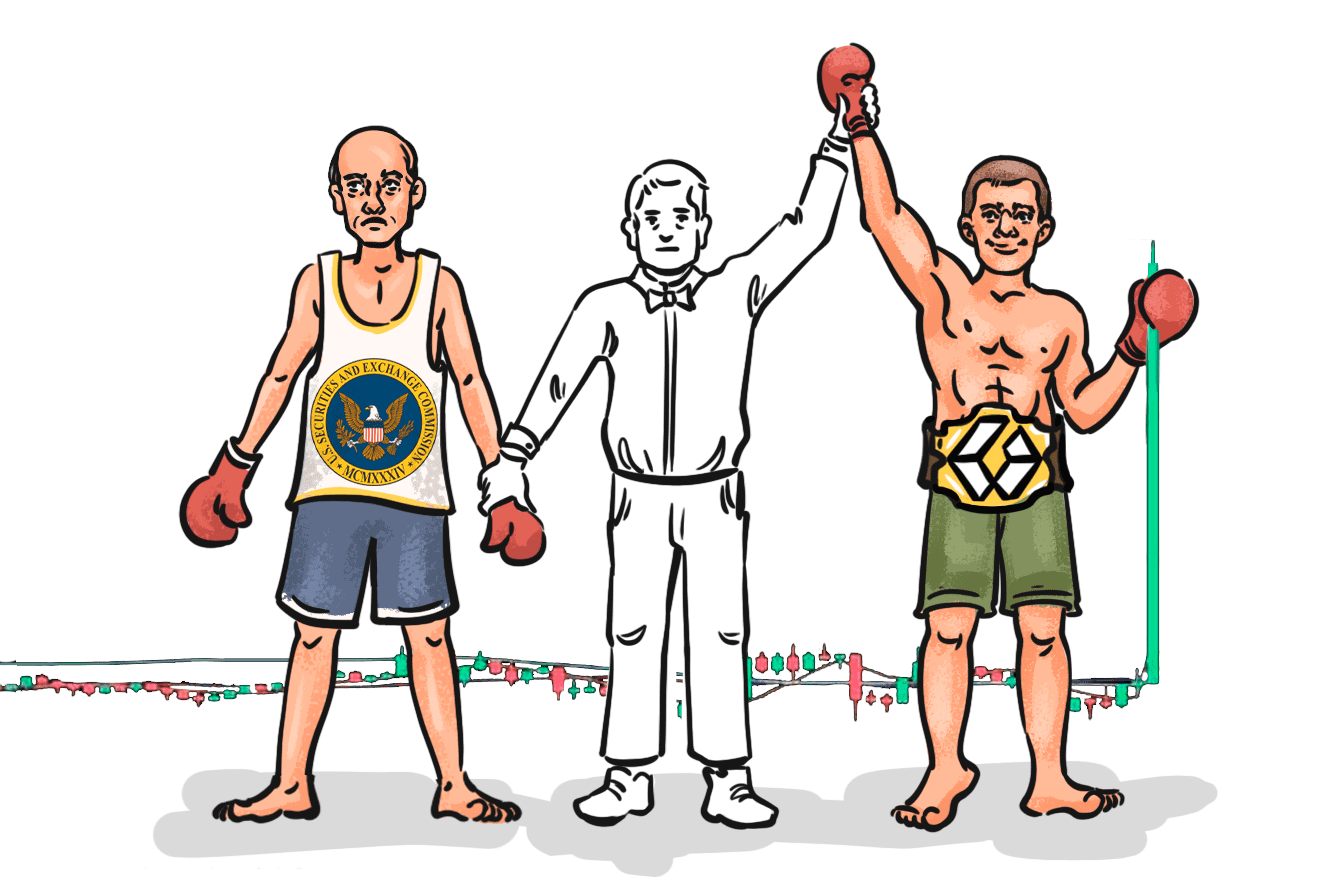

The U.S. Court of Appeals ruled on Tuesday that the Securities and Exchange Commission (SEC) was wrong to reject an application to list a spot bitcoin exchange-traded fund (ETF) by asset manager Grayscale.

The application, to convert the Grayscale Bitcoin Trust into an ETF, was first made in October 2021, but rejected by the SEC in June 2022. The regulator claimed that the rejection was due to the product not being “designed to prevent fraudulent and manipulative acts and practices.”

Unlike other spot bitcoin ETF applicants which have been turned down by the regulator over the years, Grayscale decided to sue the SEC. It argued that the arrangement for monitoring potential manipulation of bitcoin futures ETFs, which have been approved by the SEC, should also be adequate for a spot ETF.

Bitcoin futures ETFs track the price of bitcoin futures on the Chicago Mercantile Exchange (CME). According to the SEC itself, the CME, “surveils futures market conditions and price movements on a real time and ongoing basis in order to detect and prevent price distortions, including price distortions caused by manipulative efforts.”

In its ruling, the court stated that Grayscale’s proposed bitcoin ETF is indeed “materially similar” to the previously approved bitcoin futures ETFs. It went on to describe the underlying assets (bitcoin and bitcoin futures) as “closely correlated,” and said that the CME’s surveillance was “identical and should have the same likelihood of detecting fraudulent or manipulative conduct in the market for bitcoin.”

“The denial of Grayscale’s proposal was arbitrary and capricious because the Commission failed to explain its different treatment of similar products. We therefore grant Grayscale’s petition and vacate the order.”

The SEC now has 45 days to appeal the ruling, or else it must review the decision to reject Grayscale’s application. However, this does not mean that it must approve the application, as it may present alternative reasons for rejection.

As we Observed in June, three investment companies have recently filed applications with the SEC for spot bitcoin ETFs, including fund management behemoth BlackRock, which currently has a record of 575 approvals to just one rejection.

While the latest ruling against the SEC gives no guarantees that any of these will be approved, the regulator will surely be careful to avoid appearing “arbitrary and capricious” when making its decisions.