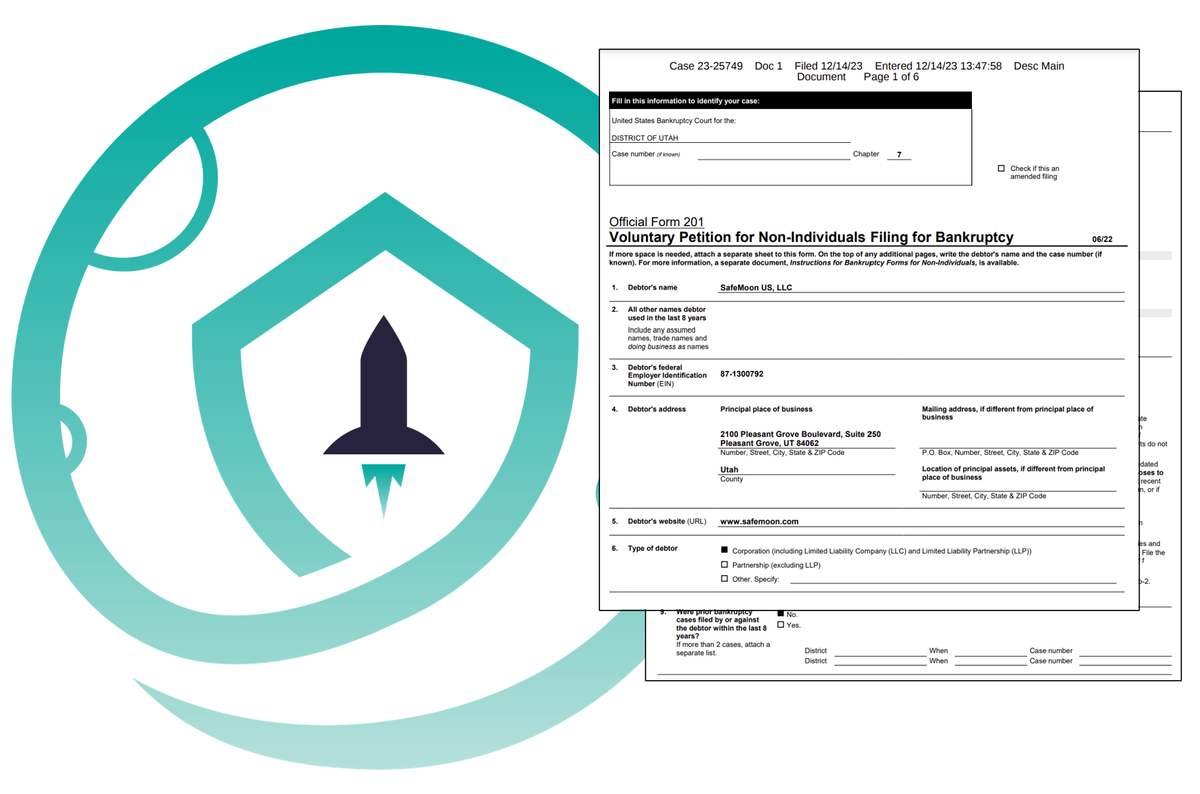

DeFi protocol SafeMoon has filed a voluntary petition for Chapter 7 bankruptcy to the United States Bankruptcy Court in the District of Utah.

A company becomes bankrupt when the value of its assets is less than the value of its liabilities, although this is not the case according to SafeMoon’s ‘self-esteem’: the company has estimated its assets to be between $10 million and $50 million and its liabilities to be between $100,001 and $500,000. According to the filing, the estimated number of creditors is between 50 and 99. The filing was signed by chief restructuring officer Kenneth Ehrler, allegedly from M3 Partners, which was also one of Celsius’ advisers in its bankruptcy process.

A letter, allegedly also signed by Ehrler and addressed to SafeMoon’s workers, states that their employment is terminated, they need to file claims for unpaid wages, and they should return all company property in their possession - the ultimate Christmas combo. One ex-employee posted that "the warning signs were there," referring to an unspecified moment when many of the employees were "abruptly fired over several weeks."

In November, the U.S. Department of Justice (DoJ) arrested SafeMoon executives, Braden John Karony and Thomas Smith, over an alleged $200 million investor fraud. Smith was released on a $500,000 bond and is pursuing a plea deal, while Karony’s bail release order was put on hold as prosecutors consider him a high flight risk. SafeMoon's creator, Kyle Nagy, also faces charges of securities fraud, wire fraud conspiracy, and money laundering but is still at large and has possibly fled the country.

The SEC has also filed civil charges against SafeMoon and the three executives for unregistered token sales. SafeMoon had vowed to lock users' staked funds in a liquidity pool, but the SEC claims that many of these funds were not secured as promised. The authority also alleges that the executives engaged in market manipulation by using funds that were earmarked as 'locked' to purchase significant quantities of their token SFM, intending to drive up its market price artificially. The SEC first suggested potential misconduct by SafeMoon's management at the time of the $8.9 million exploit this March.

The SafeMoon token has crashed in value since the news broke. SFM initially plummeted by over 30% in early November and had been volatile since then. Following the bankruptcy filing, SFM fell again by over 50%, reaching as low as $0.000029, but then slightly rebounded and is trading at $0.000041 at the time of writing.