This week, blockchain analytics company Chainalysis released its latest report on crypto uptake, the 2023 Global Crypto Adoption Index. The study aims to “highlight the countries where average, everyday people are embracing crypto the most.” The higher a country scores, the more people there are putting a greater share of their wealth into cryptocurrency.

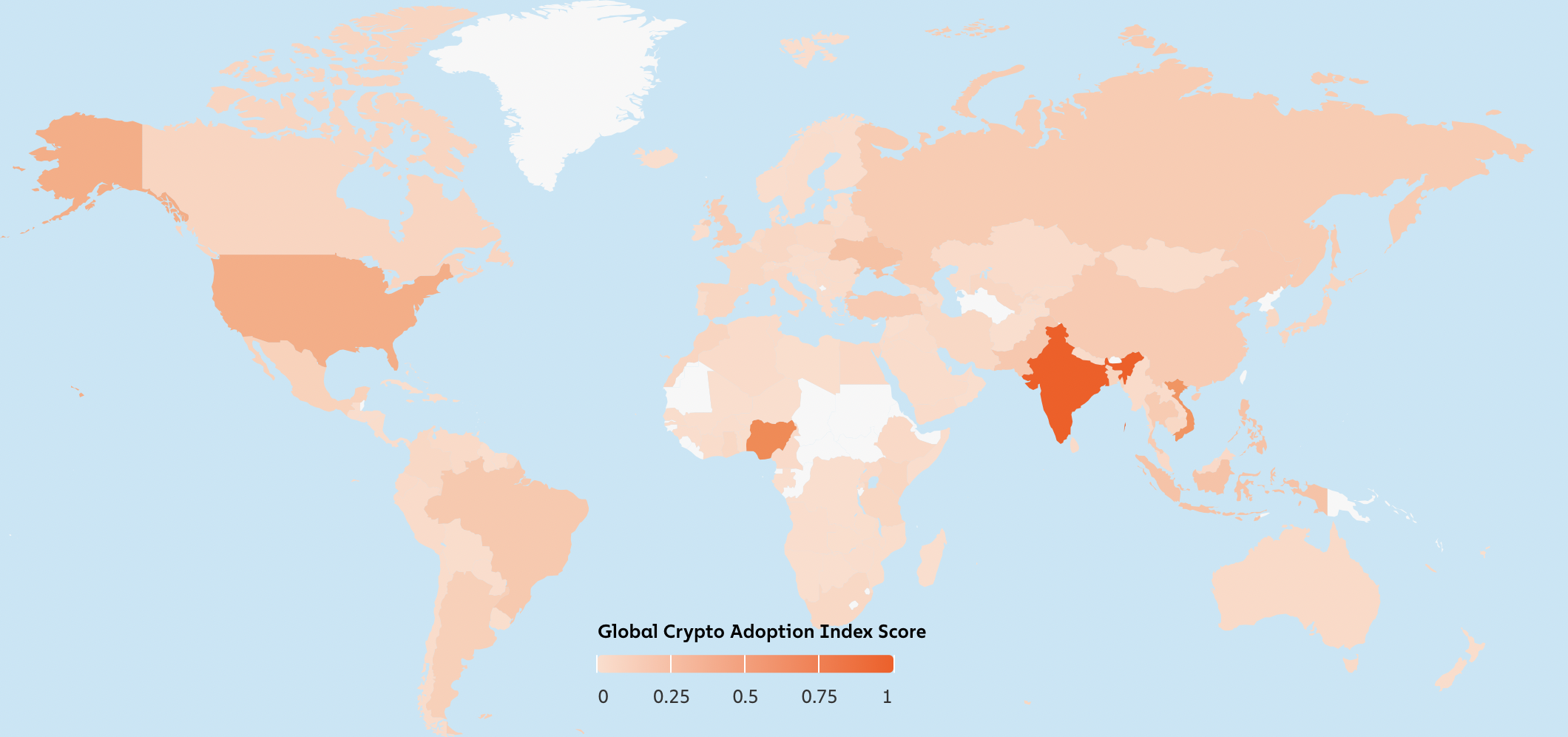

India comes out as the indisputable leader with an index score of 1.0 followed by Nigeria (0.642) and Vietnam (0.568). The U.S. ranks fourth by a wide margin, its score is only 0.367. The rest of the top-ten places are filled by Ukraine, Philippines, Indonesia, Pakistan, Brazil and Thailand.

Six of the top ten countries are located in the South and South-East Asia and Oceania region. Western Europe lacks behind: the U.K. was the only country to enter the top-20 list. Guyana comes bottom in the ranking of 154 countries.

The Global Crypto Adoption Index is made up of five sub-indices:

- “On-chain cryptocurrency value received at centralized exchanges” estimates total cryptocurrency activity occurring on CEXs;

- “On-chain retail value received at centralized exchanges” measures the activity of non-professional, individual cryptocurrency users taking similar metrics as the first index, but only counting retail-sized transactions (under $10,000);

- “Peer-to-peer exchange trade volume” weights metrics to favour countries with fewer internet users to show countries where more residents are putting a larger share of their overall wealth into P2P transactions.

