Stacks is a Layer 2 network built on top of Bitcoin. It brings smart contracts to the Bitcoin blockchain. What makes Stacks stand out is its consensus, called Proof of Transfer (PoX). It ties the Stacks chain directly to Bitcoin by using Bitcoin’s own mining power to secure it. In practice, that means if someone wanted to attack Stacks, they would have to reorganize the Bitcoin blockchain itself.

Unlike other wrapped Bitcoin options such as WBTC or cBTC, which rely on centralized custodians, sBTC custody is governed entirely by smart contracts. Bitcoin is deposited into a script (wallet) on the Bitcoin main chain and managed by a decentralized, open-membership group of participants known as signers. The system is designed to always keep a 1:1 backing between BTC and sBTC, and anyone can check this for themselves, since everything is visible and verifiable on-chain.

Because there is no central custodian involved, the process is not only more transparent but also cheaper. Users don’t have to pay custodian fees, and the transaction costs for moving BTC in and out are relatively low.

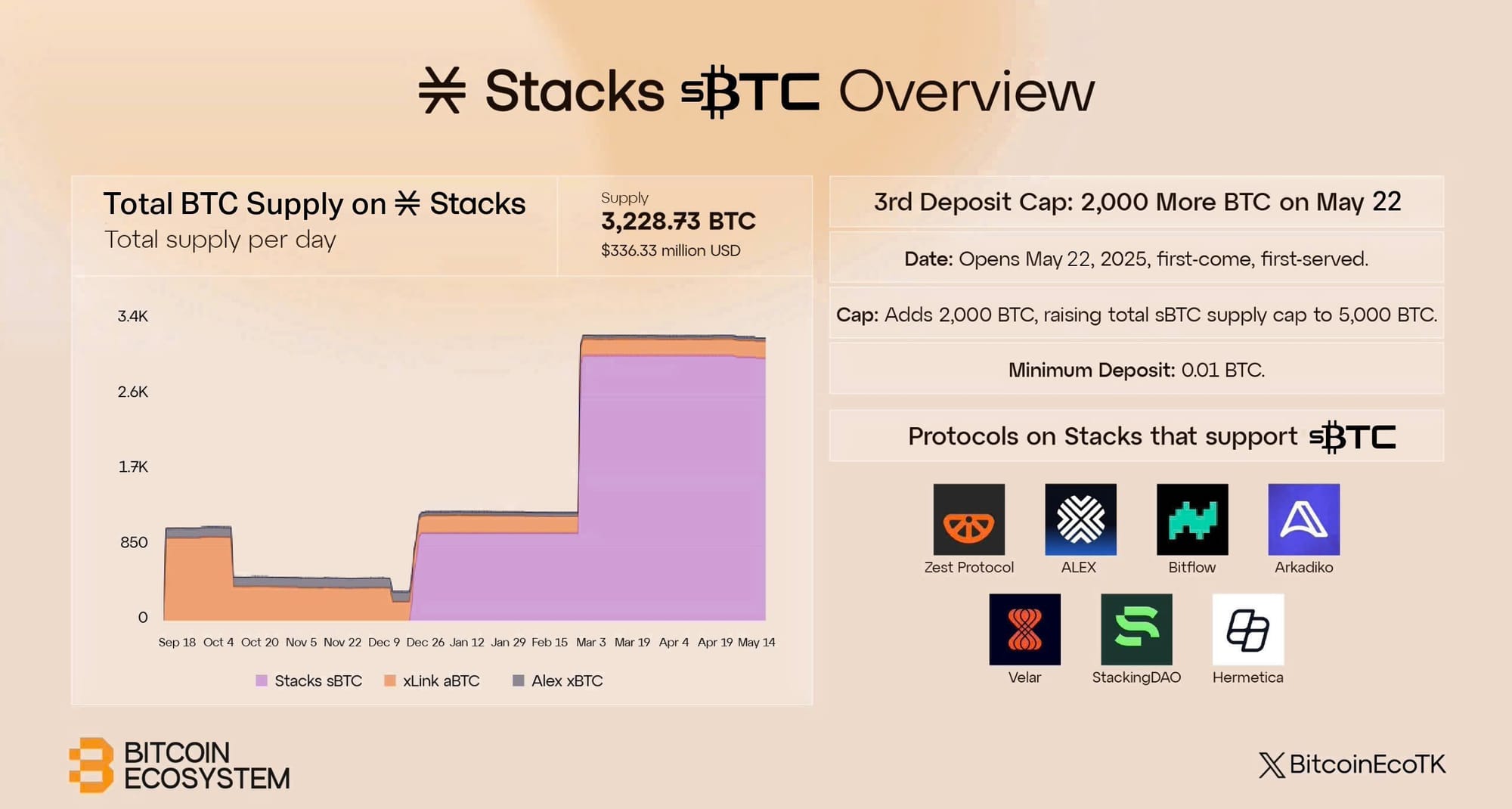

Still, in terms of total Bitcoin locked, sBTC is playing catch-up. Right now, it holds around 3,000 BTC, which is far less than what is backing wrapped tokens like WBTC (128,000 BTC), Binance’s BTC (68,000 BTC), and Coinbase’s BTC version (about 18,000 BTC). That said, Stacks isn’t standing still.

The team behind sBTC is already working on expanding to other chains, including Solana, Aptos, and Sui.

Stacks Set to Raise sBTC Deposit Cap

What sets Stacks apart is that it is the only major wrapped BTC project that uses a fixed cap as part of its core security model. Other popular options like WBTC and L-BTC allow unlimited minting, relying on centralized or federated custodians. Even protocols like tBTC, which aim for decentralization, use dynamic risk-based limits rather than a hard ceiling.

Stacks’ approach is conservative by design, trading off early growth for long-term trust. While this has slowed adoption compared to faster-scaling competitors, it has also earned Stacks a reputation for prioritizing decentralization and on-chain transparency—consistent with its mission to bring smart contracts and DeFi directly to Bitcoin.

Considering demand forecasts, Stacks is getting ready to raise the deposit cap for sBTC, after quickly hitting its previous limit. When deposits opened in February, the 3,000 BTC cap (worth over $300 million at the time) was filled in under 24 hours. Now, the team plans to lift that cap by another 2,000 BTC to allow for more sBTC to be minted.

