Twenty One Capital is becoming a reality as blockchain records and public statements confirm that 37,229.69 BTC—worth approximately $3.9 billion—has been transferred so far to fund the venture. The transactions, publicly posted on X (formerly Twitter) by Tether CEO Paolo Ardoino, have fueled excitement across the crypto community. The company plans to accumulate over 42,000 BTC, positioning itself as the third-largest corporate holder of Bitcoin, behind MicroStrategy and Marathon Digital.

Originally unveiled in April 2025, the venture was initiated by Cantor Fitzgerald, which structured the deal as a SPAC merger with its affiliate Cantor Equity Partners (CEP). Far from being a passive facilitator, Cantor is a central architect of the transaction, aligning its financial infrastructure, investor network, and regulatory experience to bring the venture to market. The project is backed by Tether, Bitfinex, and SoftBank Group, with Jack Mallers, CEO of Strike, appointed as Twenty One Capital’s chief executive.

According to investor presentations filed with the SEC, Twenty One Capital’s core objective is to maximize Bitcoin ownership per share—not just holding BTC passively but using it to build an active, Bitcoin-native financial operating system. This includes native lending models, capital market instruments, and long-term treasury tools. The company is also introducing novel metrics such as Bitcoin Per Share (BPS) and Bitcoin Return Rate (BRR) to provide transparent benchmarks for investors' Bitcoin exposure.

Shareholder Structure and Founders' Stakes

The ownership of Twenty One Capital reflects a tightly coordinated strategy among its backers. Tether and Bitfinex, both owned by iFinex Inc., are the dominant contributors, together committing 25,812.22 BTC—or approximately 61.5% of the target 42,000 BTC reserve. SoftBank Group has committed an additional 10,500 BTC, representing its most direct Bitcoin exposure to date. Mallers’ Strike is also involved, though its exact equity stake remains undisclosed.

The Deal Under Cantor Fitzgerald’s Oversight

Cantor Fitzgerald is facilitating the transaction via Cantor Equity Partners, its SPAC formed earlier this year.

The firm has longstanding ties to Tether’s business, including custody arrangements for portions of Tether’s reserves, trading services for Bitfinex, and advisory roles in major deals such as Tether’s $775 million stake in Rumble. A 2024 Wall Street Journal report also revealed that Cantor holds a 5% equity stake in Tether, acquired for $600 million.

Beyond its ties to Tether, Cantor has built out its own crypto infrastructure, including a $2 billion Bitcoin lending program and a Gold-Protected Bitcoin Fund, which blends BTC upside with downside protection through gold exposure.

The deal also reflects the influence of Howard Lutnick, Cantor’s longtime chairman, who was instrumental in forging institutional credibility for Tether. His outspoken support for the stablecoin’s operational stability helped position it as a legitimate force in digital finance.

When Lutnick was appointed U.S. Secretary of Commerce in February 2025, it marked a pivotal moment for Tether—a key government official with direct institutional ties to the stablecoin issuer. Following his departure, his son Brandon Lutnick, now 29 and a Stanford Symbolic Systems graduate, assumed leadership of the firm, overseeing over $10 billion in AUM and expanding its crypto strategy.

Funding and Listing

On June 3, 2025, Tether's CEO, Paolo Ardoino, announced two large BTC transfers totaling 11,417 BTC (~$1.2 billion):

- 10,500 BTC (~$1.1 billion) on behalf of SoftBank

- 917 BTC (~$96 million) to convertible note investors

These followed earlier contributions:

- 14,000 BTC from Tether

- 7,000 BTC from Bitfinex

- 4,812.22 BTC from Tether on June 2 as pre-funding

All transfers are visible on-chain.

Twenty One Capital will go public via its SPAC merger with Cantor Equity Partners, trading under the ticker XXI on Nasdaq. It plans to raise an additional $585 million through convertible senior secured notes and a PIPE (private investment in public equity) offering.

