Tommi Enenkel, Polkadot's Head Ambassador, recently unveiled a detailed report on the Polkadot treasury that has sparked significant discussion among community members. The financials show a surprising emphasis on marketing, a strategy that appears to be falling short, given the lack of significant traction in project developments.

The report shows that in the first half of 2024, Polkadot spent a whopping $86.5 million, with $36.7 million (or 42%) going towards “outreach,” which includes marketing, business, and community development.

A comparison between the latter half of 2023 and the first half of 2024 reveals a significant shift in spending priorities. The allocation for outreach increased from 29% to 42%, while support for the economy now accounts for 18%, and funding for research rose from 1.7% to 2.5%. Conversely, the relative budget shares for development, talent & education, and operations have approximately halved.

A number of users on X (formerly Twitter) have flagged concerns about how these hefty marketing expenses aren’t translating into visible impact. For instance, Stacy Muur pointed out that despite the large budget, Polkadot’s marketing efforts seem to be missing the mark. They are neither widespread nor effective.

Polkadot's Treasury Report: $37M spent on outreach in the last 6 months.

— Stacy Muur (@stacy_muur) July 2, 2024

Results:

-14% DAUs

-59% new accounts

+15% token holders

What went wrong?

Marketer's commentary ↓ pic.twitter.com/dVXlW4f7qY

In another X post, a user questioned why these funds were not being redirected to support actual blockchain projects and ecosystem development, which would directly enhance the blockchain’s utility and value.

It's insane to me how much money the Polkadot treasury is wasting on misplaced marketing. Did we learn nothing from FTX and https://t.co/m20U7NcBIE?

— Web3 Philosopher (@seunlanlege) April 26, 2024

Blockchains like optimism, arbitrum are giving hundreds of millions of dollars to developers and builders.

Bearish.

Even some industry insiders are weighing in with criticism. A founder of the Manta Network, Ethereum Layer-2 project, described Polkadot’s ecosystem as lacking substantive value for Web3 and not really focusing on user adoption.

As the founder of the previous largest (non-DOT) TVL and market cap/FDV project in the Polkadot ecosystem, I have to say that we do not want to engage with the Polkadot ecosystem and team at all. It is a highly toxic ecosystem that lacks any real value for web3, and it does not… https://t.co/YxAPF1CYC9

— victorji.eth ✨ (@victorJi15) July 2, 2024

Despite the concerns, Polkadot has seen some growth in its active accounts over the last six months. However, when compared to other emerging blockchains like the Ton blockchain, Polkadot’s growth is modest. Transaction numbers on Polkadot have been stagnant, hovering around 12 million per month since the year started – an indicator that development isn’t picking up the pace.

Financially, Polkadot’s treasury seems to be in a complicated position with about $245 million in assets, mostly in DOT tokens. Even though there’s an influx of about $580 million coming into the treasury each year, it all comes from DOT token inflation.

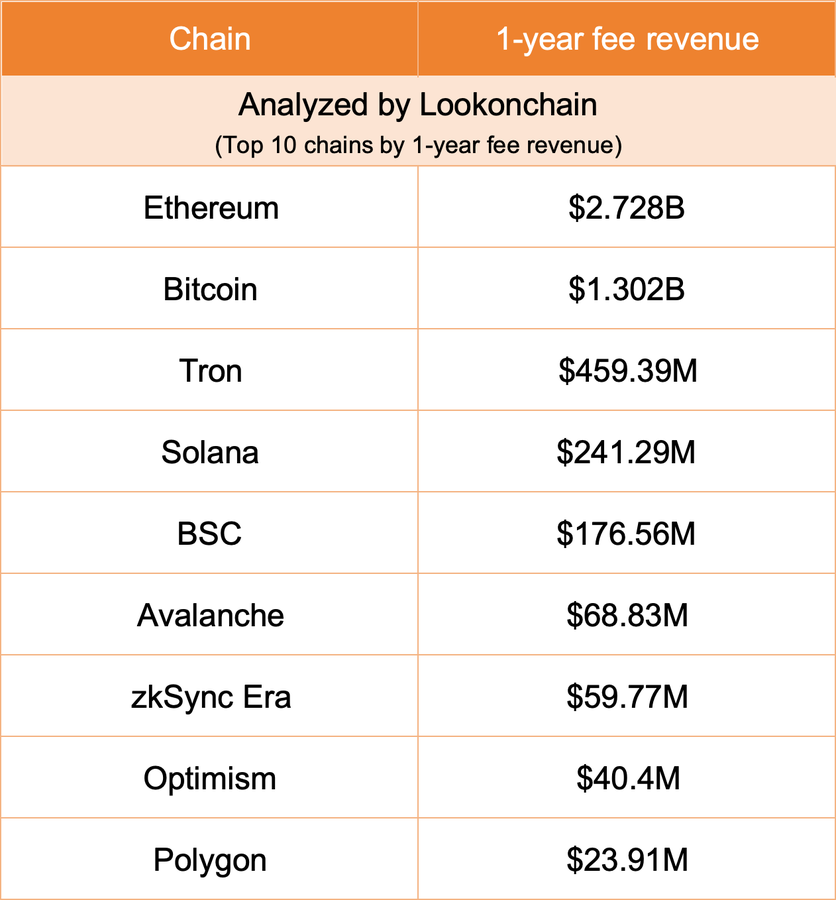

Otherwise, Polkadot earnings are minimal. According to the Token Terminal data Polkadot makes under $1 million per year from fees, which is significantly lower than other major blockchain projects:

Meanwhile, by market cap, it is the 10th largest blockchain.

This situation with Polkadot mirrors a common paradox seen in the Web3 startup space, which is rarely encountered in traditional Web2 industries. The revenue multiples can be way out of the reasonable range but still supported by speculative forces on the token price.

Also, many large blockchain startups manage treasuries worth hundreds of millions or even billions but struggle to find a product-market fit. These projects can continue operations for years without the imminent risk of running out of funds, maintaining their activities despite limited commercial success and development progress.