Described as a “new approach to money”, the Reserve Protocol initiative was created in 2018 by Nevin Freeman and backed by Coinbase, Peter Thiel, and Y Combinator’s CEO Sam Altman. It aimed to “provide highly scalable, decentralized, stable money” and permit the much wider usage of cryptocurrencies due to its stability.

The original release of the protocol included a USD-referencing RSV token, but the project authors envisaged ‘a sophisticated DAO-based legal system, which may permit the replication of true central banking on the blockchain’ for creating a floating coin.

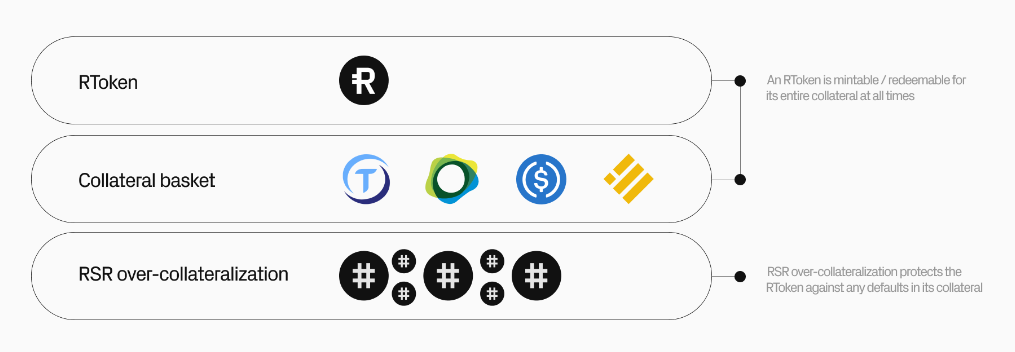

Reserve protocol allows anyone to create an asset referencing token (stablecoin), or participate in the improvement of an existing one. As the project’s website explains, RTokens (the generic name for a stablecoin that gets created on top of the Reserve Protocol) should be 100% backed by other assets which can be any combination of ERC-20 tokens. Each RToken is governed separately.

A key feature of the Reserve Protocol is the dynamic decentralized governance of the reserve assets in the asset vaults. Information about an individual reserve asset's performance is supplied to the protocol via oracles, and the system automatically rebalances the reserve mix to maintain the collateral target.

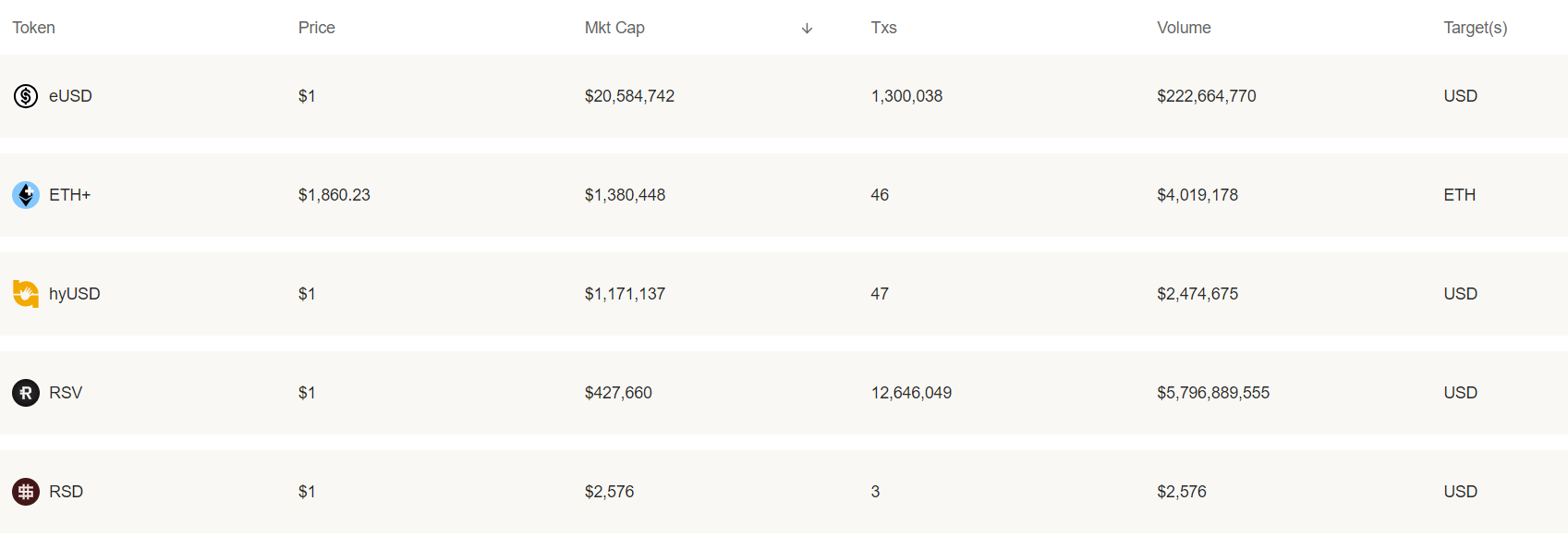

At the time of writing, there were 5 asset-referencing RTokens 'registered' by Reserve Protocol and 8 more that were unregistered. The total market cap of all of these tokens was around $23 million, with $20 million concentrated in the leading eUSD token, which was launched by the Mobilecoin project in October 2022.

The impeccable performance of eUSD in times of USDC crisis led the Reserve Protocol to adopt it as the native token of its stablecoin wallet, Rpay instead of the original RSV token.

A distinctive feature of RToken design is a special over-collateralization mechanism implemented with Reserve Rights (RSR) token staking. Reserve Rights tokens are Reserve Protocol's native tokens that provide the holders with a portion of RToken revenues. Staked RSR can be seized by the protocol in the event of a collateral token default, in order to cover losses for RToken holders.

Reserve Rights (RSR) tokens have a fixed total supply of 100 billion, out of which half are in circulation. The remaining tokens are controlled by the Reserve team in the so-called 'Slow Wallet', which is another piece of innovation brought by the project:

The Slow Wallet has a hard-coded 4-week delay after initiating each withdrawal transaction on the blockchain. Upon initiating a withdrawal transaction, the team announces the purpose of the withdrawal either through a public on-chain message or on social media. If RSR holders do not agree with the purpose of the withdrawal, they are able to sell their RSR in the 4-week period before the project is able to sell what they have withdrawn. The team can only access these withdrawn tokens after those 4 weeks.

Although much smaller in capitalization compared to other stablecoins, the Reserve Protocol has earned great popularity in communities with highly inflationary native currencies such as Latin American countries. It also provides a great deal of innovation in the search for future money technology, making it a great subject for our Observations.