Last month the U.S. National Bureau of Economic Research published a paper called ‘Do You Even Crypto, Bro?’, detailing the findings of a multi-year study into the position of cryptocurrency in household finances.

The study collated the results of a large-scale quarterly survey of U.S. households, looking at investment decisions and motives, with a particular focus on crypto and how this compared to other assets.

Since it began in 2018, the study showed an increase in the proportion of U.S. households with crypto holdings, from under 2% initially to almost 12% by the end of 2022. This number went up to almost 15% when only considering households with savings of at least one month’s household income.

Holders of cryptocurrency are slightly more likely to be men than women, and have higher than average income and spending levels, although education was not a significant factor after income had been controlled for.

Black investors are more likely to hold crypto than white investors, and voting libertarian or independent also showed a higher correlation with ownership. The most significant factor, however, was age, with those under 40 being significantly more likely to be holders.

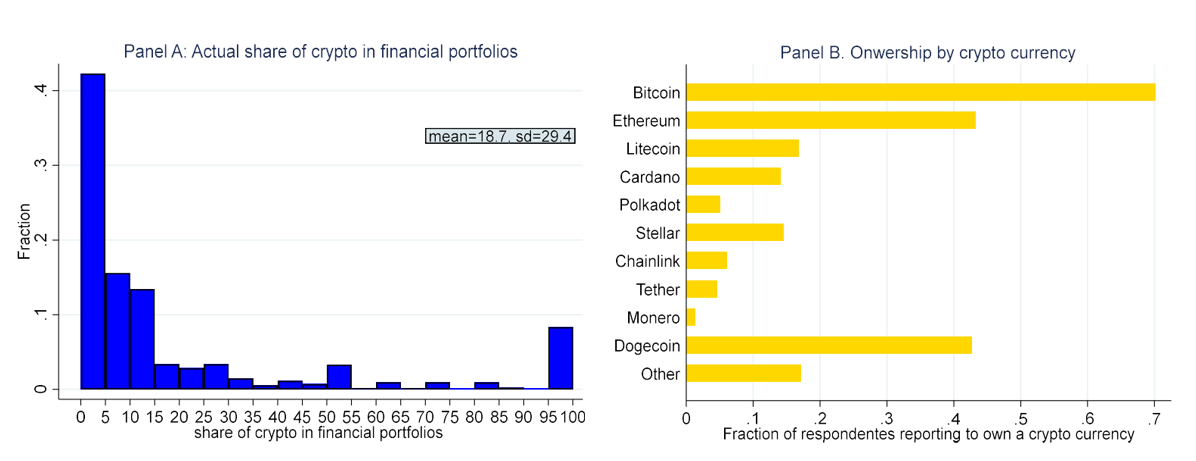

Among cryptocurrency owners, the average share of household wealth held in crypto is around 20%, with Bitcoin being the most popular token, followed by Ether and Dogecoin. Over 40% of holders wanted to increase their holdings, while 30% were happy with their portfolios and only 4% planned to sell.

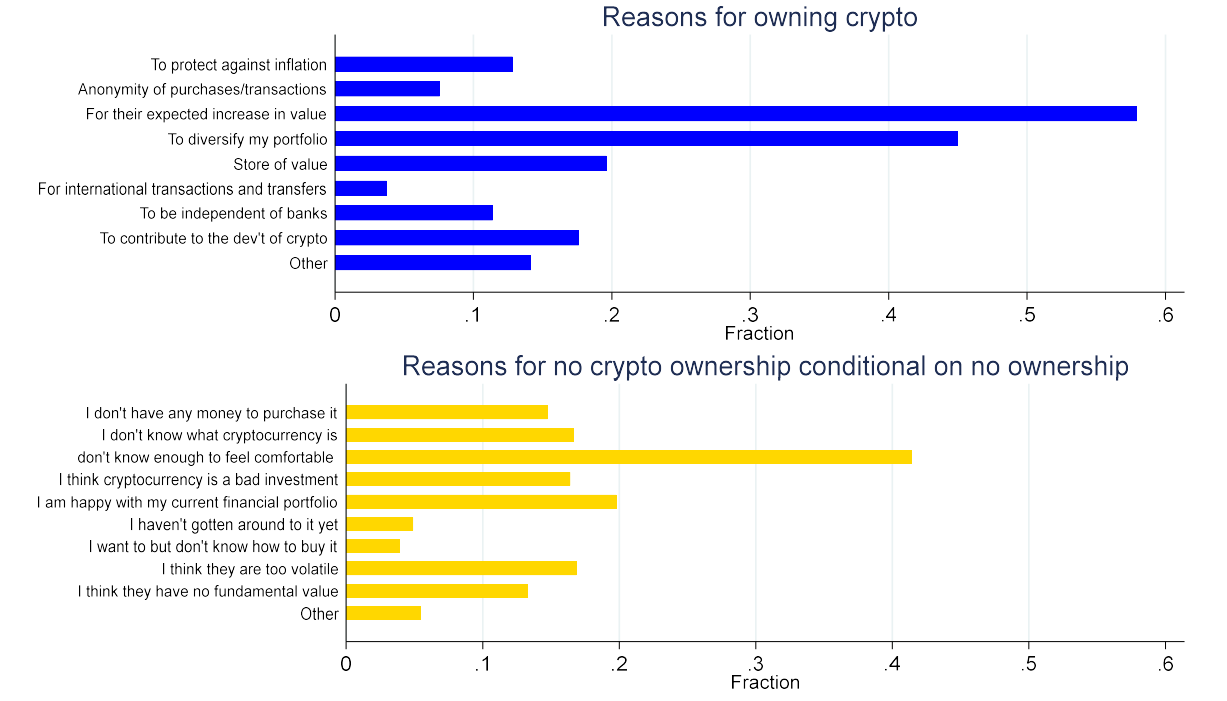

The two main reasons given for owning crypto were in terms of financial investment, those being high expected returns and diversification of portfolio. Further reasons included use as a hedge against inflation, the making of international and anonymous transactions, and a more ideological view: to support the development of cryptocurrency and be independent of banks.

Non-crypto owners were generally split into two camps as to the reason why. The most prevalent of these camps included those who did not know enough about crypto, hadn’t heard of crypto, or did not know how to buy it.

N.B. In a further randomized controlled trial (RCT), various pieces of information about stocks, cryptocurrency or both, were given to selected groups of non-crypto users, which had the overall effect of increasing their desired investment share in cryptocurrency.

The other camp of non-crypto owners were those who believed it was too risky, a bad investment, or had no fundamental value, which is hardly surprising, given the amount of FUD (fear, uncertainty and doubt) often spread by mainstream media.

Finally, the study found that an increase in crypto prices led to an increase in purchases of durable goods or big-ticket items, but very little pass-through into non-durable spending. This suggests that holders viewed such gains in a manner similar to lottery wins, rather than a persistent increase in wealth. This is in comparison to assets like bonds, which saw an increase in both durable and non-durable spending when prices rose.

The study also noted that adoption tended to rise when prices were rising and that prices tended to rise during fresh waves of adoption. So if the main reason for not owning crypto is a lack of knowledge, it follows that if you want your holdings to go up in value, the best move would be to keep spreading the word.