Banking CBDC Roundup, CBDC, Observers, Fed, Digital Dollar, DREX, e-rupee, ECB, e-CNY, Bank of Thailand, Bank of Spain, Mitsubishi, KlimaDAO, Trust Stamp, Zoniqx

Banking and CBDC Weekend Roundup: 25/05/2024

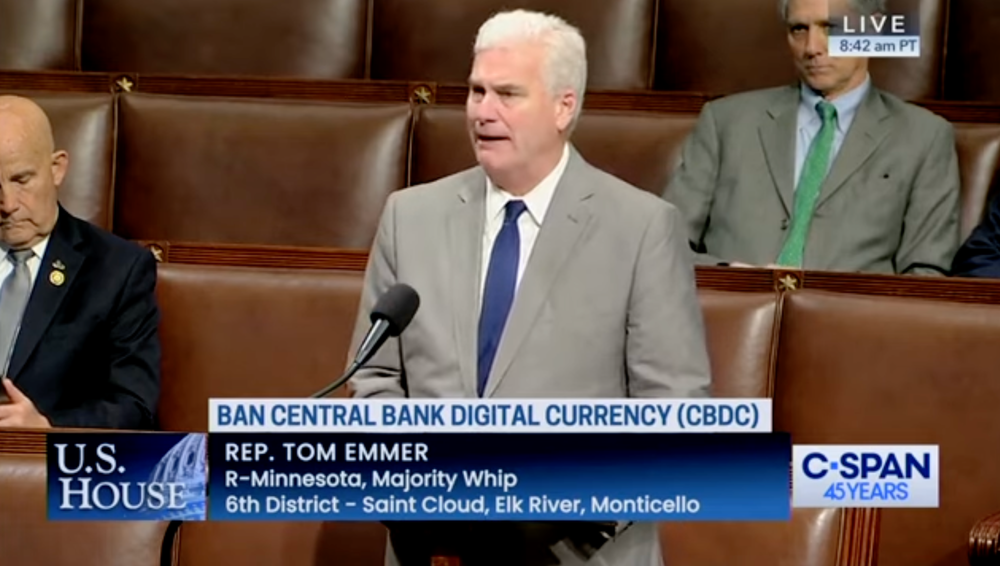

There's new legislation designed to prevent a digital dollar from intruding on consumer privacy — with a report also revealing how central banks could enhance CBDC adoption.