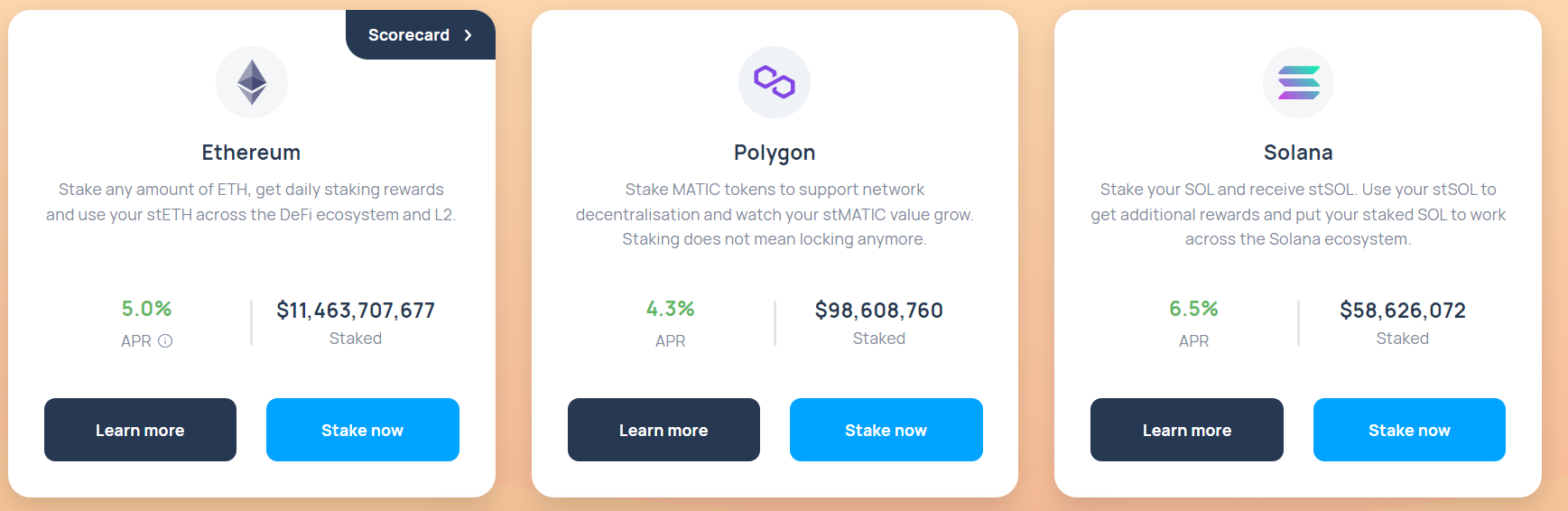

Staking is transforming from a niche technology thing to a mainstream financial instrument. The interest paid on the staked amounts is comparable with the return on financial investments in the same risk category.

Our recent Observations show a growing interest for the new investment concept among players in traditional finance. Banks are cooperating with technology companies to provide staking service to their customers.

Centralized cryptoexchanges had included staking services in their product lines much earlier, yet the prospects for the industry are not clear. In February, the SEC charged Kraken for operating unregistered securities in its staking service offer. Then in March Coinbase received a controversial Wells Notice from the regulator, alleging the company's staking products constitute unregistered securities. Both exchanges were criticized for offering investment returns that were unrelated to protocol-level staking returns and for lack of transparency.

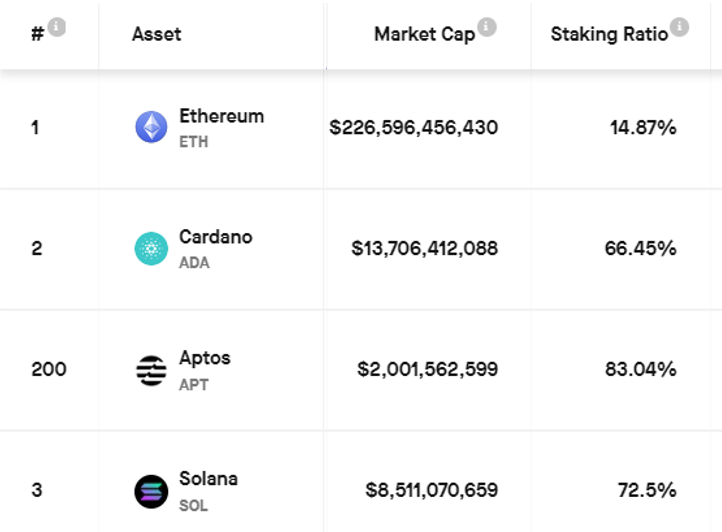

The Ethereum’s highly-anticipated Shapella upgrade last week put the largest blockchain in the center of the staking business news. Ethereum is the most advanced and popular blockchain yet only 14% of its token are staked. Before this upgrade staked tokens could not be withdrawn, making it a less attractive investment.

