On-chain asset tokenization is a possible future replacement for the existing traditional fractionalization. An issuer mints digital tokens representing fractions of an underlying digital or physical asset on blockchain. These tokens guarantee transparent and immutable ownership as a result. There are two main types of tokenized assets:

- Fungible tokenized assets which are interchangeable and divisible (each unit has the same market value, validity and can be divided into as many divisions as configured initially), for example, fiat-backed stablecoin $1 worth;

- Non-fungible tokenized assets which are unique and non-interchangeable (tokens can’t be replaced with other tokens of the same type), for example, ownership of a piece of art.

On-chain asset tokenization offers multiple advantages over traditional fractionalization, for example:

- Improves affordability;

- Enables borderless accessibility;

- Unlocks liquidity and enhances flexibility;

- Enforces immutable transparency and accountability;

- Streamlines transaction efficiency;

- Ensures better price discovery.

The report “Relevance of on-chain asset tokenization in crypto winter” by Boston Consulting Group in partnership with ADDX says that investors currently try to stay away from the crypto market because of the recent collapses of crypto companies, regulatory uncertainty, geopolitical turmoil, and unrealistic expectations of supernormal return on investments on DeFi projects, and this trend is expected to continue. Meanwhile, developer activity remains strong, indicating a resilient talent pool. The authors conclude that this situation will eventually channel capital and talent pool to viable kinds of blockchain applications and DeFi projects, one of which is on-chain asset tokenization.

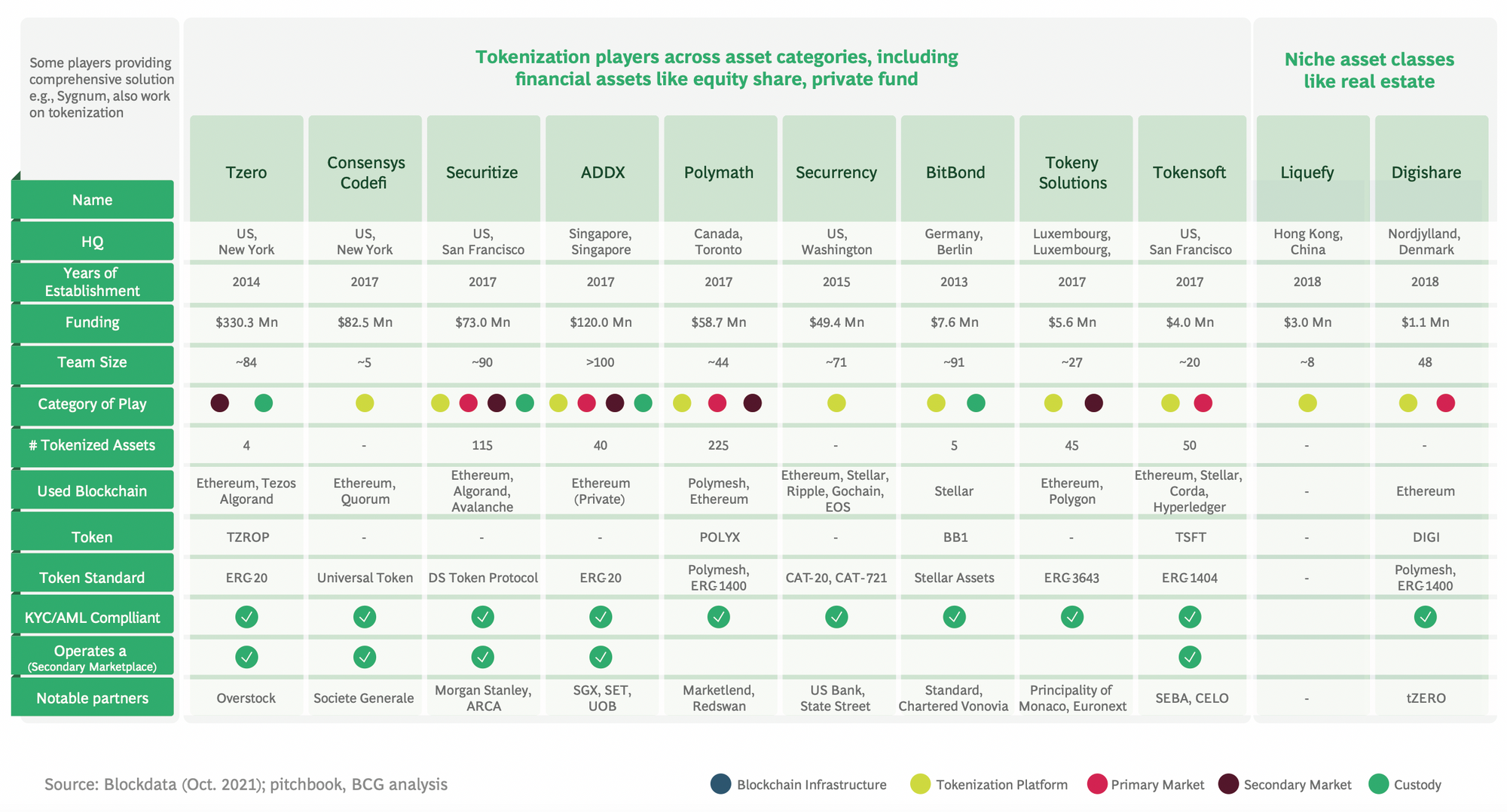

The report covers 11 emerging players offering on-chain tokenization. Polymath, a Canadian company based in 2017, offers the biggest amount of tokenised assets (225), Securitize takes second place with 115 assets. Mostly these companies work on Ethereum and Stellar networks.

