'Yield trading protocol' Pendle has shown incredible growth in onboarded capital, trading volumes and market capitalization since the beginning of the year.

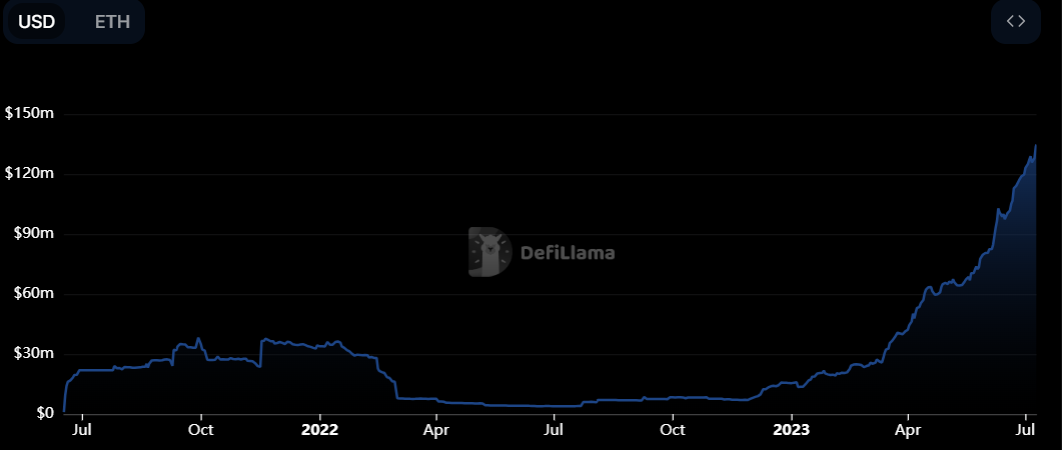

The total value locked (TVL) in the protocol surpassed $130 million this week, together with a record volume of tokens swapped on its internal exchange.

This performance is reflected in the price of the protocol's native PENDLE token, which has surged 1,800% from its pre-trend levels. Reflecting this, earlier in the week Binance announced the listing of the soaring token on its exchange, followed by an announcement from Pendle that the next network it would add support for was Binance's BNB.

Pendle was founded in 2021 by Hong Kong entrepreneur TN Lee and has received venture capital funding of $3.7 million since then. However, it was not until quite recently, when the Ethereum Shapella update allowed withdrawals of staked ether, that the project realized its full potential.

Before the update, staked ether was not withdrawable. This gave birth to a special product – liquid staking, whereby stake providers were provided with 'certificate' tokens, that could be utilized on DeFi platforms instead of locked ether.

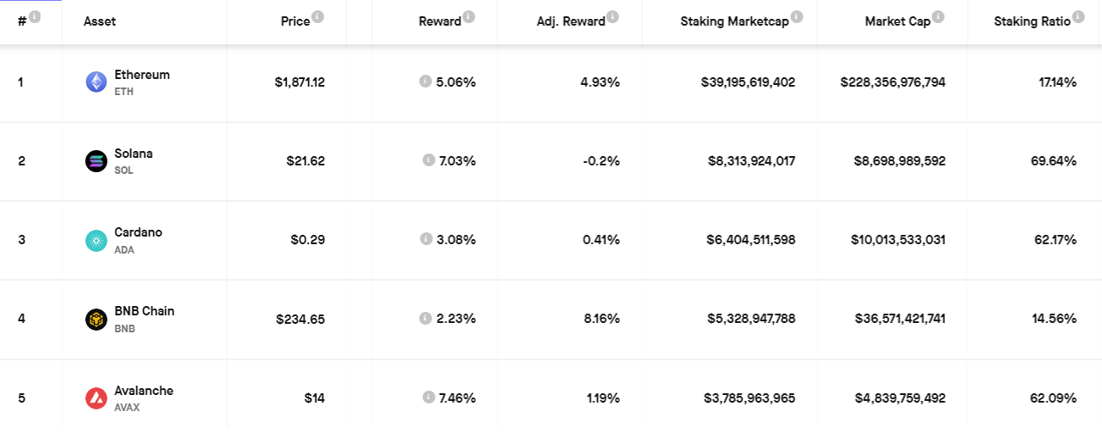

Following the update, liquidity staking protocols such as Lido became more popular due to their ability to leverage investment in staking. A range of liquid staking derivate (LSD) primitives was proposed. One method, called looping, allows restaking of the same funds by converting liquid staking tokens into the original staked assets multiple times.

"DeFi users deposit liquid staking tokens, such as stETH, to lending protocols like Aave or Compound and borrow Ether against their deposits. They then stake the Ether through Lido, deposit the stETH they receive, and repeat the process. The result is the rewards from staking Ether multiple times get compounded, pushing yields higher," - Alice Kohn, an Ethereum analyst at Glassnode explains.

Pendle protocol allows users to do the same thing with one unique feature: the liquid staking tokens of Pendle are split into principal and yield elements. Those who want amplified leverage can get more yield tokens in exchange for the principal tokens. On the other side of the protocol, those who get principal tokens receive them at a discount, allowing them to buy the principal asset, such as ether, at a lower price.

Since the Ethereum Shapella upgrade, the staked ether share increased from 12% to 17%. Liquid staking derivatives play a major role in this process, by making staking rewards on the Ethereum more attractive.

While Lido remains the undisputed leader in ether staking at the time of writing, Pendle has the potential to become a new standard in the DeFi toolbox.