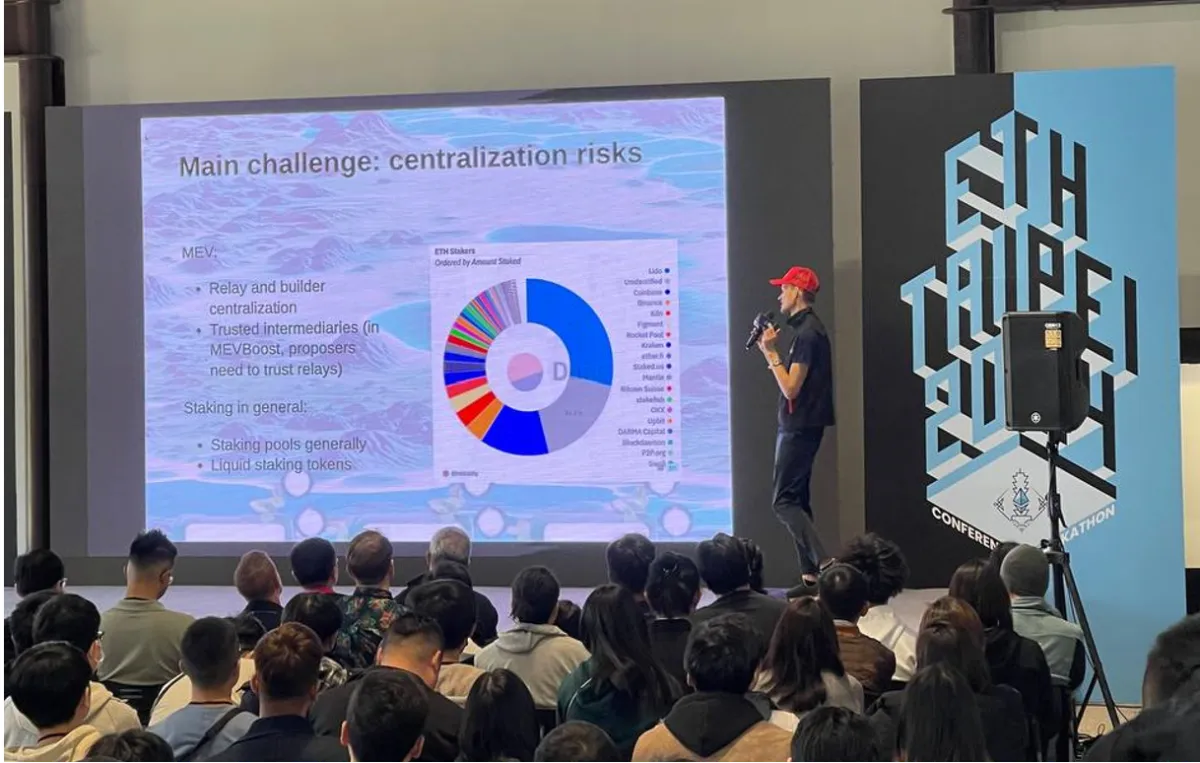

Vitalik Buterin recently highlighted the centralization risks associated with Ethereum staking at ETH Taipei. He pointed out that entities like Lido, Coinbase, Binance, and others hold a disproportionately large share of the Ethereum staking market. To address this issue, he proposed a concept called “rainbow staking,” a framework designed to enable a diverse range of protocol service providers to participate in a variety of protocol staking services.

The concern over Ethereum’s staking becoming overly centralized is not new. Large staking operators have captured a significant portion of the market, introducing systemic risks to the network. For instance, Lido currently controls 30% of the Ethereum staking market, meaning almost a third of all staked Ether is with Lido, highlighting the centralization problem.

A core issue with the current staking model is that:

…most capital is held by people who are not willing to personally run staking nodes in their current form, signing messages every slot and locking their deposits, and subjecting them to slashing.

Diversified (or Rainbow) staking is trying to mitigate that issue, by properly aligning incentives among different staking participants. This model aims to differentiate the services provided by various participants, including professional operators, solo home stakers, and passive capital providers, incentivizing them according to their contributions to the network. This system ensures that each class of service provider can operate most effectively within their niche, without the pressure of a one-size-fits-all expectation.

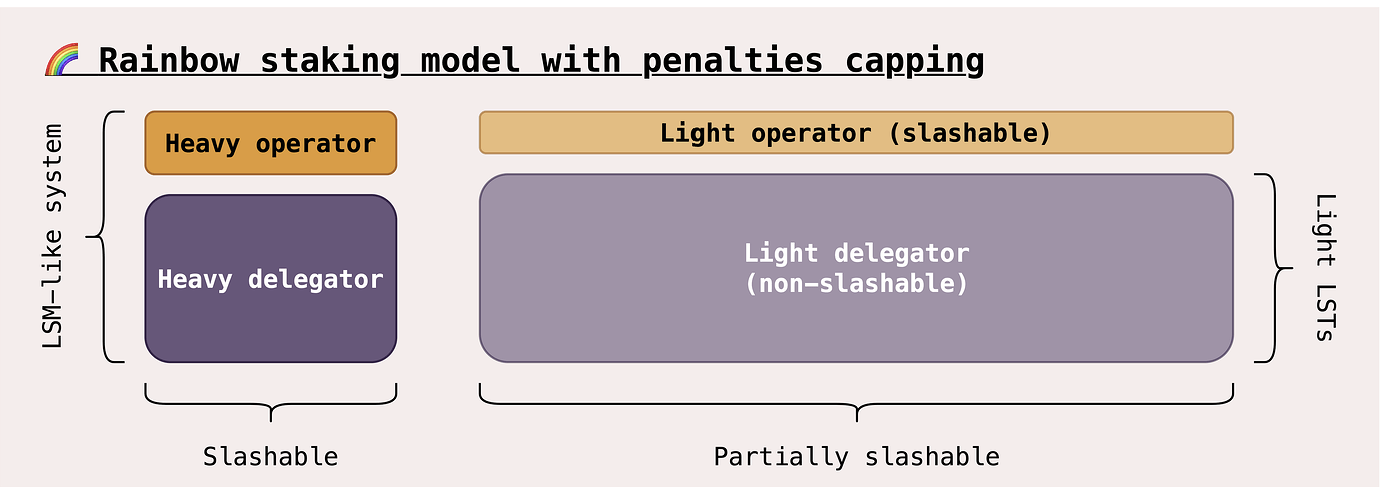

At its core, Rainbow staking is a two-tiered model, where Ethereum has Service Operators, who are at risk of slashing, and Delegators, who essentially face no slashing risk. The model also introduces the concept of 'heavy' and 'light' services.

Operators are responsible for maintaining the infrastructure critical to Ethereum’s consensus mechanism, while Delegators contribute ETH without the need to engage beyond providing collateral. The stake of heavy Operators and Delegators is slashable, working as economic security. In case of light Delegators, the proposed function of the stake is more of an entry ticket and weight allocation for voting and other functions, so slashing is not principal.

Despite not being at risk of slashing, light Delegators still earn yield through activities such as selecting operators based on criteria like fees or reliability and providing non-slashable yet vital services like contributing to censorship-resistance mechanisms.

In the rainbow staking model, the distinction between the roles of operators and delegators introduces a nuanced contribution to Ethereum’s ecosystem, where delegators, though not contributing directly to economic security via stake risk, can highlight inconsistencies in consensus operations.

We observe the evolution of blockchain systems where the original vision of a "node-user" scheme is transforming into the standard "specialized infrastructure provider, shareholder, and passive user". Eventually, we might see Ethereum transforming into a bank, replacing the word "node" with "server."