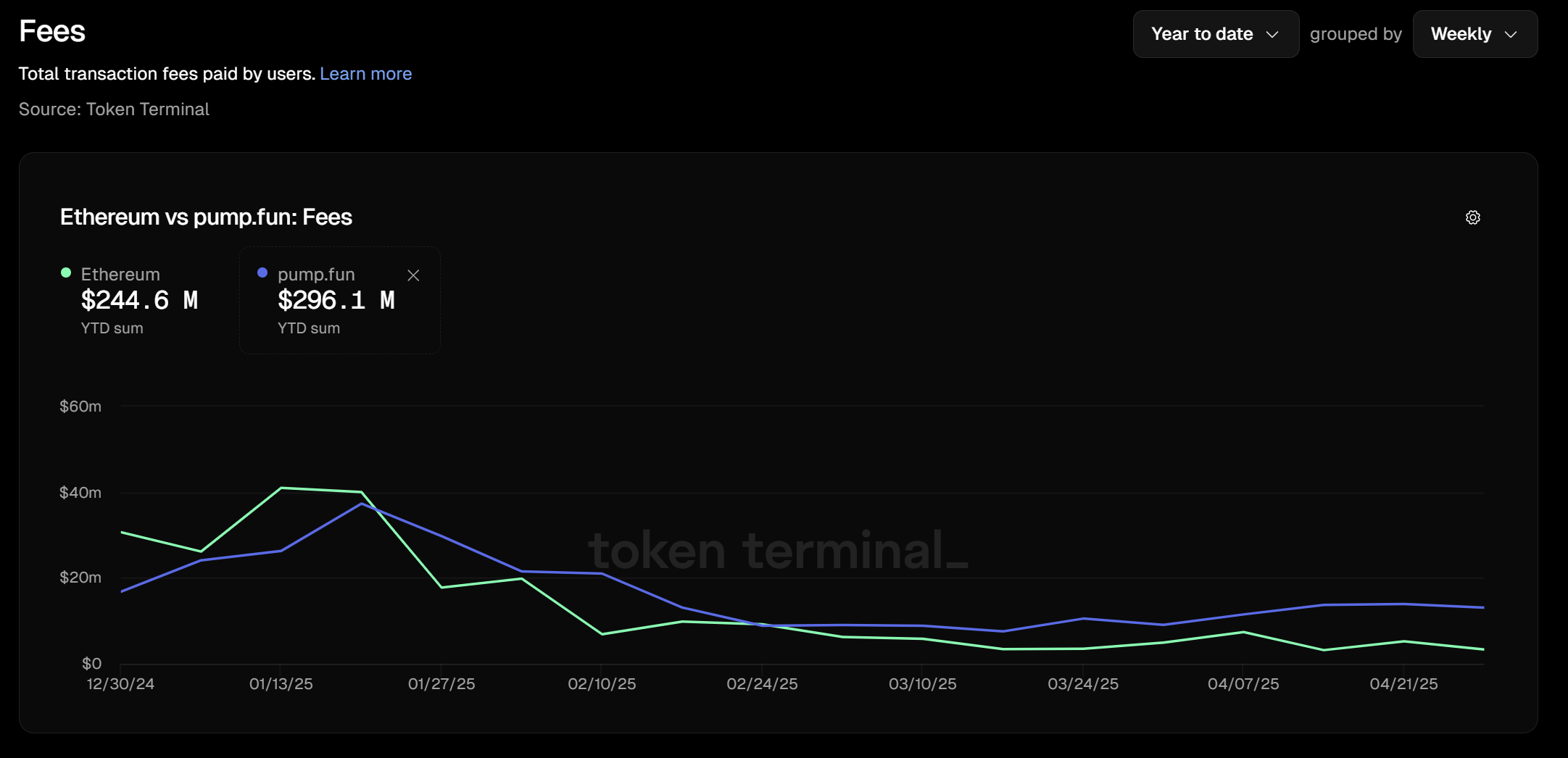

Despite a turbulent year in the broader market, memecoin trading has remained relentlessly active. Every day, traders gamble on newly launched tokens, hoping to catch the next 1000x and make life-changing profits. So far this year, Pump.fun, the largest memecoin launch platform, has already generated $296 million in fees, surpassing Ethereum’s total fees for the same period.

