The Australian Central Bank (RBA) and the industry think-tank Digital Finance Cooperative Research Centre (DFCRC) have just published a report on the Australian Central Bank Digital Currency (CBDC) pilot project.

Unlike similar projects in other countries, Australian CBDC research primarily explored the potential use cases and benefits of this new tool for the country's financial system and the wider public and only then derived its technical design and feasibility points.

Another novel feature of the Australian CBDC project was that the pilot CBDC was structured as a real legal claim on the RBA rather than as a proof-of-concept. This approach enabled the participants to test their use cases in a more realistic environment, involving real transactions and customers, and forcing them to confront real legal, regulatory, technical and operational obstacles, which might not have been addressed in a proof-of-concept project.

The project, which started in September last year, published the first progress report on the list of selected use cases in March. These potential use cases were distributed among representatives of the country's financial system and industry.

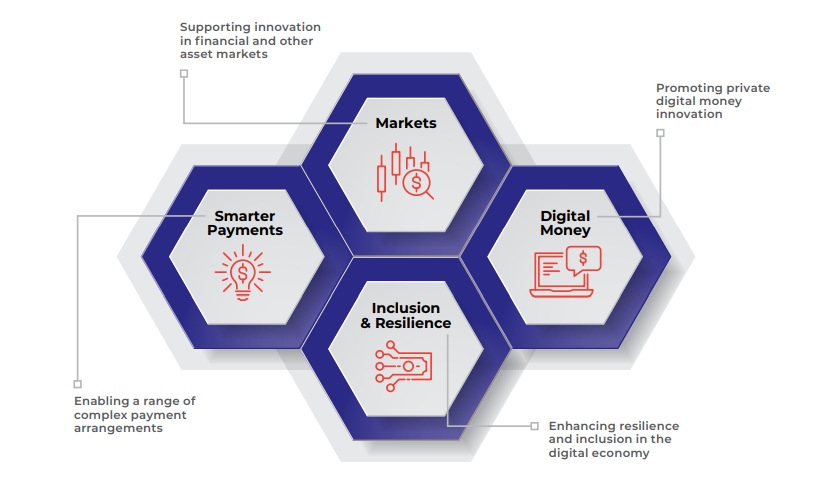

In the current phase, the findings from these fourteen potential use cases are grouped into four key areas (in the following order) that were proven:

- Smarter payments (use in smart contracts) - the study confirmed the potential of CBCD to enable a range of complex payment arrangements such as multiple-party transactions with all legs of the transaction settled simultaneously when conditions were met, delivery of government programs where participants are required to comply with requirements on their use, as well as automating the payment of utility bills and rental payments, micropayments, time-based streaming payments, and even wage payments.

- Using CBDC for settlement of tokenized financial and other real assets on Distributed Ledger Platforms. The tests included traditional assets such as corporate bonds and stock, and less liquid assets such as carbon credit units and supplier invoices.

- Digital money innovation - this is the category where most observers are skeptical on real value for countries with developed banking and payment systems. Nevertheless, the report highlighted this as one of the key themes for CBDC based on the submissions of participants who explored stablecoins backed by CBDC.

- Finally, the inclusion argument was also justified, showing that even the countries with developed infrastructure and access to financial services, might have groups that will need alternative payment means if cash currency is completely taken out of use. The tested scenarios were: offline use due to electricity or internet failure, travelers, students, and victims of domestic violence.

Even though the project focused largely on the use cases and finding benefits, it has uncovered some legal, technical and operational considerations. For example, the report mentions that the vast array of new CBDC-enabled models that the researchers project, will require a new legislative framework and cannot be governed under the existing regulations.

Interestingly, when scanning the individual cases we could not find any use case that was critically rejected by the project participants. The overall tone and expectations of the group are positive. Except, that is, for the very last statement of the report:

Given the many issues that are yet to be resolved, any decision on a CBDC in Australia is likely to be some years away.