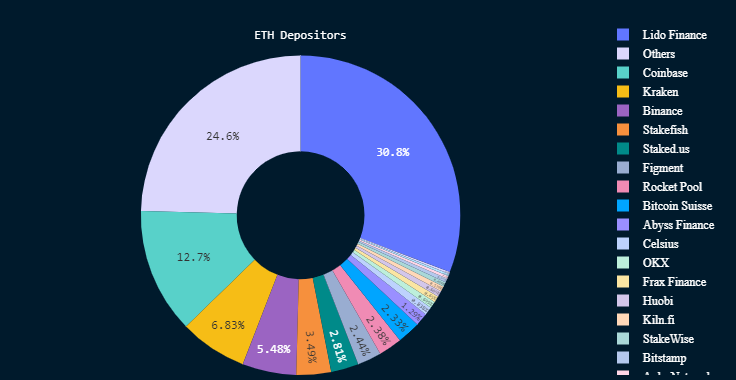

Ethereum staking is dominated by the non-custodian DeFi staking platform Lido. It keeps the leading position in Ether staking with around 30% of total staked value or 5,800,000 ETH. The next largest is Coinbase with 12.7%.

Lido charges a competitive 10% fee from the staking rewards which are mostly distributed to its token holders. But most importantly, Lido gained popularity among Ether stakers due to its liquidity staking feature.

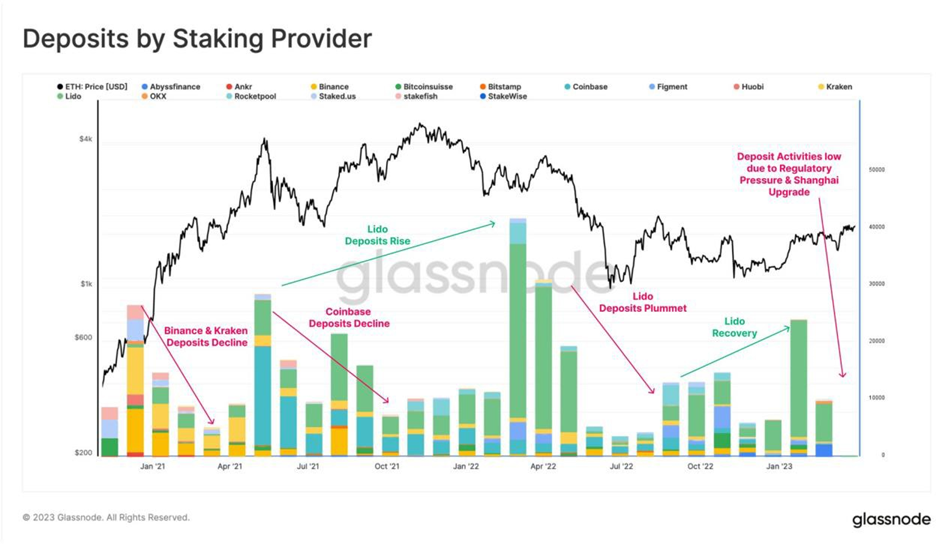

The liquid staking compensated investors for the lack of liquidity on their staked Ether before the upgrade. As we can see on the Glassnode graph, published via Twitter on April 9, 2023, initially, Kraken, Binance, and Coinbase competed for deposit shares during the early phase of the Ethereum Beacon Chain. However, later Lido (the green stack on the graph) rose as a dominant force, continuously attracting larger deposit inflows.

Many analysts believe that Lido and similar liquid staking platforms might lose their Ether market after Shapella upgrade because the staked Ether are now liquid themselves. Others point to the problems centralized staking services are experiencing and predict a brighter future for this business. We don't believe or point to anything and just continue to Observe.