- “On-chain cryptocurrency value received from DeFi protocols” highlights countries where users are conducting a disproportionately high share of their financial activity using DeFi protocols.

- “On-chain retail value received from DeFi protocols” measures the same metrics but for retail-sized transactions.

All the metrics are weighted to favour countries with a lower purchasing power parity (PPP) and thus highlight those where residents are putting a larger share of their overall wealth into cryptocurrencies. The metrics are based on the web traffic patterns of crypto services’ and protocols’ websites.

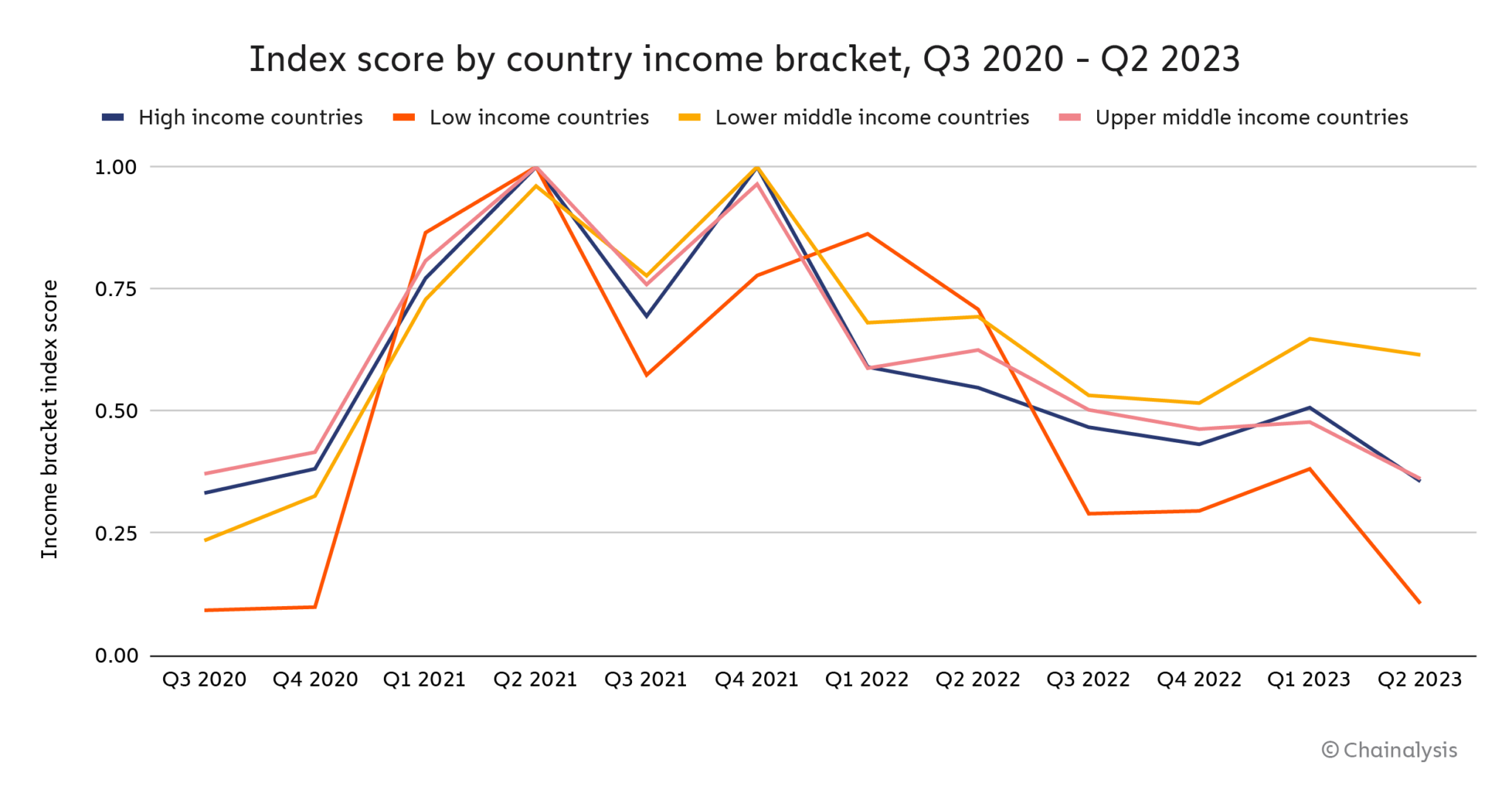

The overall trend suggests that global adoption is significantly down compared to data from 2021 but recovering slightly compared to the end of 2022. The only exception are countries with lower middle income, e.g. India, Nigeria, Ukraine. Taking into account that these countries account for 40% of the world’s population, the future of crypto adoption does not seem gloomy at all.

This year we observed many institutional players and big companies embracing crypto and a significant rise in crypto regulation efforts in developed countries. Combined with crypto spread among world population this increases confidence in the future of crypto industry.

The report is a part of the Chainalysis 2023 Geography of Cryptocurrency Report. The full study will be released this October and we will share with you all the insights when this happens.