From Telegram Bots To Solana

With such intense interest in memecoins, it is no surprise that an entire ecosystem of tools and platforms has sprung up almost overnight. Initially, the space was dominated by Telegram bots, which offered a faster and simpler trading experience than traditional DEX interfaces. These bots quickly became the go-to method for memecoin trading.

As trading volume shifted from Ethereum to Solana, and platforms like Pump.fun took center stage, the ecosystem evolved. Telegram bots gave way to more advanced trading platforms, which now combine Telegram support with feature-rich web interfaces. These platforms offer real-time data, analytics, and tools designed to help traders navigate the incredibly fast-paced memecoin environment.

In the early days of Telegram-based trading, bots like Trojan and Banana Gun led the market. However, their lack of user-friendly interfaces ultimately cost them the top spot, as more innovative platforms emerged with advanced tools and better UX.

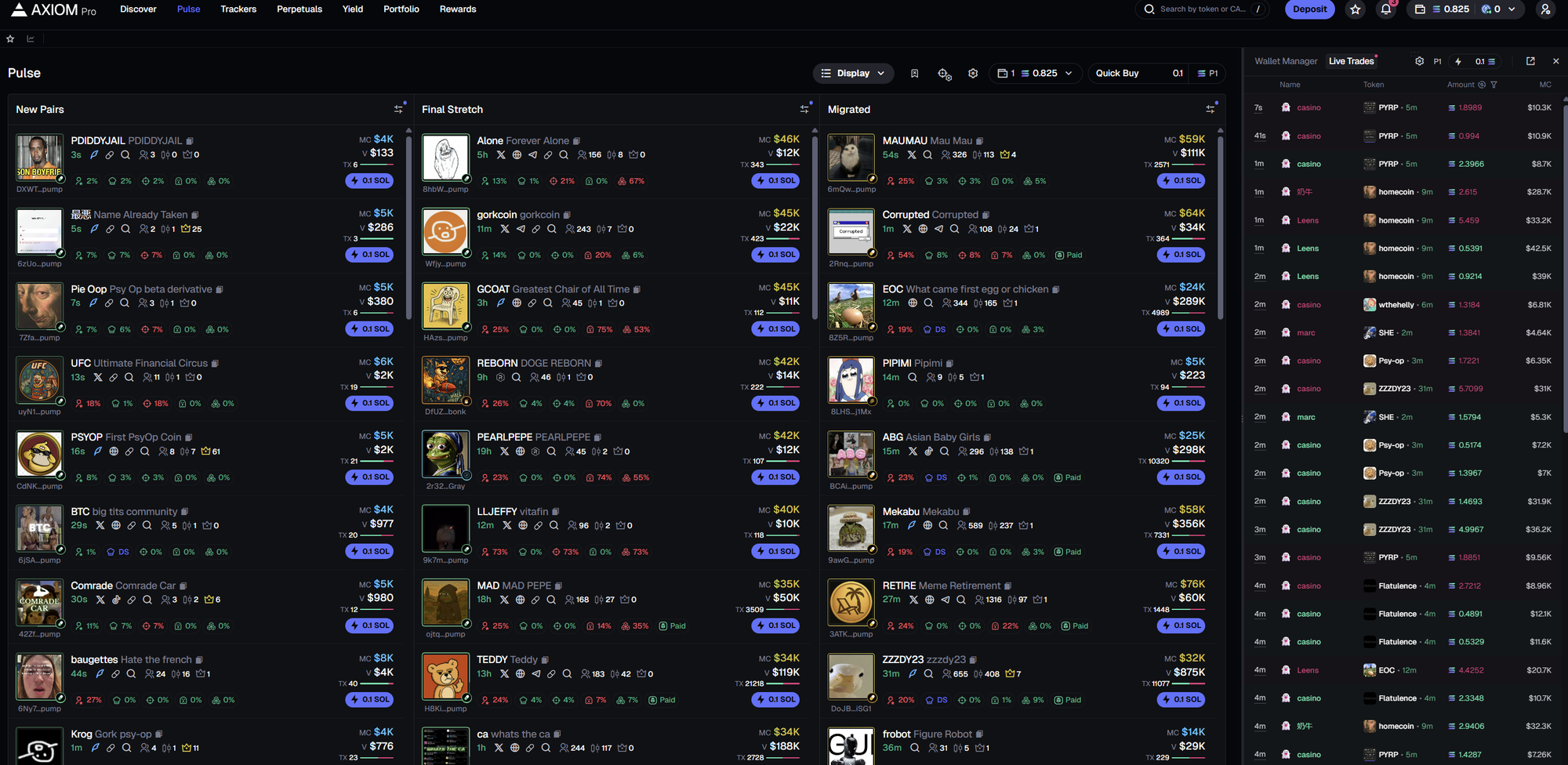

Trading directly in Telegram is fast, but when new tokens are launching every few seconds, analyzing them effectively through a chat window becomes impractical. A web-based terminal offers a far more powerful way to sift through data and make informed decisions.

Modern trading UIs have become highly advanced, offering data on market caps, trader activity, wallet analytics, influencer involvement, and even links to social channels. Since many of these tokens are blatant scams, the trader's primary task is to identify and avoid them—a job made much easier with access to detailed data. Trying to do all this from a Telegram chat is virtually impossible.

