The stablecoin market is currently dominated by centralized custodial tokens such as those issued by Tether and Circle. The only major DeFi stablecoin project, MakerDAO, supports its stability with a 60% centralized stablecoin reserve and is talking about rebranding.

Nevertheless, the concept of a decentralized stablecoin is too attractive to be ignored. In the last few months we have observed established DeFi players such as Curve, Aave and SORA expanding into the decentralized stablecoin niche.

Curve Stablecoin – crvUSD

On May 4, the popular stablecoin-focused decentralized exchange Curve launched its own collateralized stablecoin crvUSD. The token was first announced in the Curve stablecoin whitepaper back in 2022.

crvUSD is an overcollateralized decentralized stablecoin, similar to MakerDAO. In such a design, users borrow (mint) stablecoins against crypto collateral, using smart contracts with predefined parameters.

The core innovation advertised by the Curve team is a special liquidation algorithm LLAMMA, that adjusts (liquidates or borrows back) the client’s position based on the collateral price. The authors claim that the new feature will minimize losses that users experience as a result of harsh liquidations on other lending protocols.

Among other features of the stablecoin is an automatic stabilization mechanism PegKeeper that sets asymmetric mint and burn rules when the price of the stablecoin is above or below the peg.

On May 17, the Curve team released a web interface for crvUSD and expanded the pool of possible collateral options by adding WBTC, WETH and Lido’s stETH.

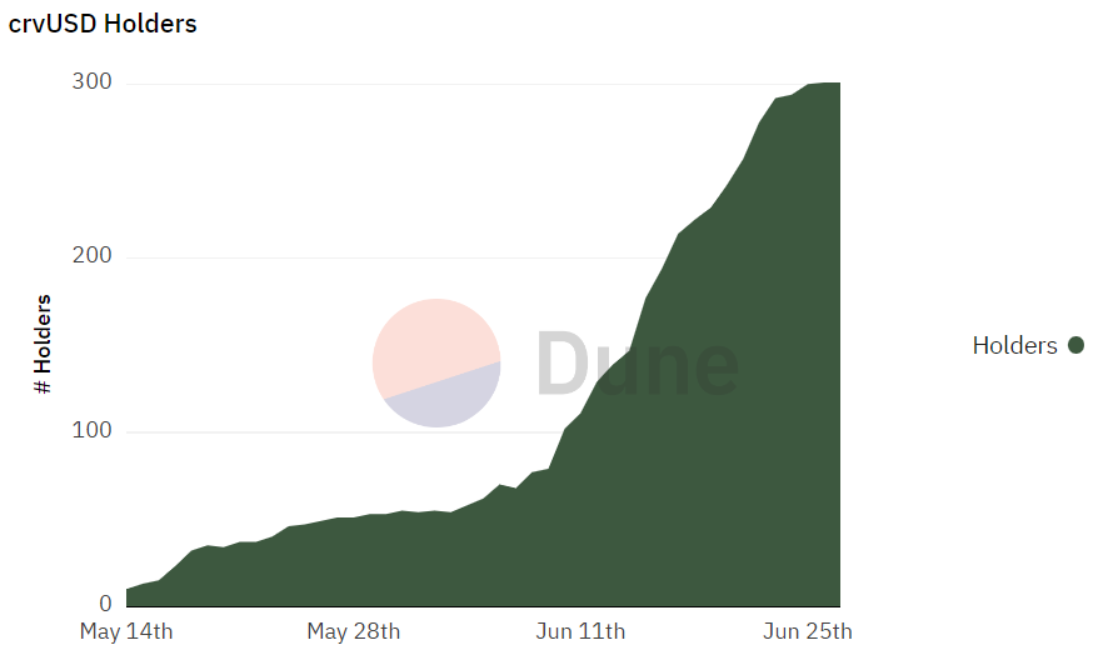

Within a month more than 300 holders subscribed for the new stablecoin, minting a total of 43 million crvUSD.

Aave Stablecoin – GHO

On June 6, after months of testing, Aave published the final design for the launch of its native stablecoin, GHO, on Ethereum. The GHO token will also be overcollateralized by crypto, with special discounted terms if borrowed against Aave's native staking token.

Known for its specialization in flash loans, Aave proposed a similar option for its stablecoin. The 'FlashMinter' protocol allows users to borrow GHO without collateral if they commit to returning the borrowed GHO in the same transaction.

Aave has also introduced the concept of a facilitator entity, a special protocol that will control how much and under what terms users can mint GHO. This is designed to separate the risks associated with stablecoin collateral from the rest of the assets in the Aave pool. Initially, two facilitators are planned: one for the Aave v3 Ethereum pool and one for the FlashMinter GHO described above.

The authors of the proposal are collecting community feedback, after which it will be moved to an Aave governance vote. If approved, it will not only increase the crypto locked in Aave pools but will provide an additional source of revenue for the project in the form of interest charged to the stablecoin holders.

SORA ecosystem stablecoin – TBCD

Earlier this year SORA introduced its stablecoin, TBCD, which stands for Token Bonding Curve Dollar. TBCD is an algorithmic non-synthetic stablecoin.

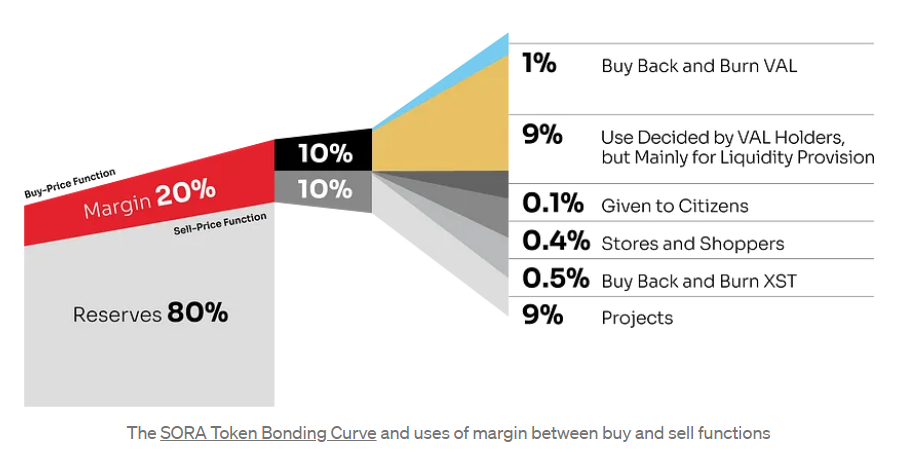

The core innovation by the SORA team is a special SORA token bonding curve – a smart contract, built into Polkaswap, which mints SORA's native XOR tokens in exchange for reserve assets, and burns XOR to return the reserve assets. Launched as a reserve asset of the SORA token bonding curve, TBCD is convertible to XOR and used for transactions of the projects funded by SORA community that require a peg to fiat currency.

The unique feature of SORA's token bonding curve is a margin between the selling and buying functions.

Interestingly, TBCD is created to be worth slightly less than its peg of $1 when SORA native token XOR is far lower than the current price point on the token bonding curve, thus reducing sell pressure to XOR.

Decentralized stablecoins fell under increased scrutiny after the synthetic Terra UST stablecoin project collapsed in 2022. While overcollateralized types such as MakerDAO remained afloat, user confidence in the concept of non-custodial stablecoin was shattered. Now, with major DeFi players rolling out their own stablecoins, investment and innovation may return to a much-demanded product.