Given that crypto markets are still evolving and sometimes lack efficiency, noticeable price variations can arise. With cryptocurrencies traded on so many exchanges worldwide, traders often spot opportunities to benefit from these price discrepancies.

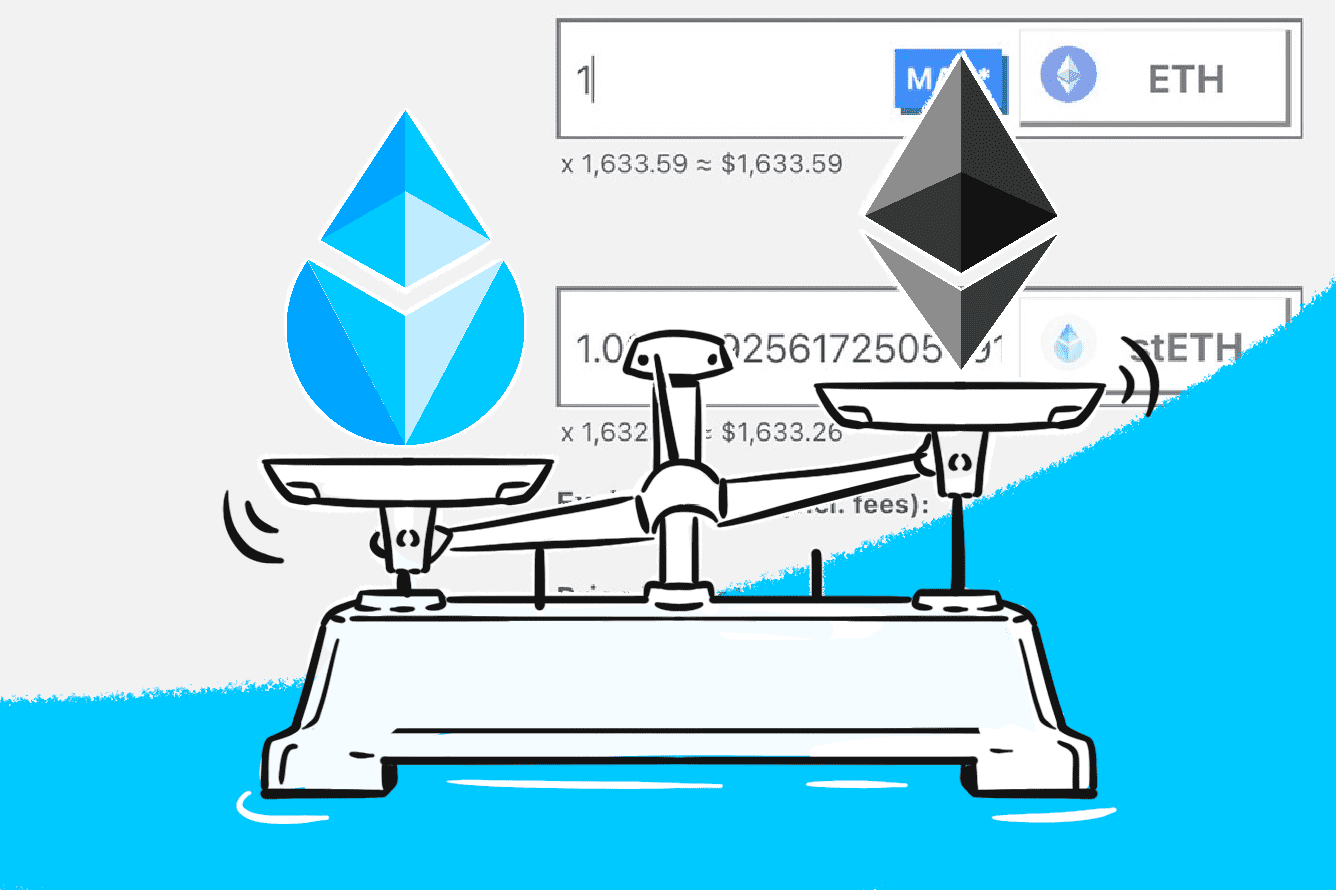

One notable example of an actionable arbitrage opportunity can be demonstrated with stETH, the ETH staked on Lido Finance. On Lido, users can get stETH for ETH and redeem it on a 1:1 basis. Consequently, many track the price of stETH across various platforms. Should there be a significant discrepancy from the ETH price, it could spell a profitable opportunity.

The essence of the strategy lies in market inefficiencies: the greater the inconsistency, the more arbitrage opportunities. Through their actions, arbitrage traders help bring stability to markets. Their constant buying and selling acts as a balancing force, narrowing the price discrepancies of similar assets across various platforms.

As depicted in the chart below, there have been moments over the past three months where these deviations were notably pronounced.

Intriguingly, even minor shifts in stETH pricing can be lucrative. In fact, one effective strategy highlighting this was shared by X (formerly Twitter) user Lookonchain.

He noticed that users can exchange ETH for stETH on the decentralized exchange Curve, for a slight profit. Specifically, exchanging 1 ETH would give traders about 1.0003795 stETH in return. Traders could then take the 1.0003795 stETH and redeem it for ETH at a 1:1 ratio on Lido, effectively making 0.003795 ETH.

While this opportunity is not feasible for small traders because of gas fees, it can yield significant returns for larger traders. For instance, one whale swapped 1,370 ETH (around $2.1 million) for 1,370.3351 stETH on the 1-inch exchange and then redeemed 1,370.3351 ETH on Lido. With just 0.0061 ETH spent on gas fees, he netted a profit of 0.329 ETH, equivalent to $540.

In practice, this strategy can be automated using bots and executed multiple times a day until there's no price difference between stETH and ETH, and thus no arbitrage profit.

This is a good example showing that crypto markets, especially decentralized finance, are still far from being fully efficient, and there are many opportunities for smart traders.

Interestingly, the opportunity with stETH still exists, at the time of writing. So, if you're a crypto whale, you might want to head to Curve and capitalize on some arbitrage profit.