Plasma is building a blockchain tailored specifically for stablecoins. According to the founders, while demand for stablecoins is growing rapidly, most existing blockchains are not optimized to support them efficiently.

The project's documentation highlights several core limitations of current networks: high fees, centralization concerns, frequent outages, and limited functionality—all of which hinder the scalability of stablecoin applications. Plasma aims to address these challenges directly.

At the core of its infrastructure is a custom consensus protocol called PlasmaBFT, built on Fast HotStuff. This protocol enables fast finality and low-latency transactions—critical features for global, high-frequency stablecoin usage.

Plasma is also fully Ethereum-compatible, allowing developers to deploy existing smart contracts without modification. Notably, the network won't require its native token for gas fees; instead, users will be able to pay with widely used assets like USDT and BTC. As expected, USDT transfers will carry zero fees on the platform.

In an ambitious but somewhat contradictory move, the team promises support for confidential transactions that protect user data while maintaining regulatory compliance. However, technical details remain undisclosed, as this feature is still in development.

Plasma is not the first blockchain to target the lucrative stablecoin market. As the most widely adopted crypto use case, stablecoins generate real revenue for blockchains—an increasingly rare trait in an industry still struggling with sustainable monetization. Tron, for example, earns an estimated 90% of its revenue from USDT transfer fees alone.

In 2024, Telegram's TON blockchain also announced zero-fee USDT transfers and invested significant resources in promoting its use. Yet despite those efforts, it still ranks behind Tron, Ethereum, Solana and Aptos in terms of the stablecoin's circulating value, highlighting how hard it is to break into this competitive space.

Nevertheless, the new project caught investor interest.

Plasma Secures $500M in Minutes

On June 9, Plasma closed one of the largest fundraising rounds of this cycle, raising $500 million in just minutes. The sale was initially capped at $250 million, but after a surge of investor demand, the team doubled the limit to accommodate additional interest.

This wasn’t the project’s first major raise. Previous funding rounds had brought in $27.5 million from a mix of high-profile investors, including Peter Thiel, Tether CEO Paolo Ardoino, and crypto exchanges like Bitfinex and Bybit.

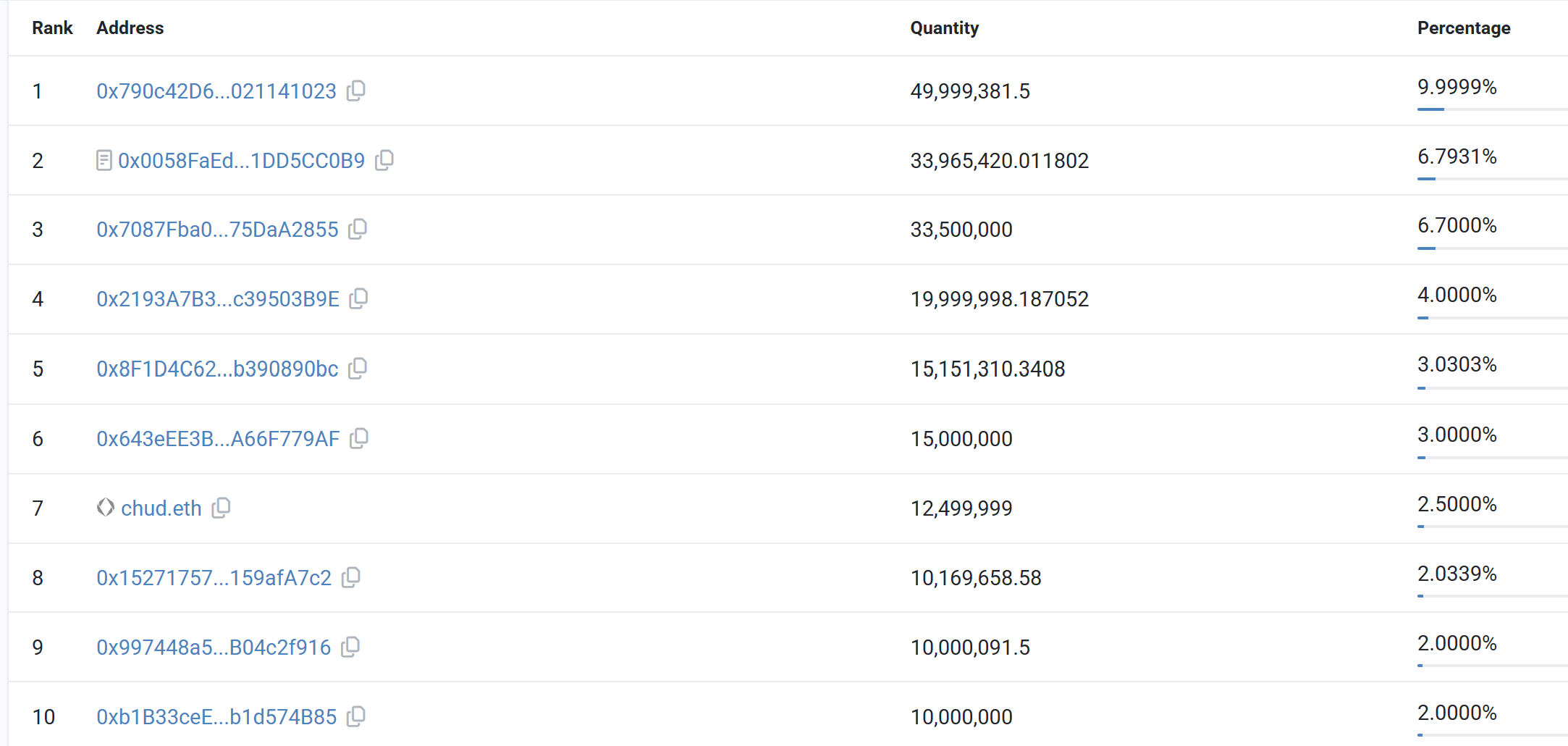

The public sale, however, wasn’t without controversy. The top ten wallets received approximatelу 40% of the total allocation, roughlу 80% of the original 250 million limit, while the total number of holders is around 1,100, according to Etherscan.

Some observers noted that the top wallets claimed the cap in just a few seconds. The tactic mirrored past behavior often attributed to Justin Sun, fueling speculation that the Tron founder may have secured a controlling stake in his coming competitor.

Regardless of the controversy, the scale of the raise makes it one of the largest crypto fundraising events since the ICO boom of 2017.

Whitepaper Coming Soon

What sets Plasma apart from standard ICOs is that the project has not yet released a whitepaper or disclosed any major technical breakthroughs. Its core features remain either broadly defined or marked as "under development," leaving much of its design opaque.

The project also appears to be pulling in several trending directions, sometimes at the expense of a coherent architecture. One example is its announcement of a Bitcoin Bridge, which aims to periodically anchor Plasma’s state to the Bitcoin blockchain. This would technically make Plasma a Bitcoin sidechain, although it still functions as a standalone Layer 1 with its own consensus protocol.

Plasma is targeting a beta mainnet launch in late summer 2025, though several promised features are expected to roll out later. Hopefully, by then, the project will also have released its whitepaper—offering a clearer answer to what truly makes a blockchain purpose-built for stablecoins.