For all the key details of new blockchain projects in the banking world, real-world asset (RWA) tokenization, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

This week it has been difficult to avoid the SEC's approval of 11 spot bitcoin ETF applications, even from a banking perspective. While one might assume that the approval of the SEC may have sealed the deal for all bank customers to be able to trade in the new products, this was not necessarily the case.

Asset manager Vanguard blocked customers from purchasing the ETFs, leading to fears that banks UBS and Citibank would also bar clients from such transactions. However, these fears turned out to be unfounded, and both UBS and Citi have reportedly made the products available, at least to some of their institutional and higher risk-tolerant clients.

[Incidentally, Vanguard is one of the biggest shareholders in MicroStrategy, giving it significant indirect exposure to bitcoin price, and making it somewhat hypocritical for not allowing its clients to join the fun.]

Before the SEC decision was published, Standard Chartered bank had predicted a $200,000 BTC price by the end of 2025, contingent on spot bitcoin ETFs gaining approval and becoming successful in the U.S.... Well, we now know how the first proviso turned out, so let's wait and see how the rest of the prediction goes.

Last week we Observed the European Central Bank (ECB) put out five calls for service vendors to support its digital euro project. On further inspection, we see just how important offline payments are to the bank's plans. Of a total value of €1.2 billion put out to tender, over half is assigned to supporting offline payment functionality.

We also looked at reasons for the disappointing uptake of Nigeria's eNaira CBDC so far, noting that it may soon face tough competition in the shape of the cNGN stablecoin, which has just been approved for use. It seems that we aren't the only ones who believe that the new stablecoin may pose an existential threat to the eNaira, as Nigerian multi-utility Stablecoin Ecosystem, Finna Protocol, believes it is 'almost impossible' for the two to complement each other.

Not quite a CBDC, but the Thai government's plan to distribute digital currency to every voter in the country may be under threat, after the Office of the Council of State took a look at the measure's proposed funding methods. The council said that funding the plan through legislation could take months, and the move should have been enacted by decree. However, the Deputy Finance Minister later confirmed that the council had found the proposal legal and could be implemented on May 1 as planned.

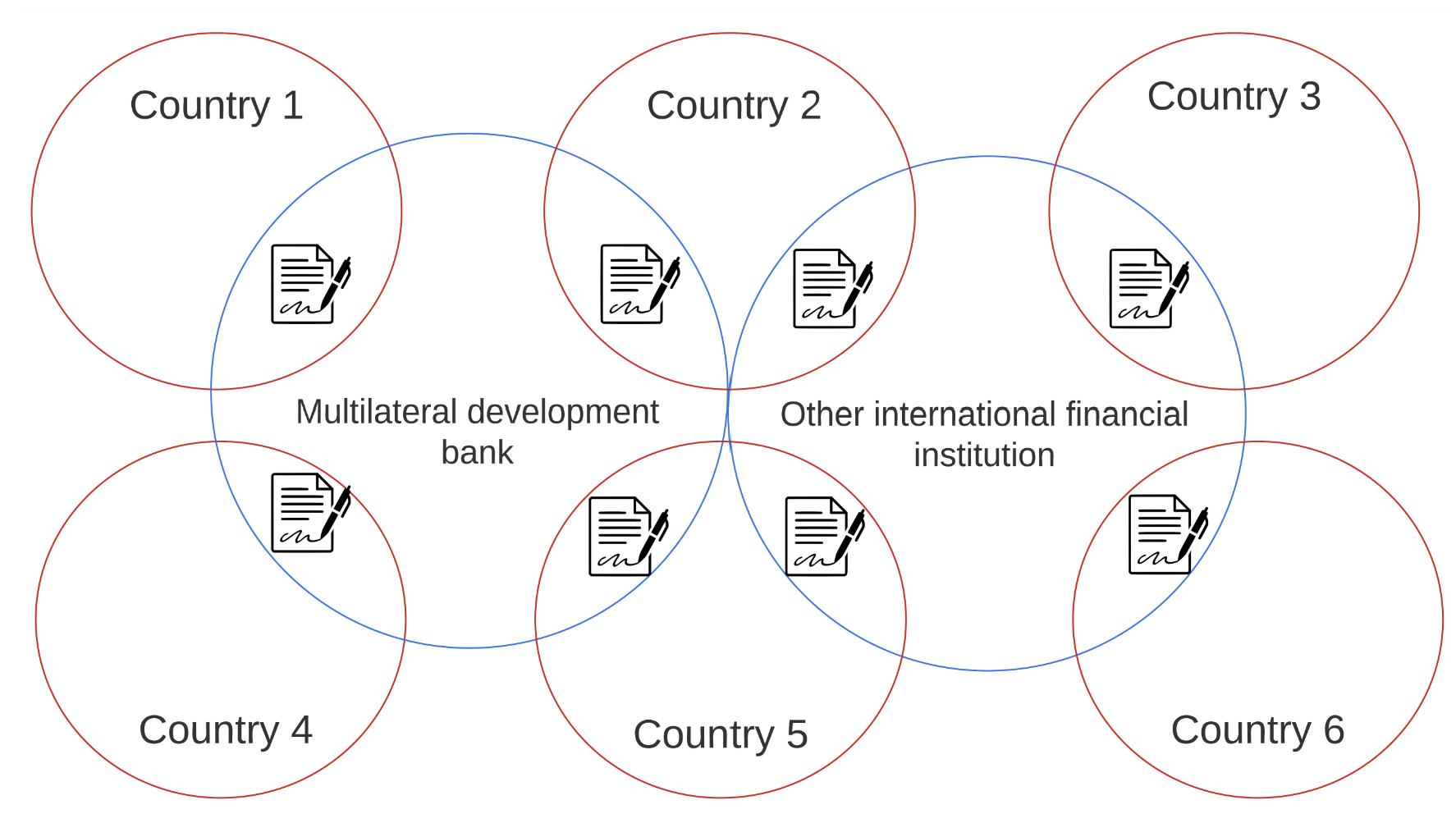

Project Promissa has been launched by BIS Innovation Hub, Swiss National Bank, World Bank and the International Monetary Fund as an observer, to build a platform for digital tokenized promissory notes – types of financial instruments used by multilateral development banks. The goal is to create a unified system for member states and development banks to track the outstanding notes.

And finally, also not-quite CBDC related, but after making bitcoin legal tender two years ago, Honduras' special economic zone, Próspera, has officially recognized the grandaddy of all cryptocurrency as a unit of account. This means that it can now be used for "commercial, tax and financial transactions".

Meanwhile, the governor of the Bank of England this week told the U.K. parliament that bitcoin is too inefficient for payments use and that the integration of crypto with TradFi was 'losing momentum'. On the ball, as ever, from the crypto-hub hopeful U.K.