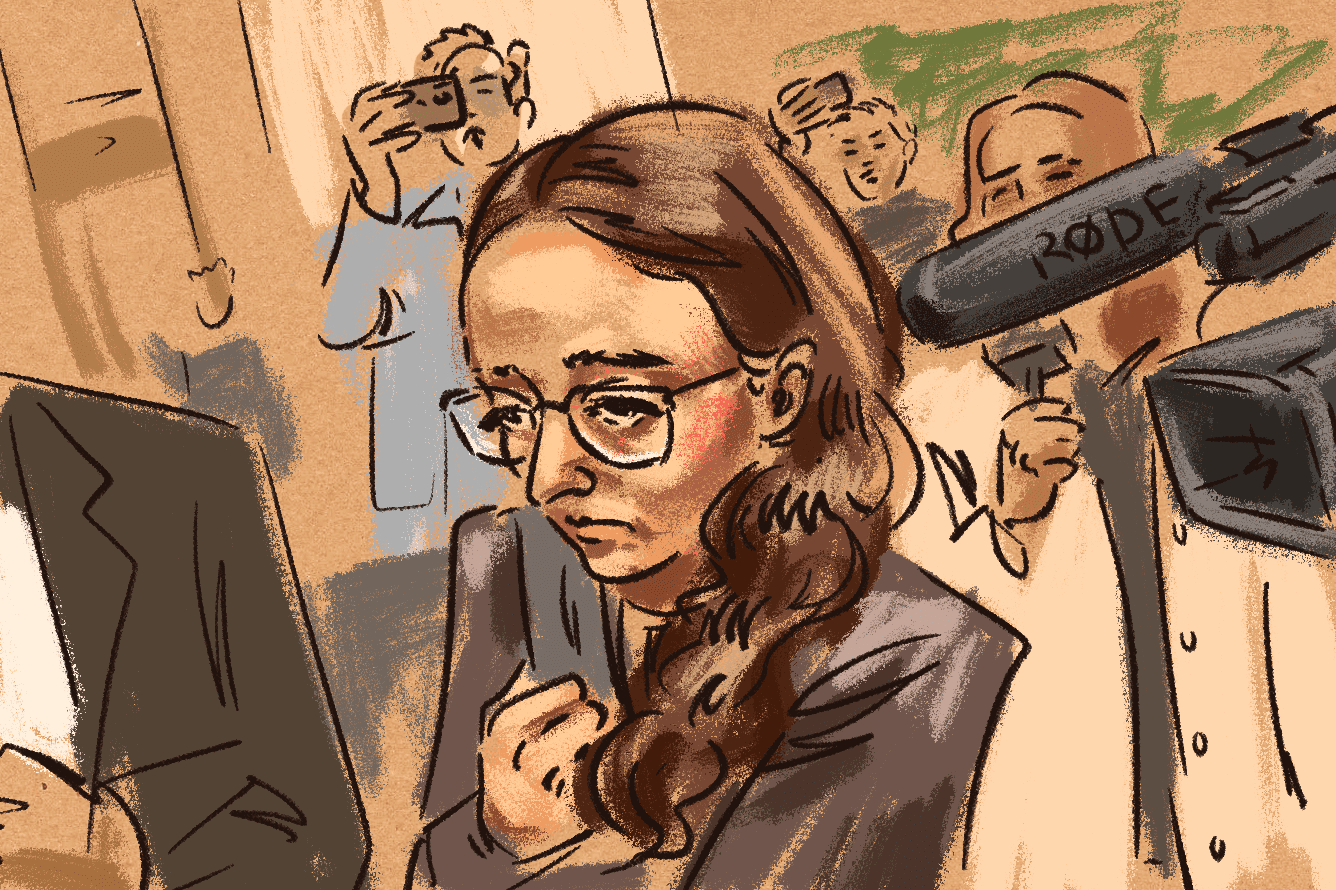

This week, star witness, Sam Bankman-Fried's ex-girlfriend, and former Alameda Research CEO, Caroline Ellison stepped into the spotlight. She started by confirming that she was indeed guilty of fraud, as “Alameda took several billions of dollars from FTX customers and used it for investments.” Ellison put all the blame on Bankman-Fried, however, saying that he was the one to set up the systems that allowed Alameda to take $14 billion from the exchange.

According to Ellison's testimony, in mid-June, months before the eventual collapse of FTX, lenders including Genesis were calling in multi-million dollars worth of loans to Alameda Research, causing Bankman-Fried to instruct her to work on several alternative versions of Alameda’s balance sheet. The one eventually presented showed $10.3 billion in total liabilities after Ellison erased a $9.9 billion loan from FTX, to make Alameda “look less risky than it was,” as otherwise Genesis could recall its $500 million loan.

Ellison added that SBF was considering multiple options to survive the storm, including raising capital from the crown prince of Saudi Arabia, borrowing more capital from BlockFi and turning regulators against crypto exchange Binance. Apparently, none of the alternatives worked out.

"Still a fan..." 😂

— CZ 🔶 Binance (@cz_binance) October 11, 2023

Lesson: Forget about your competitors; focus on your customers. - Jack Ma https://t.co/cxYx0FNgXx

Aside from this, Ellison shared some personal information about the defendant including his ambitions to become president of the United States and his idea to pay off Donald Trump to prevent him from running again. She mentioned that communication with her ex-boyfriend had deteriorated after their last breakup and she was trying to avoid meeting him one-on-one. Ellison felt that she wasn’t doing a great job in the months before the collapse, but Sam Bankman-Fried persuaded her to stay.

Selected segments of an audio recording of Ellison meeting with former Alameda employees days before the collapse were also played before the court as part of the witness testimony of Christian Drappi, a former software engineer at Alameda. At the meeting, Ellison told staff about the use of FTX customer deposits. The record shows that employees had no idea that the fund had been using FTX customers’ funds. When Ellison was asked by an employee whose idea it all was, she replied with, "Um, Sam, I guess," and giggled.

Alameda was kind of borrowing a bunch of money via open-term loans and using that to make various illiquid investments. So like a bunch of FTX and FTX US equity [...] most of Alameda’s loans got called in in order to meet those recalls. We ended up borrowing a bunch of funds from FTX, which led to FTX having a shortfall in user funds,” - Ellison explained the situation to the staff.

Ellison has already pleaded guilty and confirmed having held at least 20 meetings with prosecutors since December 2022 as part of her cooperation agreement.

On cross-examination, she confirmed that funds borrowed by Alameda could have legally been used for a range of purposes, including trading activities and covering the company’s operating expenses. The defence used this to show that the lenders knew the capital might have been used for undefined purposes.

FTX co-founder Gary Wang also concluded his testimony this week, and was cross-examined by Bankman-Fried’s attorney. According to him, Bankman-Fried thought there was a 30% chance that Alameda should be shut down. He also stated that he was not sure whether a tweet by Binance's CZ or leaked financials caused the eventual run on the exchange.

Another witness, Zac Prince, the founder and former CEO of BlockFi, described its financial relations with FTX and Alameda, stressing that Alameda had always paid its loans on time. However, he was unaware of the fact that Alameda was doing this using funds from customers. He also stated that BlockFi would not have had to file for bankruptcy if not for the failure of FTX.

Lawyers representing Bankman-Fried are allegedly going to use details from the crypto exchange’s terms of service during witness testimonies. On October 12th they submitted a filing to the court asking for permission to question witnesses for the prosecution over the terms, as well as to preclude testimony from "lay fact witnesses" as they "would only serve to distract and confuse jurors in considering the facts in light of the meaning of the Terms of Service."

The trial will continue on October 16th, stay tuned!