Axiom Leads the Space

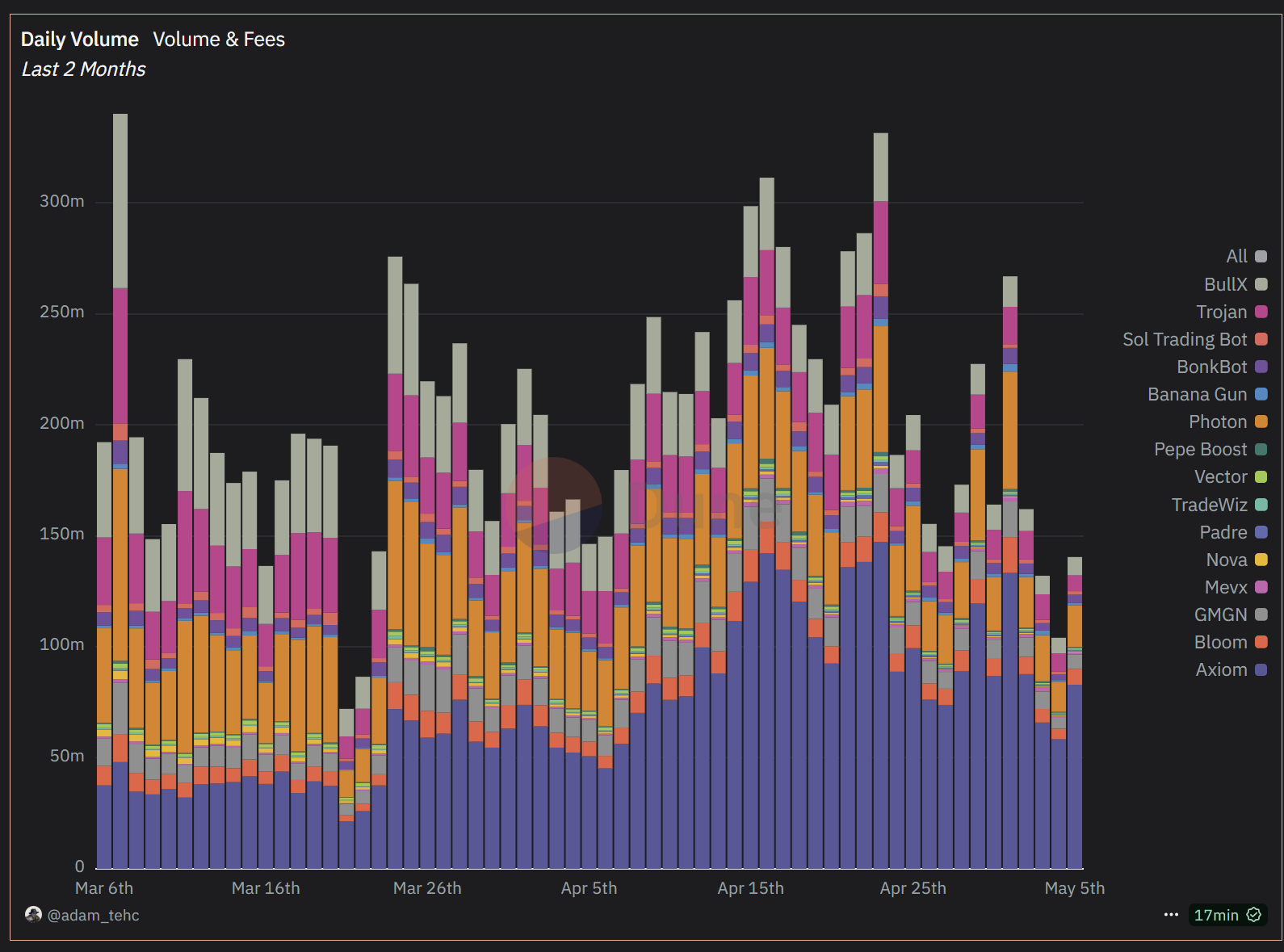

Today, daily memecoin trading volume on Solana sits between $140 million and $200 million, with several trading terminals dominating the space. Axiom leads with 58% market share, followed by Photon (12%), BullX (5.7%), and a long tail of smaller players.

While Axiom wasn’t the first platform to offer a trading UI, within a few months, it gained significant market share by innovating faster than competitors. It introduced more comprehensive data, like Twitter tracker, bundled wallet holdings, and various volume metrics. It also undercut others on fees, charging just 0.7%–0.9%, compared to the industry standard of 1%, a reduction that adds up quickly for high-frequency traders.

Additionally, the platform offered various referral programs and shared a portion of its fees with users, creating a viral effect as influencers across the space began recommending it. Unsurprisingly, this led to a large influx of users. Today, the platform generates approximately $800,000 to $1 million in daily fees, significantly outpacing its second-largest competitor, Photon, which earns only around $160,000 per day.

Axiom’s rapid growth is a case study in how a latecomer can still dominate a crowded market by moving fast, listening to users, and building a better product.

What Is The Next Innovation in Trading Bots?

The automated trading landscape remains fluid and unpredictable. No platform holds a guaranteed lead, and in such a fast-moving market, the next wave of innovation could come from anywhere.

Crypto trading bots are currently classified into the following main categories:

- Arbitrage Bots: Exploit price differences between exchanges.

- Market Making Bots: Provide liquidity by placing limit orders on both sides of the order book.

- Trend Following Bots: Trade based on indicators like moving averages to catch trends.

- Grid Bots: Place orders at fixed intervals around a set price, profiting from volatility.

- Scalping Bots: Make many small trades to accumulate profits over time.

As competition intensifies, the next generation of bots is likely to incorporate AI-driven decision-making, real-time sentiment analysis, and tighter integration with social platforms to better predict market movements. With the line between trading tools and social media blurring, traders will increasingly rely on hybrid platforms that combine speed, data, and community insight. The question now isn’t whether the bots will evolve—but how quickly, and which platform will set the next standard.