At the end of May, Binance suspended Australian dollar withdrawals via bank transfer, having already removed the functionality for Australian users to deposit funds via PayID earlier in the month. Local payment services provider, Zepto, had reportedly been instructed to offboard the exchange by its partner, Cuscal, which gave a statement to CoinTelegraph:

“…we are focused on supporting the industry in protecting Australians from financial crimes and scams… Cuscal has, and will continue to, terminate any clients or their customers and/or merchants that do not meet our strict requirements.”

In March, Binance contacted users in the UK, to let them know that pound sterling deposits and withdrawals via bank transfer would also be suspended in May. Again, this was down to the local payment services provider, Skrill, ending its partnership with the exchange.

In September last year, Binance registered as a financial service provider in New Zealand and opened an office in the country. Four months later, after asking every bank it could find, the exchange had still been unable to open a local account, meaning staff wages and rent had to be paid from offshore sources.

Over in the U.S., authorities have done little to hide their desire to see crypto companies debanked, with the Federal Reserve, FDIC and Office of the Comptroller of the Currency issuing joint statements in both January and February, reminding banks of the risks they faced dealing with crypto-asset-related entities.

By mid-March, the FDIC had stepped in to force the closure of three U.S. banks with perhaps the biggest crypto exposure, although arguably the bigger problem had been the reduced value of government bonds held by these banks, due to Federal Reserve interest rate rises.

The recent events in the U.S. have even led members of the government’s House Financial Services Committee to request information from the three agencies, on a potential coordinated attack on digital assets firms, which some believe is both undeniable and illegal.

The notably crypto-friendly state of Wyoming recently joined a legal action suing the Federal Reserve for its anti-crypto stance.

Wyoming created a new kind of bank called a Special Purpose Depository Institution (SPDI) as a safe and federally regulated alternative to the reckless speculation often associated with crypto. In January, after more than two years of deliberation, the Federal Reserve announced that it would not allow SPDI Custodia to become a member and access the Fed’s payment systems.

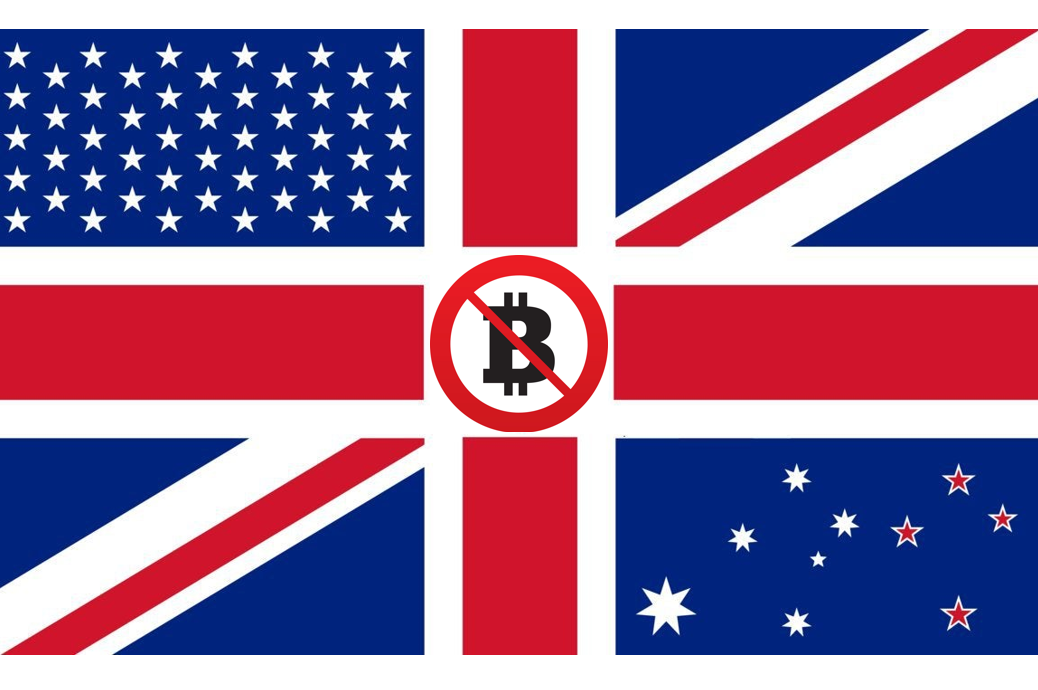

So why exactly do majority-English-speaking countries (the Anglosphere) seem so keen to debank crypto? Cast our gaze almost anywhere else in the world and we see European banks offering crypto trading, Asian banks issuing their own stablecoins, South American crypto exchanges licensed as payment institutions.

Perhaps the banking institutions in these English-speaking countries fear that they have the most to lose from the democratization of the financial sphere that crypto initially promised. So they desperately try to stifle such innovation while the rest of the world welcomes such democratization with open arms.

But crypto will do just fine without them… and it will be interesting to Observe how long it takes for banks in these countries to eventually realize the futility of their actions and climb on board.