TRON and Movement Labs have refuted allegations of a token swap deal with President Trump-backed World Liberty Financial (WLFI).

According to a Blockworks report, WLFI proposed a buy-in structure of 10-15 million to be included in its treasury, which would incur a 10% fee. TRON, whose TRX token is the second-largest holding of WLFI at 9.3 million, denied the report, claiming, "There is no token swap agreement."

Similarly, Movement Labs, whose MOVE token surged after WLFI purchased 2 million worth, also denied any secretive deals. Co-founder Rushi Manche clarified, "It was purely just market buying." Both entities maintain they have no formal agreements with WLFI.

Also this week (after Trump's tariff policies prompted a 21% drop in WLF's holdings), WLF transferred over $307 million in digital assets to Coinbase Prime for what they called routine "treasury management." This substantial move included cryptocurrencies like Ethereum and Wrapped Bitcoin. Large transfers like this often indicate a potential sale, which is something WLF denies.

We’re making routine movements of our crypto holdings as part of regular treasury management, and payment of fees and expenses and to address working capital requirements. To be clear, we are not selling tokens—we are simply reallocating assets for ordinary business purposes.…

— WLFI (@worldlibertyfi) February 3, 2025

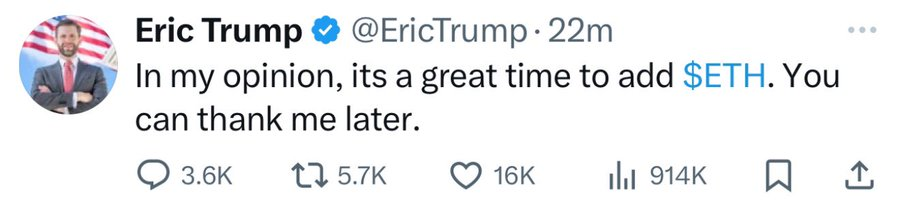

A few hours later, Eric Trump advocated buying $ETH. In a post on X, he urged people to buy up, promising they would "thank" him later. That latter part of the post was later removed, probably under advice from his legal team.