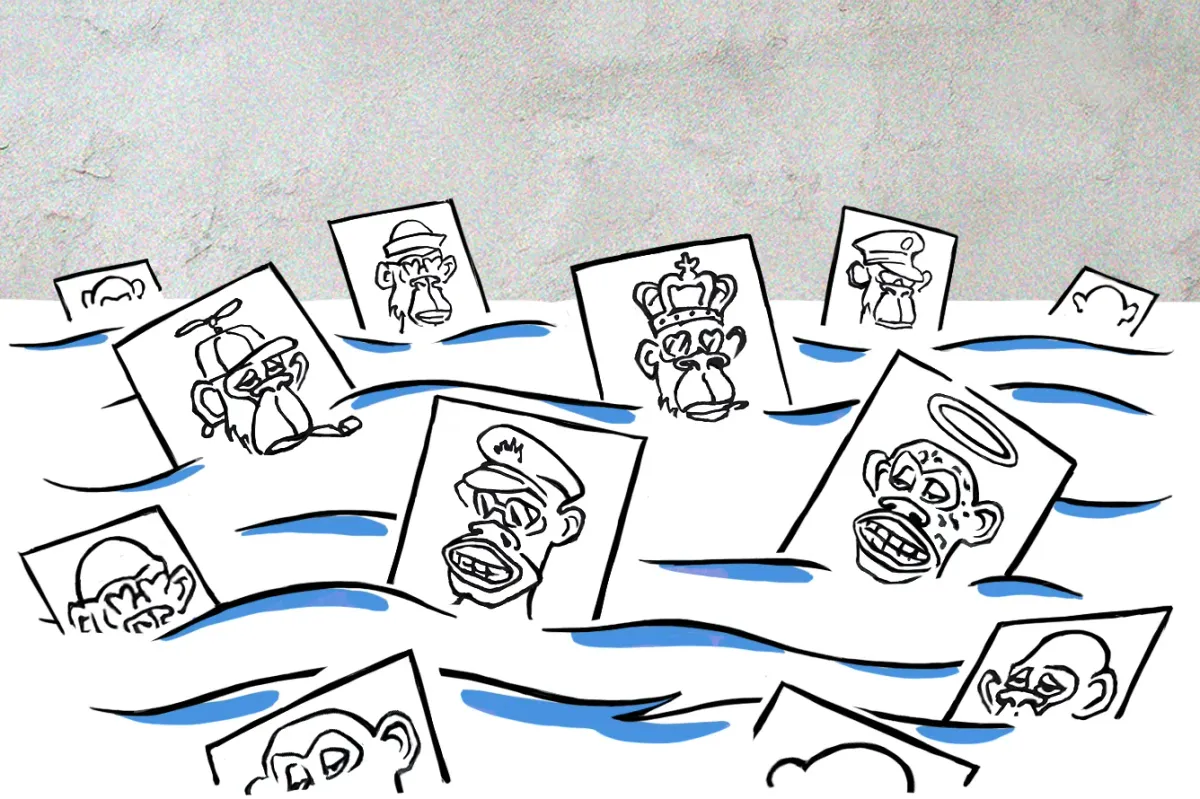

“Is there anything tanking faster than Yuga NFTs right now?” a user going by the name Bentoshi asked on X earlier this week.

While the price of Bitcoin and other crypto assets keeps reaching new highs, the floor price of perhaps the most iconic non-fungible tokens ever, BAYC, fell to 12.5 ETH on March 12 - a level not seen since the first months after the collection was launched in 2021. Over the last seven days, the Ether valuation of Bored Apes is down 38%, while that of its Mutant Ape relatives is down 44%.

Otherdeed, the NFT collection that grants holders ownership of a piece of virtual land in the Otherside metaverse created by the digital assets studio lost 44% of its value during the past week.

“This crash is all on yugalabs,” suggests another user, and the $4 billion NFT studio has certainly been through some turbulent times recently.

After one year away, former CEO Greg Solano came back to the helm in an attempt to rebuild a community that had started to fragment over a series of questionable business decisions (including the purchase of competitor studio Proof), increased competition, and underwhelming new project launches.

Even new people know what Yuga did in the past Larry, until Yuga fixes problems nothing is going up again. I am not saying it is impossible, everything is possible but they need to fix it. So many promises, no delivering. Nonsense moonbird acquire in the middle of this. Blocking…

— Murat (@NightDeatHs) March 12, 2024

The NFT studio also seems incapable of putting an end to its legal dispute over intellectual property rights, against Ryder Ripps and Jeremy Cahen for creating a Bored Apes copycat collection, RR/BAYC.

Although the case was settled in Yuga's favour last October, the studio's legal team has recently asked a U.S. court to sanction Ripps for maliciously destroying the private keys to the wallets containing the collections. The aper of the Apes has since refuted the claims.

Despite the drop in floor prices, BAYC is still the second most traded collection over the past seven days, with MAYC in twelfth.

Everyone freaking out over BAYC price needs to calm down.

— Adam Hollander (@HollanderAdam) March 12, 2024

In USD terms a BAYC is still $50,000+

That was also true last year. An ape cost more ETH then but price of ETH was much lower. And no one was screaming that the sky was falling.

1 ETH = 1 ETH isn't a thing. It never has…

Furthermore, this downturn is common to most digital asset collections on Ethereum, which have been losing ground to the Bitcoin Ordinals phenomenon (during the last seven days, only seven of the top 20 NFT collections were Ethereum-based).

The NFT space is very different from during the last Bitcoin run. New and cheaper collections spread across more blockchains are captivating the attention of both new and old users, and the opportunity cost of having funds “stuck” in a Yuga NFT rather than investing in new projects doesn't always compensate.

Adam Hollander, who continues to be a ferocious and proactive defender of the value of BAYC collections, sold his own Ape a couple of weeks ago because, in his words, “it made more sense for me to have funds available for that vs. storing them in the ape.”

With many selling, there is also a new wave of enthusiastic ape holders who have been patiently waiting for a moment like this to become part of one of the most exclusive and dynamic communities on Web3.

After acquiring a Mutant Ape, Dro-Man-Dan took to X to express he was “beyond grateful” to join the Apes community and that he believes “in what YUGA has been building and am STOKED to see what they bring next!”

Been wanting to join the club for over 2 years, finally made it! Couldn’t resist this sick M2 DMT 👁️👁️👁️@BoredApeYC @yugalabs #apefollowape#MAYC pic.twitter.com/x6HlzDT1T9

— jlongo ❤️ Memecoin (@jlongo25) March 13, 2024

Another user who recently bought a Bored Ape claimed on X, “Whatever this becomes in the future [BAYC], even if it turns out to be unsustainable, it'll still be a part of human history, nothing less than that.” Going for the best but expecting the worst, Marcel is sure that, even if Yuga's original collections don't recover from this cycle, being an Ape will always be something utterly iconic.