South Korea is taking action against foreign VASPs for operating in the country without registration. KoFIU reported 16 cryptocurrency exchanges for working illegally.

The Korea Financial Intelligence Unit (KoFIU) which works under the Financial Services Commission (FSC) has recently reported 16 virtual asset service providers for operating without the necessary registrations in the country. The list is as follows: KuCoin, MEXC, Phemex, XT.com, Bitrue, ZB.com, Bitglobal, CoinW, CoinEX, AAX, ZoomEX, Poloniex, BTCEX, BTCC, DigiFinex, Pionex.

Last year KoFIU warned 27 foreign VASPs about the necessity to register according to the law:

“With the Act on Reporting and Using Specified Financial Transaction Information going into effect from March 25, 2021, all VASPs are required to register their business with the KoFIU by September 24, 2021. As such, the KoFIU has sent out a notice to 27 foreign VASPs about their obligation to register. For foreign VASPs that continue to operate without registration, the KoFIU will notify them of their illegal activities and take actions such as blocking access to their websites to inhibit their illegal business operations”.

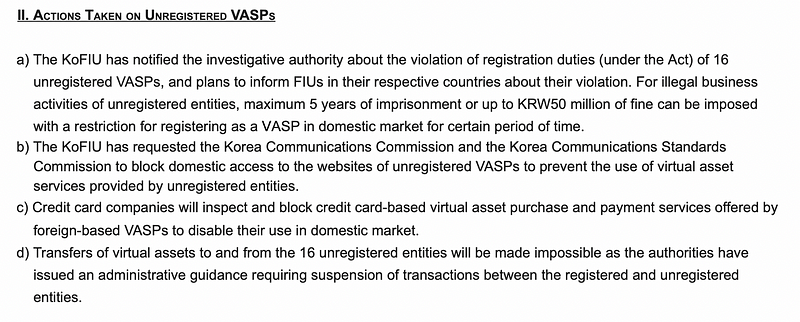

Seems that the above-mentioned sixteen didn’t pay attention and now KoFIU claims that they “were found to have been engaged in business activities targeting domestic consumers by offering Korean-language websites, having promotional events targeting Korean consumers and providing a payment option that supports the purchase of virtual assets using credit cards”. The following measures will be imposed on “the outlaws”:

Earlier this year FSC announced the enforcement of the travel rule on VASPs which aims to prevent money laundering. The rule states that when sending a virtual asset worth 1 million KRW or more to another VASP, the originating VASP is required to provide the names of senders and receivers as well as virtual asset addresses to the VASP at the receiving end. It is also bound to provide the resident registration number of the sender when requested by KoFIU or the VASP at the receiving end. In addition, VASPs were obligated to keep user information for five years from the time of termination of transactions.

We wrote earlier about the Terra collapse that triggered a round of regulatory actions in South Korea as well as in other countries.

Today the increasing regulation of VASPs can be seen all around the globe. Every country has tried to adapt to the crypto surge in its own way. This is quite expected: the influence of VASPs on the economies of nations is growing rapidly and governments want to secure financial stability. All in all, they don’t have any experience in this field — nobody does. That is why it is difficult to predict whether these measures will help economies to stay healthy or will stop them from developing. Anyway, it will be interesting to observe, stay tuned!