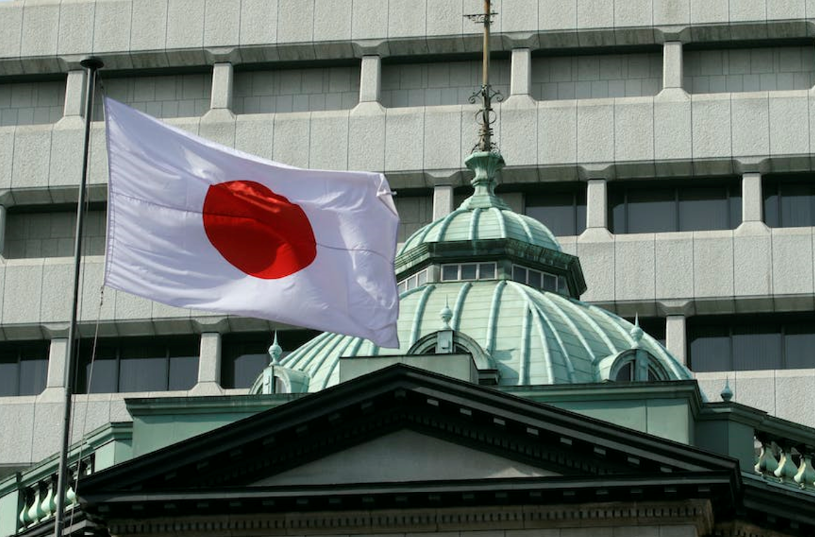

Last week the Japanese central bank convened a new Central Bank Digital Currency (CBDC) Forum consisting of 60 companies to discuss plans for the potential launch of a digital yen. Talks centred around the business and technological requirements needed to fulfil retail payments and settlements using a CBDC, according to a report by Reuters.

The Bank of Japan insists that it has not yet made a decision on whether to issue a CBDC, saying that the choice ultimately lies with the government and parliament. However, many large Japanese firms are included in the CBDC Forum group, including Sony, the financial arm of auto giant Toyota and East Japan Railway. This is in addition to the usual selection of banks and financial services companies such as MUFG, SBI and Soramitsu.

Some believe that the inclusion of such major players suggests that the central bank is steadily progressing towards a live launch. The bank’s director of monetary policy, Seiichi Shimizu, stated that the BOJ had a global outlook, and needed further input from a business perspective before considering any decision on whether to launch a CBDC.

Prior to founding the CBDC Forum, the Bank of Japan began a pilot program in April this year following a two-year Proof of Concept (PoC) to test the technical feasibility of the key functions and features required for a CBDC. Phase 1 of the PoC started in April 2021 and focused on ledger design, while Phase 2 began in April last year and investigated the feasibility of more complex functionality.

The current pilot program has two main aims, according to a speech given by executive director Shinichi Uchida in February. Firstly it will further test the technical feasibility of aspects not covered in the PoC. The PoC was mainly focused on the central system controlled by the bank. However, the pilot will extend this to include intermediaries, their network systems and other stakeholders.

The second key aim of the pilot program is to improve the existing designs by utilizing the input and expertise of private businesses, which is where the newly created forum comes in. Topics being considered include:

“measures and potential challenges for connecting the experimental system with external ones, alternative data models and architectures for offline payments, the optimal design of the CBDC system in providing value-added services, and challenges and technologies or functions that could become necessary where a touchpoint with users arises.”

The bank is not expecting to process any actual retail transactions during the pilot program, and will focus purely on simulated transactions in a test environment.

This perhaps suggests that a decision is maybe not as imminent as some commentators think. As we Observed last month, countries such as Thailand are including live payments as part of their pilot schemes, and China’s extended pilot program is already processing cross-border payments.