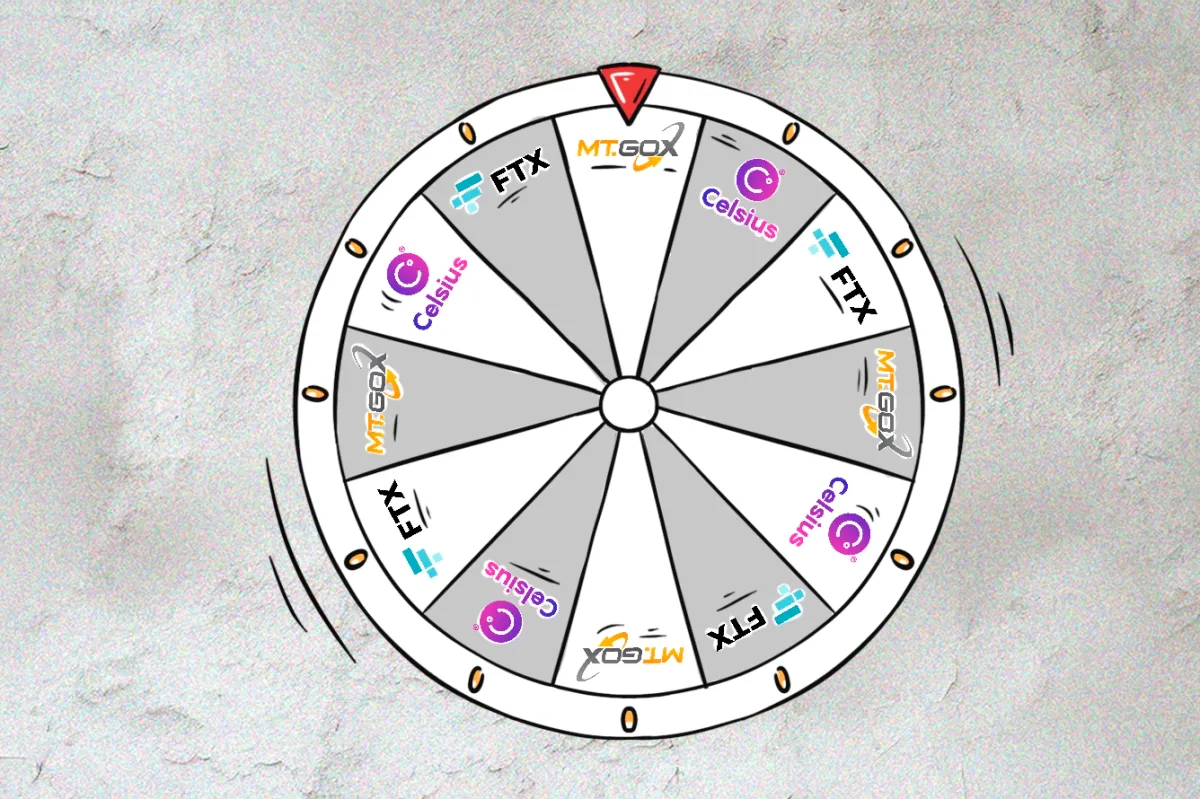

Recently, we have observed some progress in the redistribution of assets from certain high-profile crypto bankruptcies. As the story continues to unfold, we bring you the latest updates.

Celsius

18 months after the company paused all transfers and withdrawals due to "extreme market conditions,” Celsius now appears to have made it through to the other side. The crypto lender has completed the restructuring process and successfully emerged from bankruptcy, it announced this week.

Celsius recently moved large amounts of Ethereum to centralised exchanges, allegedly in preparation for distributions to creditors. The company outlined that it managed to increase the amount of cryptocurrency for distribution by nearly $250 million dollars “by converting altcoins to BTC and ETH.”

According to the Plan of Reorganisation approved in November by 98% of the company’s account holders, the company will now start asset distribution and create a Bitcoin mining company via a MiningCo transaction approved by the court at the end of December. Ionic Digital stock is expected to be traded publicly after obtaining all the required approvals. Celsius is going to terminate all services and shut down apps by February 28. The distribution will be made through PayPal, Venmo and Coinbase.

“The Plan includes the distribution of over $3 billion of cryptocurrency and fiat to Celsius’ creditors, and the creation of a new Bitcoin mining company—Ionic Digital, Inc.—which will be owned by Celsius’ creditors and will have its mining operations managed by Hut 8 Corp. Today… we began distributing… cryptocurrency, fiat, and stock in Ionic Digital to Celsius creditors.”

Earlier this month, the company started reclaiming user funds subject to withdrawal preference exposure.

FTX

We reported earlier that FTX had struggled to come to a proper agreement concerning crypto asset prices with its former clients. The exchange wants to repay its creditors in dollars with the values calculated at prices on the day FTX filed for bankruptcy in November 2022, although the ex-customers argue that this would cause major losses for them as the prices have risen significantly since then.

During an Omnibus hearing on January 31, the judge reportedly sided with FTX and declined the customer complaints. The company’s legal team promised to focus on providing users with full repayments but warned that this is not guaranteed and is unlikely to happen any time soon.

Attorneys also announced that plans to restart the exchange had been shelved, due to its fundamentally flawed structure and investors’ unwillingness to deal with it:

"FTX was an irresponsible sham created by a convicted felon. The costs and risks of creating a viable exchange from what Mr. Bankman-Fried left in a dumpster were simply too high,” - said FTX attorney Andy Dietderich.

The next hearing is scheduled for February 22. Around the same dates, the FTX legal team is expecting to prepare documents describing how the creditors will be repaid.

Mt.Gox

In December, we observed the first funds received by Mt. Gox creditors via PayPal after almost 10 years of waiting. Last week, creditors received e-mails confirming upcoming payments in BTC or BCH. Since then, creditors have reported receiving initial bank transactions with fiat repayments in Germany and Brazil.

“The wheels are turning!” - commented one of the MtGox creditors. We are indeed happy to finally observe that.