Range of emerging on-chain tokenization players. Source: “Relevance of on-chain asset tokenization in crypto winter” by BCG and ADDX.

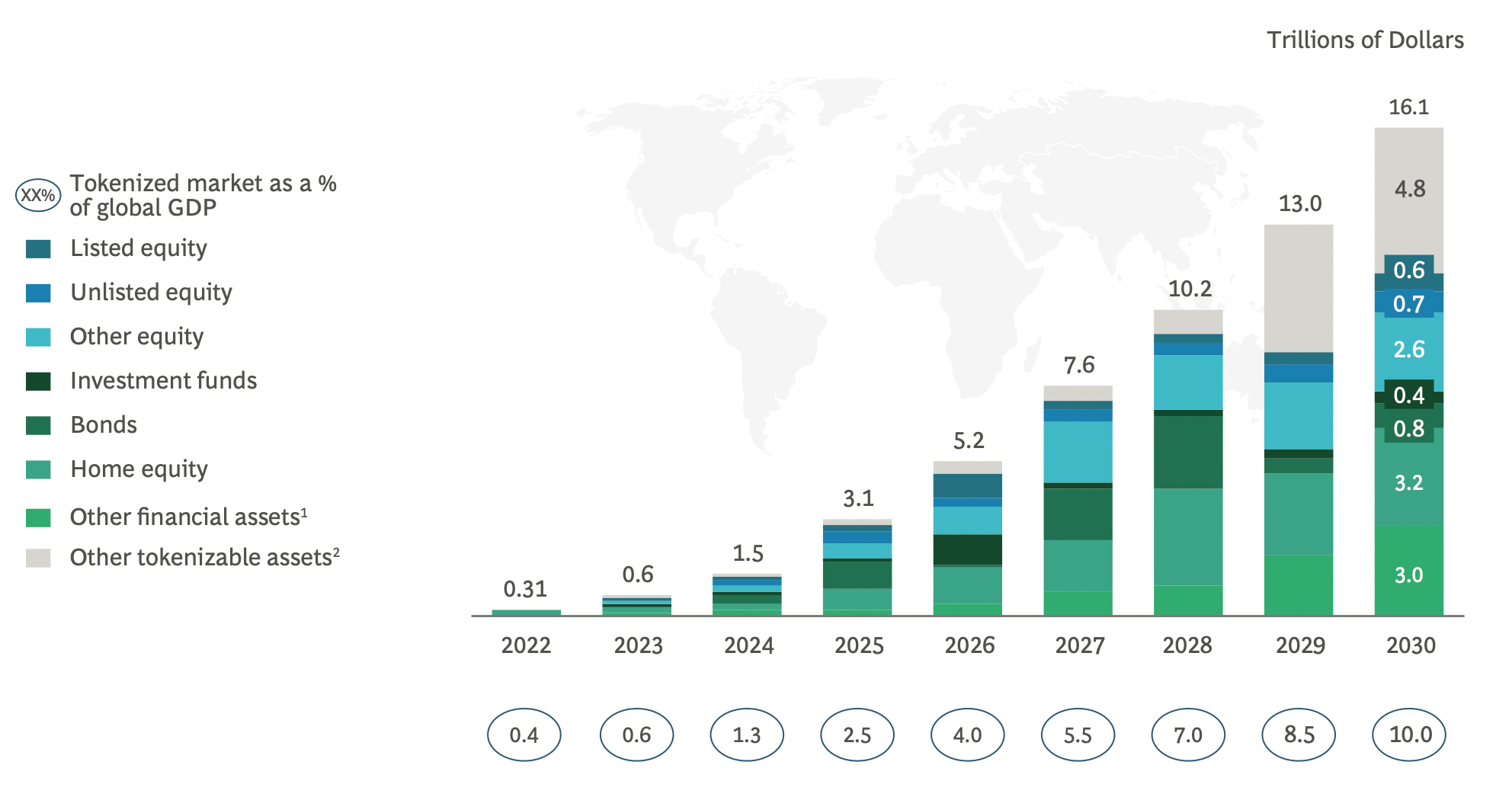

The report says that “tokenization of global illiquid assets estimated to be a $16 trillion business opportunity by 2030”

It highlights that the total tokenized market can reach 10% of global GDP by 2030.

Tokenization of illiquid assets to be a $16 trillion worth opportunity globally. Source: “Relevance of on-chain asset tokenization in crypto winter” by BCG and ADDX.

The report was published half a year ago, but the latest news confirms that real-world assets’ tokenization is going on. Recently there were rumours that Amazon marketplace will tie digital ownership to physical goods delivered to customers, Goldman Sachs launched a tokenization platform for traditional financial assets GS DAP, Seimens released its first digital bond, Hong Kong issued tokenized green bond using Goldman Sachs’ platform, which is meant to finance environment-friendly or climate-focused projects etc. It looks like the real-world assets’ tokenization is inevitable, and, for example, the Circle CEO thinks the same:

Love this. So obvious that tokenized property and contracts will be the norm in the next 5-10 years. https://t.co/FpwQwUFVB9

— Jeremy Allaire (@jerallaire) March 29, 2023

Citi bank states in its “Money, Tokens and Games” March 2023 report that the tokenization market will reach between $4 trillion to $5 trillion by 2030 (which is way less optimistic than the BCG outlook, but still is impressive) and suggests that private equity and venture capital funds will become the most tokenized assets.

If the outlooks suggested are correct, this might be the catalyst for mainstream crypto adoption worldwide. Well, let’s check it in 7 years or so.

By the way, would you love to have your ownership over real-world assets to be fixed in blockchain or in a more traditional way? Share your thoughts in the comments. Meanwhile, we continue to observe, stay tuned!