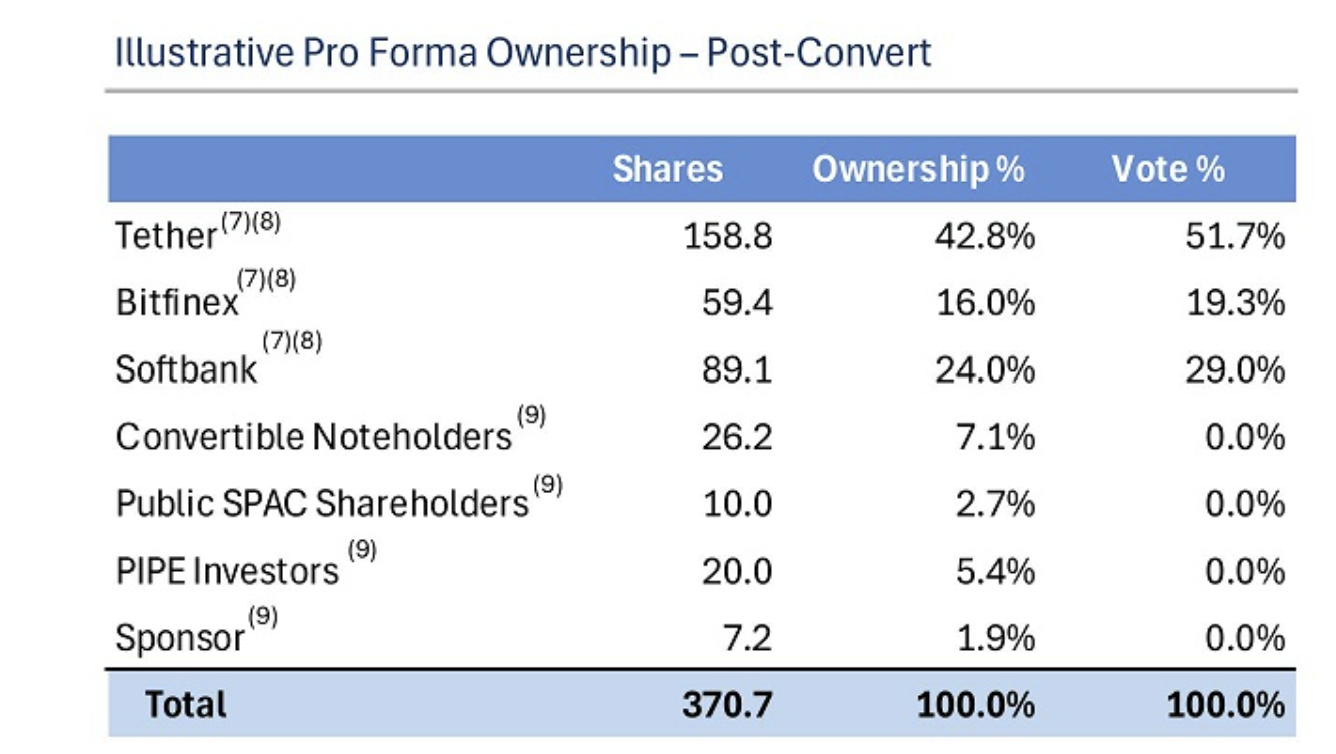

The post-conversion ownership structure of the company is dominated by iFinex, which holds 58.8% of the equity, followed by SoftBank with a 24% stake. Together, iFinex and SoftBank control 100% of the company’s voting shares. Of that, iFinex holds 71% of the voting power, while SoftBank controls the remaining 29%, giving the two founding investors full governance control over Twenty One Capital.

This multi-party initiative—spearheaded by Cantor and backed by Tether, Bitfinex, and SoftBank—marks a watershed moment in institutional crypto finance. It sets a precedent for how traditional financial powerhouses can leverage Bitcoin infrastructure to launch publicly traded, crypto-native financial platforms.