With all the fanfare around Coinbase launching its Ethereum layer-2 network Base, it is easy to forget that the largest U.S. crypto exchange has other ongoing business… lots of it, in fact.

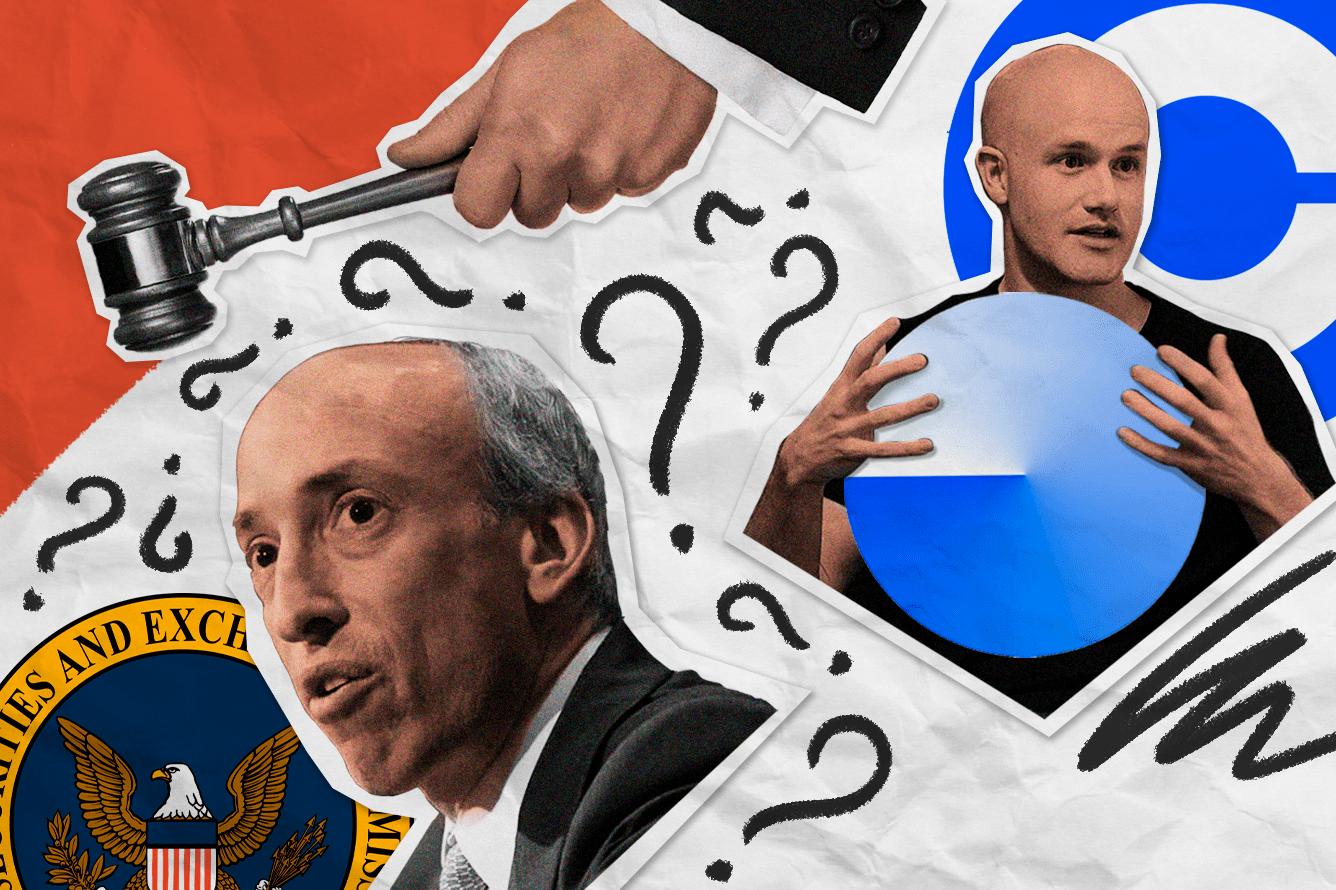

Just last week the company filed a motion to have the lawsuit brought against it by the U.S. Securities and Exchange Commission (SEC) in June dismissed. The key argument supporting this motion is simply that Coinbase does not trade securities.

In its June filing the SEC listed 13 tokens that it claimed were securities, all of which are traded on the Coinbase exchange. However, as Coinbase counters, the regulator does not make a claim that there are ‘investment contracts’ or ‘contractual undertaking’ attached to any of these examples.

It also suggests that the SEC misreads the Howey Test, which in itself is a controversial tool for determining whether a modern concept like cryptocurrency is a security. This alleged misreading leads the regulator to assert that a ‘scheme’, even without a contractual undertaking, represents a security.

This has not been borne out in recent court cases such as the one in which Ripple scored a partial-victory.

Perhaps slightly disingenuous, considering its previously stated position that crypto is ‘the future of finance’, is the reduction of digital assets to the level of Beanie Babies. While we would agree that secondary sales certainly have no investment contract attached, the comparisons made perhaps devalue cryptocurrency somewhat:

“On Coinbase’s secondary-market exchange and through Prime, there is no investment of money coupled with a promise of future delivery of anything. There is an asset sale. That’s it. It is akin to the sale of a parcel of land, the value of which may fluctuate after the sale. Or a condo in a new development. Or an American Girl Doll, or a Beanie Baby, or a baseball card.”

At the end of July, before the latest court filing, Coinbase CEO Brain Armstrong told the Financial Times that the SEC had asked the exchange to delist all assets other than bitcoin, right before it sued the company in June. This would have led to ‘the end of the cryptocurrency industry in the U.S.’, according to Armstrong…

Except that a spokesperson for Coinbase quickly backtracked on the statement, claiming that the FT report had taken the comments out of context, and that while certain SEC operatives may have expressed such feelings, this was not an official request from the regulator.

Finally, on Monday Coinbase announced that it is to buy back up to $150 million of its 2031 debt bonds, for a rate of 64.5 cents on the dollar, or a 35.5% discount. The bonds were trading at 62 cents at market close on Monday, but had been trading as low as 52 cents in November last year.

With all that going on, it’s a wonder the exchange has time to launch its own blockchain.