Vitalik Buterin’s recent posts reflect a shift from idealistic decentralization toward pragmatic system design. Rather than rejecting Ethereum’s core principles, he questions where complexity, governance, and the current development path fail under real-world constraints.

Alex Harutunian

Hyperliquid is evolving from a perp DEX into a vertically integrated financial stack. By launching its own L1, native stablecoin, and spot markets, it prioritizes market fit over ideology. Started on Arbitrum, its roadmap reveals a larger ambition: to become the global base layer for all trading.

Alex Harutunian

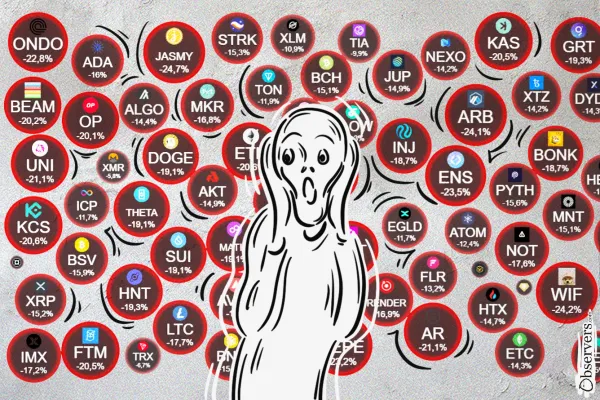

Triggered by a routine macro shock, crypto once again unraveled faster than any other market. Not because of sentiment alone, but because CEX risk engines, DEX liquidation incentives, and always-on leverage turn small moves into cascading stress.

Alex Harutunian

From Polymarket’s stripped-down design to Kalshi’s regulatory breakthrough, prediction markets are turning collective opinion into a financial asset class — and a new battleground over who defines truth

Alex Harutunian

Curve Finance is launching Yield Basis with a $60M crvUSD credit line. The product aims to eliminate impermanent loss for liquidity providers, and at the same time transform CRV from a governance token into an income-generating asset with revenues shared back to holders

Alex Harutunian

Vitalik Buterin’s recent posts reflect a shift from idealistic decentralization toward pragmatic system design. Rather than rejecting Ethereum’s core principles, he questions where complexity, governance, and the current development path fail under real-world constraints.

Alex Harutunian

NASHVILLE, Tenn. Nakamoto Inc. (NASDAQ: NAKA) (“Nakamoto” or the “Company”) today announced that it has entered into merger agreements to acquire BTC Inc, the leading provider of Bitcoin-related media and events, and UTXO Management GP, LLC (“UTXO”), an investment firm focused on private and public Bitcoin companies (collectively, the “Transaction”

The digital euro is increasingly framed as a tool of EU sovereignty. China’s interest-bearing e-CNY shows no banking disruption so far. Tokenization goes mainstream as the ECB validates DLT collateral and the U.S. SEC distinguishes issuer-backed from wrapper tokens.

Bermuda is integrating USDC stablecoin into its economy. In a dollar-pegged island state, stablecoins aren’t replacing money—they’re upgrading the rails. If it works, dozens of “Other Bermudas” could emerge as the next growth engine for stablecoins.

• US CFTC filing asserts its authority over prediction market regulation in the US. • X to launch “Smart Cashtags” for in-app crypto and stock trading. • Compass Point and Canaccord name BitGo a potential acquisition target.

01.01.2026 EU crypto tax transparency directive DAC8 takes effect, requiring crypto-asset service providers to report user data to national tax authorities. 01.01.2026 MiCA comes into force in Spain. 31.12.2025 Ethereum smart contract deployments hit a record high in Q4. 2026 OUTLOOK Haseeb Qureshi (Dragonfly

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

01.12.2025 Telegram’s Pavel Durov announces Cocoon, a decentralized confidential AI compute network. 01.12.2025 SushiSwap CEO steps down as Synthesis invests $3.3M in the struggling DEX. 01.12.2025 Grayscale to launch the first Chainlink ETF in the US. 01.12.2025 Germany and Switzerland

