencies and recently announced the launch of its own token Mercadocoin which will be a part of its loyalty program.

Other major Brazilian fintech players who have started offering crypto trading services over the last few months are Nubank (the largest Brazilian digital bank by market value) and PicPay (a Brazil-based digital payments app with 30 million active users).

All in all, Latam is a great region for blockchain initiatives taking into account the popularity of crypto among people and quite “flexible” regulations. Brazil is in the spotlight. It registered a 10% inflation rate in 2021 and steady depreciation of its currency against the U.S. dollar. Moreover, Brazilian Central Bank prohibits locals to save U.S. dollars in domestic bank accounts plus they have to pay special tax when buying foreign currencies. Such a mix has made crypto extremely popular among people and led to the boom of crypto trading in 2021 when traded volume of stablecoins tripled. Plus Bitcoin trades are not taxable in Brazil, although operations with blockchain-based currencies are discouraged by financial authorities due to their high operational risks.

Brazil seems to be a fertile ground for crypto projects, but lacking a regulatory framework. Let’s observe what the harvest will bring.