Members of Congress are trying to force the hand of the Securities and Exchange Committee (SEC) regarding how it handles the digital assets market, adding their voices to a growing choir of U.S. government officials disappointed with the regulator’s current course of action.

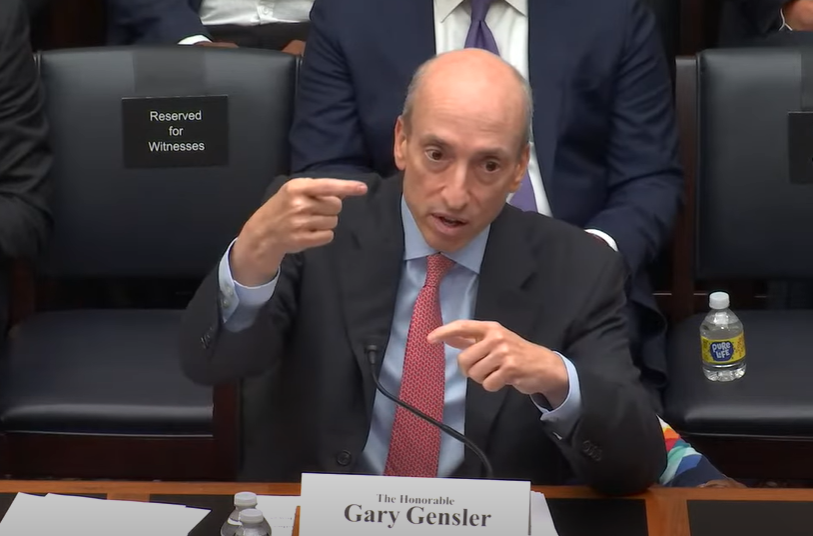

SEC Chair Gary Gensler was scolded yesterday for disrupting the markets with legal uncertainty at a hearing with the United States House Committee on Financial Services. The previous day, Gensler had received a letter from Congress members demanding that the market regulator stop discriminating against Bitcoin spot ETFs.

Discrimination Against Spot Bitcoin ETF’s Must Stop “Immediately”

The new-found dissent among Congress members follows the SEC’s loss of its court battle against Grayscale last month, which has seemingly marked a turning point for crypto market regulation.

The “arbitrary and capricious” behaviour by the SEC has been denounced by market players multiple times in the past, but after the District of Columbia Court of Appeals determined that such behaviour was “unlawful”, tables have turned - the SEC lost its legal standing.

In the letter sent by Congress Representatives Mike Flood, Tom Emmer, Ritchie Torres, and Wiley Nickel, the market regulator was asked to “immediately” approve Bitcoin spot ETFs.

As a result of the Court finding that the SEC’s arguments to invalidate Grayscale’s request before fell “short of the standard for reasoned decision making,” the congressmen state that “there is no reason to continue to deny such applications.”

“Investor Protection” Card No Longer Useful

Gensler continues to justify the cautionary strategy of the supervisory body he chairs as a mechanism for protecting investors from the “fraudulent and manipulative acts” typical of a market that is not yet mature.

Fear that the hard-won money of the American people is squandered by crypto gangsters like Sam Bankman-Fried is not an exclusive position of the SEC. Such concerns are frequently voiced by influential Democrats such as Senator Elizabeth Warren or Congresswoman Maxime Waters.

Yet, it seems that they are now the minority.

Congressmen and women are lending their voice to major financial firms, including Fidelity, BlackRock, Bitwise, VanEck, Galaxy, Invesco, and WisdomTree, who find the $1 trillion market mature enough to step into and want to get at it while the bull is still asleep.

Gensler Between a Rock And a Hard Place

The SEC might be the supervisory body of the largest financial market in the world, but as Chairman Patrick McHenry of the House Financial Services Committee said, it is “not above the law.” With the U.S. government on the verge of a closedown, so is the time frame to appeal to the court’s decision in Grayscale vs. SEC. If the committee doesn’t appeal, it will have to reconsider the spot Bitcoin ETF application.

At the same time, Gensler has been asked to clarify and reconsider the SEC’s position regarding all other digital assets but has so far failed to do so. During the hearing yesterday, the committee’s chair was asked if Bitcoin was a security, to which he didn’t have a clear answer.

He was also asked if tokenized Pokemon cards constituted an investment, and once again, as it has been SEC’s position all along, his answer implied that the matter had to be approached case-by-case, which is unfeasible.

Also yesterday, Franklin Templeton submitted yet another spot Bitcoin ETF application to the SEC, showing that the enthusiasm for digital assets is not going anywhere. But as pressure from all sides increases, Gary Gensler might.