This week the largest stablecoin issuer Tether published its quarterly Consolidated Reserves Report (CRR). The company has been publishing its reserves since 2021, as part of its declared path to transparency. However, the private company is not part of any state or specialist regulatory regime, so it can choose the extent and the content of its reports.

Tether has not chosen to publish its financial reports in accordance with any standard. Instead, it began to publish the most important information that users seek for any custodial stablecoin - the balance and breakdown of its reserve assets. Such a report is far from being comprehensive because it omits important information about revenues, cash flows and other disclosures, and gives only a snapshot of the reserves at the end of the quarter.

BDO is not one of the Big4 (KPMG, PWC, EY and Deloitte) audit firms, but it is fifth in the list. Also worth noting is that the member firm that did the report, BDO Italia, is based in Milan, the hometown of Giancarlo Devasini, Chief Financial Officer of Bitfinex and Tether.

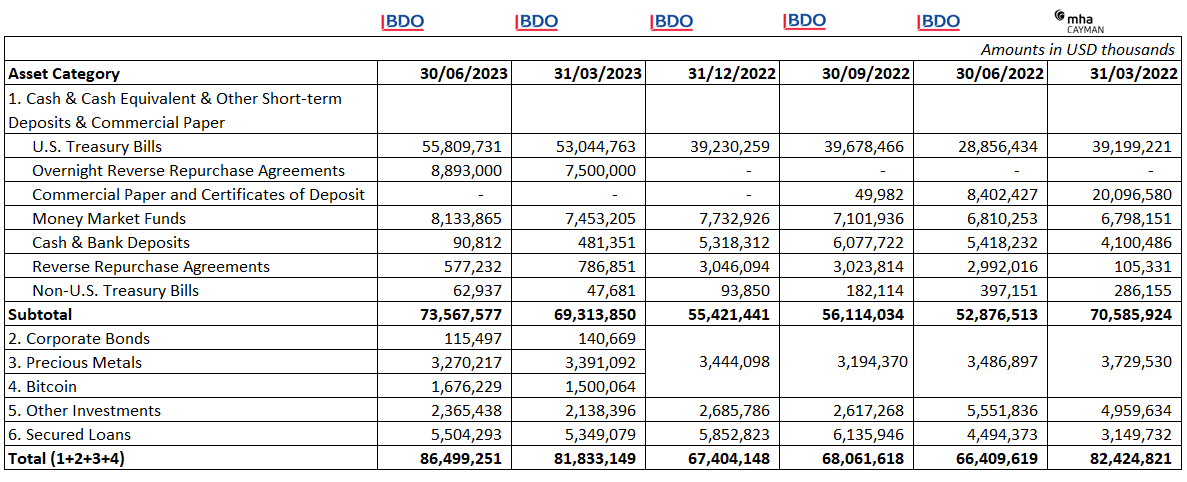

Nevertheless, we have what we have been given, so let's check what has changed since the previous Tether CRR:

There is an increase in assets of around $4.66 billion, an amount almost $860 million higher than the reported increase in total coins issued. The increase is presumably due to the retention of a $1 billion operating profit reported by the company.

To look at Tether's performance in perspective, PayPal, whose operation-related assets and liabilities are equal to roughly half of those of Tether, reported $1.6 billion profit for a second consecutive quarter.

Interestingly, Tether has not invested any of its new reserves in Bitcoin. The change in the value of its $1.5 billion crypto holdings was only around $176 million, which is mostly explained by the increase in Bitcoin price from $28,000 on 31 March to $30,000 on 30 June.

Most of the reserves went into buying U.S. government Treasury bills. The second largest increases were in Overnight reverse repurchase agreements and Money market funds. Due to a new disclosure that was added for the first time in this quarter's CRR, we learned that these two categories are also backed by U.S. government Treasury bills to almost 98% of their value.

The report also disclosed three ongoing litigations in which Tether is the defendant, without detailing the other parties. It is noted, however, that the probable settlement amounts are not provisioned in Tether's liabilities. However, one of these cases, the class action lawsuit filed by Matthew Anderson and Shawn Dolifka against Tether and Bitfinex companies, was recently reported to have been won by Tether.