The cap on sBTC was not originally outlined in a formal white paper but was introduced as a risk management mechanism during the rollout of the Stacks Bitcoin bridge in early 2024. Given that sBTC uses a novel decentralized custody system—where Bitcoin is locked on the main chain and managed by a group of signers without a central custodian—the cap served as a security measure to limit the total amount of BTC at risk during the protocol’s early stages. By setting the initial cap at 3,000 BTC, the Stacks team aimed to test the system under real conditions while ensuring that a potential failure wouldn’t result in massive capital loss.

Bitcoin DeFi Is Possible—But Is It in Demand?

While more than 3,000 BTC is technically on-chain via sBTC, only a fraction of it is actively deployed in productive DeFi strategies. The rest is likely idle or sitting in custodial contracts, waiting for safer or more attractive yield opportunities—something the upcoming cap increase and new integrations aim to unlock.

The largest application on the Stacks protocol is Stacking DAO, which focuses on yield generation for the STX token.

Other key applications on Stacks protocol include ALEX, a decentralized exchange and launchpad; Arkadiko, which enables borrowing against STX; and Zest Protocol, which seeks to connect Bitcoin capital with real-world yield opportunities. However, most of these platforms are still centered on STX and its derivatives rather than Bitcoin itself.

The applications that truly represent Bitcoin-native DeFi on Stacks are still limited but steadily growing.

Zest Protocol is a standout, offering sBTC holders the ability to lend their Bitcoin to real-world borrowers in exchange for yield, all managed through smart contracts. It aims to create a more decentralized and permissionless form of Bitcoin lending, avoiding centralized intermediaries.

ALEX has begun integrating sBTC into its liquidity pools and trading pairs, allowing users to trade sBTC against STX and stablecoins.

Bitflow, a newer entrant, provides swap functionality for sBTC, simplifying conversion between BTC and other assets on Stacks.

There is also early-stage experimentation in using sBTC as collateral for loans or stablecoin minting, though adoption remains limited due to the capped supply and modest protocol support.

In the long term, the success of Stacks will depend on whether Bitcoin-native DeFi can scale and attract meaningful adoption. The initial sBTC cap has helped ensure security, but raising it could unlock more capital and drive greater usage of Bitcoin-backed applications.