29.10.25 Ondo Finance launches Ondo Global Markets on BNB Chain. 29.10.25 Ethereum Foundation launches portal to guide institutional adoption. 29.10.25 Securitize goes public via SPAC merger with Cantor Fitzgerald’s CF Acquisition Corp VIII. 28.10.25 Trump Media & Technology Group to launch

Kazakhstan launched a state-backed crypto reserve, Alem Crypto Fund, partnering with Binance Kazakhstan and starting with an investment in $BNB. SWIFT is building a blockchain ledger with 30+ banks using Consensys. Polish lawmakers passed a Crypto-Asset Market Act, aligning rules with the EU’s MiCAR. Vitalik Buterin opposes EU’s

ORE’s mining model and economic structure present an innovative overlap of Proof of Work and Proof of Stake, aiming to carve a niche within the crowded cryptocurrency market.

Alexander Mardar

The NFT craze is long over, and the chances of it ever coming back are slim. Left behind by speculation is a market bursting with creativity, community spirit, and fun.

Eva Senzaj Pauram

As liquidations mounted to $400 million, DeFi protocols performed reliably, safeguarding user assets against losses.

Alexander Mardar

Shortly after receiving approval from the local anti-money laundering watchdog, Binance is now haunted by another regulator. Other global crypto exchanges might face the same charges.

Sasha Markevich

The markets experienced its steepest decline in a year. This downturn coincides with disappointing job reports and renewed geopolitical anxieties.

Rebecca Denton

Offline digital euro and eSIM, low traction for digital rupee, e-CNY extends use cases, Brazil's DREX and Pix integration. Ripple and Open Eden in T-bill tokenization.

Observers

Hello Observers! It was a hot week, almost feverish. Following Trump’s speech at the 2024 Bitcoin conference in Nashville last Sunday, crypto Twitter and media, from inside and outside the United States, became more political and divided than ever before. Having a pro-crypto president in the United States, the

Eva Senzaj Pauram

At the Bitcoin 2024 conference, Howard Lutnick emphasized Tether’s transparency, regulatory compliance, and security, contrasting it with Circle’s practices.

Sasha MarkevichNASHVILLE, Tenn. Nakamoto Inc. (NASDAQ: NAKA) (“Nakamoto” or the “Company”) today announced that it has entered into merger agreements to acquire BTC Inc, the leading provider of Bitcoin-related media and events, and UTXO Management GP, LLC (“UTXO”), an investment firm focused on private and public Bitcoin companies (collectively, the “Transaction”

The digital euro is increasingly framed as a tool of EU sovereignty. China’s interest-bearing e-CNY shows no banking disruption so far. Tokenization goes mainstream as the ECB validates DLT collateral and the U.S. SEC distinguishes issuer-backed from wrapper tokens.

Bermuda is integrating USDC stablecoin into its economy. In a dollar-pegged island state, stablecoins aren’t replacing money—they’re upgrading the rails. If it works, dozens of “Other Bermudas” could emerge as the next growth engine for stablecoins.

• US CFTC filing asserts its authority over prediction market regulation in the US. • X to launch “Smart Cashtags” for in-app crypto and stock trading. • Compass Point and Canaccord name BitGo a potential acquisition target.

01.01.2026 EU crypto tax transparency directive DAC8 takes effect, requiring crypto-asset service providers to report user data to national tax authorities. 01.01.2026 MiCA comes into force in Spain. 31.12.2025 Ethereum smart contract deployments hit a record high in Q4. 2026 OUTLOOK Haseeb Qureshi (Dragonfly

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

01.12.2025 Telegram’s Pavel Durov announces Cocoon, a decentralized confidential AI compute network. 01.12.2025 SushiSwap CEO steps down as Synthesis invests $3.3M in the struggling DEX. 01.12.2025 Grayscale to launch the first Chainlink ETF in the US. 01.12.2025 Germany and Switzerland

29.10.25 Ondo Finance launches Ondo Global Markets on BNB Chain. 29.10.25 Ethereum Foundation launches portal to guide institutional adoption. 29.10.25 Securitize goes public via SPAC merger with Cantor Fitzgerald’s CF Acquisition Corp VIII. 28.10.25 Trump Media & Technology Group to launch