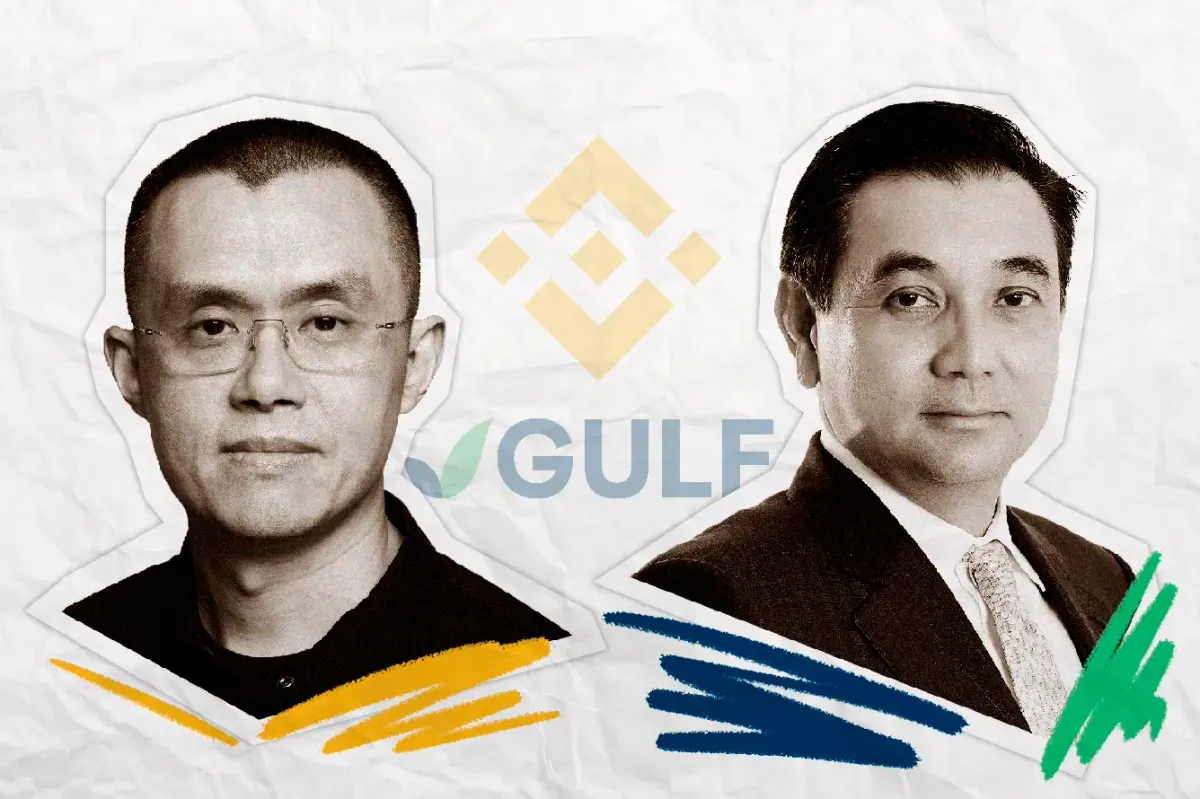

Binance is planning to establish a presence in Thailand by starting a new crypto exchange in the country through a joint venture with Gulf Innova. Gulf Innova is a subsidiary of Gulf Energy Development, one of the country’s largest businesses, whose owner Sarath Ratanavadi is the country’s second richest person. Gulf Energy was already an investor in Binance.US.

The two companies first reached an agreement back in 2022. This May, Gulf Binance was licensed by the country’s Ministry of Finance. On November 10, Gulf Binance obtained approval from the Securities and Exchange Commission to commence operations of the digital asset business, according to a notification from the company to the Stock Exchange of Thailand.

Gulf Energy and Binance partnership to showcase Thai Blockchain potential

— CZ 🔶 Binance (@cz_binance) November 16, 2023

Regulatory approval secured for Gulf Binance in Thailand.https://t.co/qfLzlcjdks

The cooperation aims to combine Binance’s digital asset expertise with Gulf’s deep understanding of the local market and established presence in the country. Gulf believes the exchange “will elevate the level of service in Thailand and promote advancements in the country's blockchain ecosystem.”

The exchange will first be available on an invite-only basis, with plans to open to the general public in early 2024. The Thai crypto market is currently dominated by Bitkub, with over 4 million active users. We will Observe if Binance Gulf proves itself as a worthy competitor.

Earlier, Binance claimed that the companies had been working closely with Thailand’s regulators to ensure “the formation of a compliant-first exchange” that strictly follows the SEC’s guidelines, which is a wise step, considering Binance’s compliance problems in other key jurisdictions, including Europe and the U.S.

The country doesn’t consider digital assets to be lawful currencies, but the overall level of adoption is relatively high. Local cryptocurrency regulations are pretty soft and underdeveloped but aim to protect investors. This summer, SEC Thailand issued new rules banning crypto lending services and prohibiting VASPs from using customers’ funds for investment.

Meanwhile, the government is generally in favour of cryptocurrency. The Prime Minister of Thailand even promised crypto cash to every voter if elected. The Bank of Thailand’s Project Inthanon has been researching CBDC adoption since 2018. Currently, the country is in a pilot phase of the use of digital baht. Thai commercial banks also show interest in blockchain technology. One of the largest banks recently acquired a local regulated crypto exchange and launched a $100 million venture capital fund targeting AI, Web3, and FinTech startups.

Apparently, crypto-friendly Thailand might become a fertile ground for blockchain initiatives, but to harness that wave, the government will have to elaborate proper regulatory frameworks as soon as possible.