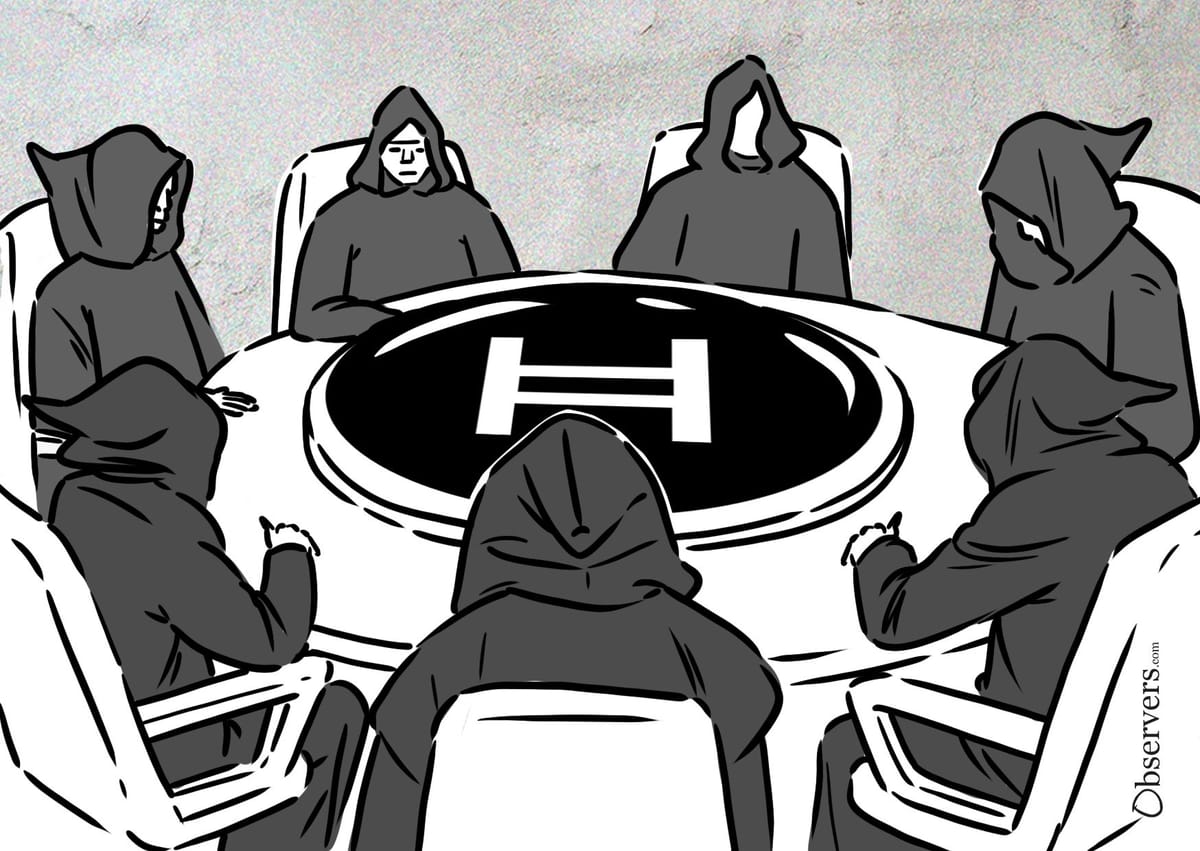

Hedera has been a mainstay on the crypto stage since 2018 — but there's one thing in particular that differentiates this open-source, public network from the other projects vying for investor attention: how it's governed.

More than 30 members form the Hedera Council, with each given an equal vote on the network's development to achieve decentralization. And since launch, it's attracted some pretty big names.

The investment company abrdn, which has $94 billion in assets under management, is one prominent name that recently became a member. They are joined by an eclectic range of industry heavyweights, including tech giants Google, Dell, and IBM, along with financial titans such as Nomura and Standard Bank. Other surprising council members include the aviation company Boeing, the multinational food manufacturer Mondelez International, and the gaming brand Ubisoft.

And, what's especially interesting is that each member can only serve a maximum of two three-year terms before their time on the council is over.

Decentralized governance is hard to come by in #web3.

— Hedera (@hedera) May 15, 2024

Transparent, responsible, and trusted #governance - with established, enterprise members spread across industries and continents - even more so.

Explore the #Hedera Council 🌐 https://t.co/2g5UuCGlWa pic.twitter.com/Hx8PbpZv4O

So, what has led some of the world's biggest companies to join the Hedera Council?

Govern and Learn

One explanation could be their interest in tokenization and distributed ledger technology in general. Some of them are already looking to modernize their offerings and are actively building on Hedera.

For example, Mondolez (whose brands include everything from Oreo to Cadbury) is turning to DLT for supply chain management and enticing customers through digitized money-off vouchers rather than paper coupons. One of the company's executives, Xiang Xu, was especially bullish when its arrival at the Hedera Council was announced in February, declaring:

"The potential to solve longstanding retail industry challenges for consumer-packaged goods companies and merchants is very compelling."

The tokenization of real-world assets in particular is a compelling use case for Hedera — and the public network claims it's successfully handled over 142 million transactions in the past 24 hours, with each costing just $0.0001 on average.

Another council member, EDF, has been looking to tokenize its carbon offset and credit system through this platform. The French energy giant completed a proof of concept last year that allowed the drivers of electric vehicles to ensure the power used to charge their cars is from renewable sources.

Patented Ledger Technology

Another explanation of the corporate interest could be the legal and commercial structure of the project. Hedera was founded by Hashgraph inventors Leemon Baird and Mance Harmon. Unlike most public blockchains, the Hashgraph technology used by Hedera was patented and held by a private company, Swirlds, owned by Leemon Baird and Mance Harmon. Hedera had an exclusive license to the Hashgraph patents held by their company.

Such structure is explained on the Hedera website by the risk of forks for mission-critical applications:

"The patents are a tool designed to inhibit forking and the associated instability and loss of network effects. The absence of enterprise-grade applications running on the public networks today is partly due to the possibility of those networks splitting into competing networks and cryptocurrencies. This represents risk to anyone considering building mission critical applications on those networks. The patents will allow Hedera to make a commitment to such enterprises that we will never authorize a fork.

In an interesting development of this position, in January 2022, the members of the Governing Council voted to acquire the Hashgraph IP from Swirlds, promising to make it Open Source. Some part of the code was indeed placed in the public domain; however, there is no information on if all of the key components have been transferred from Swirlds. After almost two years, there is no news of another project utilizing Hashgraph either.