President Bola Tinubu’s new policies are having a profound negative impact on Nigeria’s economy, causing inflation to skyrocket and the naira to crash.

Since the recently elected president simplified the intricate exchange rate regime in June, the naira has been on a sharp decline. This week, it crashed to a record low of 970 to the dollar on the parallel market.

As the official money markets fail to provide enough foreign exchange, some buyers turn to the streets. Others turn to crypto.

This year's Chainalysis Global Crypto Adoption Index ranks the country in second place, with crypto transaction volume growing at 9.3% during the past year, totalling $56.7 billion. The analytics firm reports that “interest in Bitcoin and stablecoins has generally risen as the Naira’s value has decreased.”

Cryptocurrencies can be an effective way of avoiding the pitfalls of rising national inflation. Owning to Tinubu’s end to a subsidy on fuel, inflation in July reached 24.08%, a level not seen in almost twenty years.

The Central Bank of Nigeria (CBN) can try to offset the negative impact of the president’s policies, but as the governor’s seat remains empty, so the institution remains dormant.

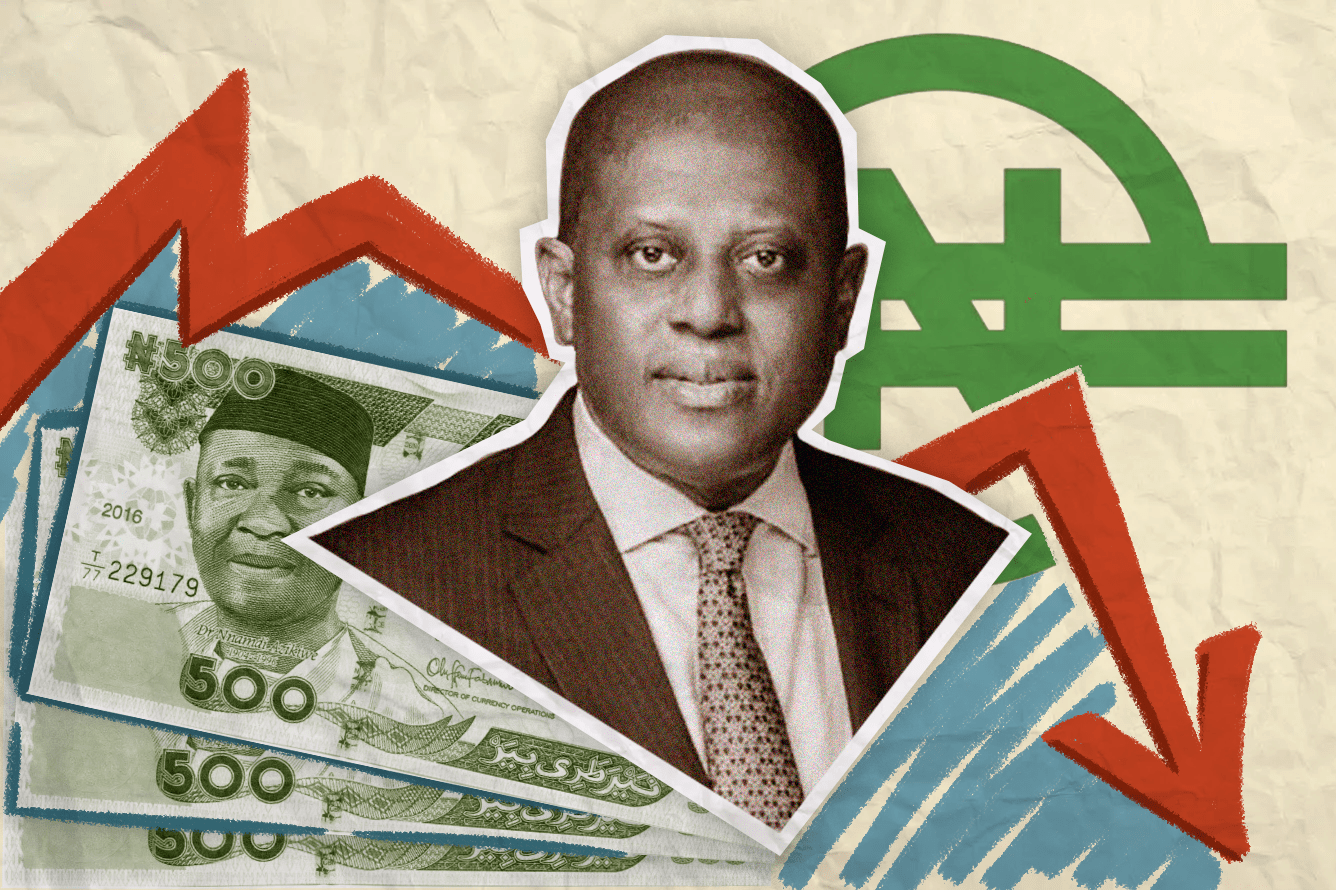

Back in June, the country’s head of state suspended the mandate of then CBN governor, Godwin Emefiel. Only last week, Tinubu appointed a successor, Olayemi Michael Cardoso, to take the wheel of the country’s monetary institution. This appointment is now awaiting the Senate’s approval.

The Harvard graduate and former chairman of Citibank is in for a lot of work once approved. After taking care of the exchange rates, the future governor will have to figure out what to do with the ailing Central Bank Digital Currency (CBDC).

The e-Naira has never reached the initially desired adoption levels. The loss in value of the national currency, combined with the project’s unpopularity and lack of retailer adoption, has led the digital currency to fall into oblivion.

The launch of the CBDC in 2021 was an attempt by Emefiel to counteract the growing interest in decentralized money. Two years later, as Chainalysis reports, “crypto has penetrated key markets and become an important part of many residents’ day-to-day lives,” meaning that the e-Naira stands no chance of curtailing crypto adoption now.

Yet, at the same time, CBDCs are becoming an essential tool in the monetary arsenal of sovereign states, as a vast majority of countries are either considering or already implementing a digital version of their national currency.

India and China, the first and second largest trading partners of the country, are well ahead in the pilot phase of their national digital currency. To let go of the CBDC project now would be a step back for Nigeria.

As Cardoso prepares to take the lead on the country’s monetary policy, the e-Naira remains the elephant in the room. Stopping the fall of the naira is the first step; what will be his second?