The U.S. Securities and Exchange Commission (SEC) might be on the verge of approving spot Ether exchange-traded funds (ETFs), with a decision expected imminently. On Monday, the agency reportedly asked the Nasdaq, the CBOE (Chicago Board Options Exchange), and the NYSE (New York Stock Exchange) to update their 19b-4 filings, a step typically indicative of impending approval.

The price of Ether surged over 20% following the unexpected news of potential ETF approval, climbing to over $3,800 and reflecting heightened investor optimism.

While approval is not guaranteed, the SEC's request for revisions suggests that these applications are under serious consideration, leading Bloomberg analysts James Seyffart and Eric Balchunas to revise their approval odds from 25% to 75%.

However, even with a favorable 19b-4 ruling, issuers must still secure approval for their S-1 applications, a process with no defined timeline. These forms are detailed registration statements that companies must file with the SEC, providing comprehensive information about the company and the securities they intend to offer.

Journalist Eleanor Terrett reported on Wednesday that discussions between SEC staff and spot Ether ETF issuers concluded with the understanding that there was still "work to do" regarding the S-1 forms. The SEC is expected to decide on VanEck today and ARK Invest's spot Ethereum ETF applications tomorrow.

The FIT21 (Financial Innovation and Technology for the 21st Century Act) crypto bill successfully passed in the U.S. House of Representatives on Wednesday, garnering significant bipartisan support (279-136 votes) and paving the way for regulatory clarity in the crypto industry.

On the same day, a bipartisan group of House lawmakers, including Majority Whip Tom Emmer and New Jersey Democrat Josh Gottheimer, sent a letter to SEC Chair Gary Gensler on Wednesday urging the approval of Ethereum ETFs. They argue that approving ETFs would provide investors with a regulated, transparent, and safe way to invest in crypto.

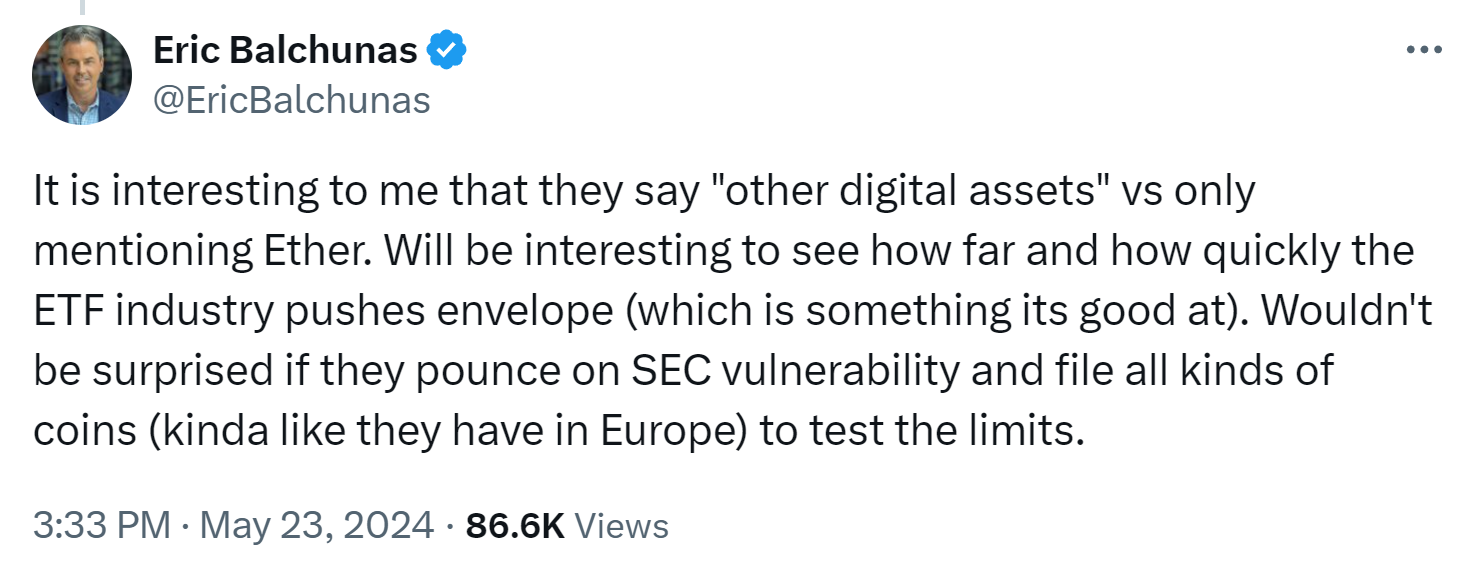

"We urge the Commission to maintain a consistent and equitable approach when reviewing upcoming applications for other digital asset-backed ETPs. Specifically, the Commission should apply the same principles set forth in the approval of the spot Bitcoin ETPs as it evaluates the pending Ether ETP applications as the legal considerations pertinent to Bitcoin also apply to Ether."

Balchunas said on X that the letter mentions "other digital assets" alongside Ethereum, which indicates that the ETF industry might rapidly expand its offerings to include a variety of cryptocurrencies if the SEC shows any regulatory flexibility, similar to trends observed in European markets. Balchunas's comments suggest that the industry is poised to explore and test the boundaries of SEC regulations, potentially leading to a wider range of crypto ETFs in the future.

Alex Thorn, head of research at Galaxy Digital, discussed the SEC's potential approach to Ethereum ETFs in an X post on May 21. Thorn suggested that the SEC might distinguish between regular Ether (ETH) and staked Ether, possibly classifying the latter as a security. This nuanced approach could allow the regulator to approve Ethereum ETFs while maintaining its stance that staking activities fall under securities regulations. Thorn also speculated that the SEC might prohibit ETFs from staking the Ether they hold to align with their regulatory framework and ongoing investigations. This strategy would be consistent with the SEC's existing legal arguments and investigation reports.

The SEC's recent actions suggest the imminent approval of spot Ethereum ETFs, which would be pivotal in shaping the future of Ethereum investments and broader digital asset regulations.