Hyperliquid is evolving from a perp DEX into a vertically integrated financial stack. By launching its own L1, native stablecoin, and spot markets, it prioritizes market fit over ideology. Started on Arbitrum, its roadmap reveals a larger ambition: to become the global base layer for all trading.

Alex Harutunian

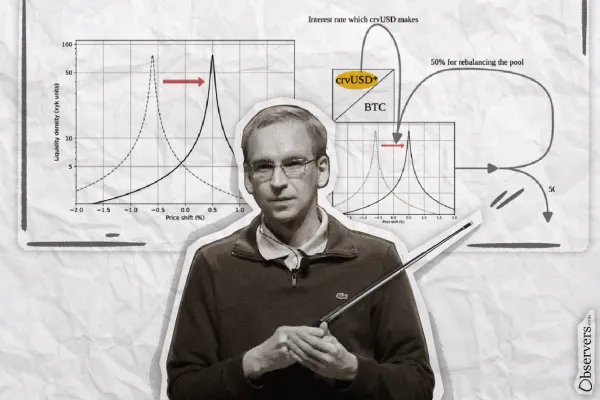

Triggered by a routine macro shock, crypto once again unraveled faster than any other market. Not because of sentiment alone, but because CEX risk engines, DEX liquidation incentives, and always-on leverage turn small moves into cascading stress.

Alex Harutunian

From Polymarket’s stripped-down design to Kalshi’s regulatory breakthrough, prediction markets are turning collective opinion into a financial asset class — and a new battleground over who defines truth

Alex Harutunian

While crypto remains banned, China’s state-backed blockchain ecosystem — led by Conflux — is expanding across Asia and into global finance. Conflux Network bridges China’s academic research, state strategy, and open blockchain innovation.

Alex Harutunian

Monero, the leading privacy coin, suffered an 18-block reorg after Qubic consolidated large mining power. Debate rages: Qubic claims 51% control; Monero devs deny widescale damage. Exchanges raised confirmations. The episode shows PoW chains can be threatened by economic incentives

Alex Harutunian

Hyperliquid is evolving from a perp DEX into a vertically integrated financial stack. By launching its own L1, native stablecoin, and spot markets, it prioritizes market fit over ideology. Started on Arbitrum, its roadmap reveals a larger ambition: to become the global base layer for all trading.

Alex Harutunian

13.01.2026 YZi Labs invests $10M+ in privacy-focused decentralized trading platform Genius Trading. 13.01.2026 ETHGas plans an airdrop of its governance token, GWEI. 13.01.2026 Grayscale releases Q1 2026 “Assets Under Consideration” list: Tron, ARIA Protocol, Nous Research, Poseidon, and Double Zero added; Prime Intellect removed.

01.01.2026 EU crypto tax transparency directive DAC8 takes effect, requiring crypto-asset service providers to report user data to national tax authorities. 01.01.2026 MiCA comes into force in Spain. 31.12.2025 Ethereum smart contract deployments hit a record high in Q4. 2026 OUTLOOK Haseeb Qureshi (Dragonfly

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

01.12.2025 Telegram’s Pavel Durov announces Cocoon, a decentralized confidential AI compute network. 01.12.2025 SushiSwap CEO steps down as Synthesis invests $3.3M in the struggling DEX. 01.12.2025 Grayscale to launch the first Chainlink ETF in the US. 01.12.2025 Germany and Switzerland

29.10.25 Ondo Finance launches Ondo Global Markets on BNB Chain. 29.10.25 Ethereum Foundation launches portal to guide institutional adoption. 29.10.25 Securitize goes public via SPAC merger with Cantor Fitzgerald’s CF Acquisition Corp VIII. 28.10.25 Trump Media & Technology Group to launch

Kazakhstan launched a state-backed crypto reserve, Alem Crypto Fund, partnering with Binance Kazakhstan and starting with an investment in $BNB. SWIFT is building a blockchain ledger with 30+ banks using Consensys. Polish lawmakers passed a Crypto-Asset Market Act, aligning rules with the EU’s MiCAR. Vitalik Buterin opposes EU’s

Uniswap’s Unichain has boosted L2 volumes past $40B, but liquidity tells a different story. TVL has halved since July, exposing the limits of incentive-driven growth. Despite cheaper fees, users remain on Ethereum—where Uniswap continues to be one of the network’s largest revenue engines.

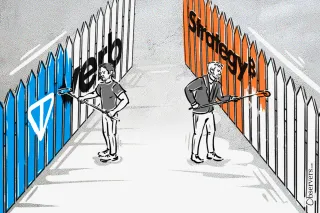

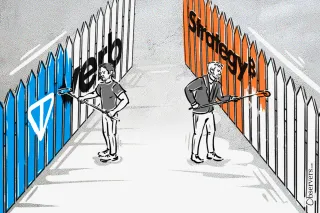

TON Strategy Company, formerly Verb Technology, has rebranded as a Toncoin treasury, holding $713M in TON and targeting over 5% of supply. By staking its holdings and adopting financial engineering akin to Strategy’s playbook, it aims to turn crypto reserves into shareholder returns

From $GOAT to $FART, memecoins show how hype burns fast and budgets vanish faster. Market caps in the tens of millions may look like real businesses, but behind the joke lies sunk marketing spend, fragile communities, and the math of attention that always runs out of breath

One region, 33 crypto cultures. In Latin America, each country has their own stance towards cryptocurrency, creating a patchwork of adoption levels, regulations, types of assets held and exchanges used.

Eva Senzaj Pauram

Slashing is a key component of the blockchain security mechanism in proof-of-stake networks. However, we haven't heard much about the cases when it is applied.

Alexander Mardar

The Italian supercar builder has started accepting cryptocurrency payments at dealerships in the U.S. with plans to extend the scheme to Europe following requests from customers. But what else can you buy using bitcoin?

Jack Martin

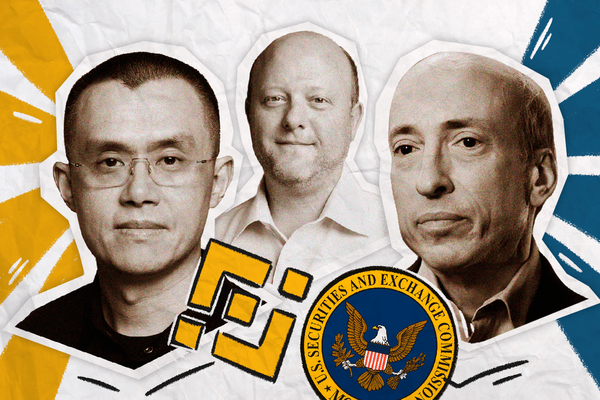

As the Binance vs SEC hearing lumbers on, the parties struggle to agree on discovery requests and dispositions, and Circle was admitted as a 'friend of the court'.

Sasha Markevich

China is making progress on expanding the use of its e-CNY beyond national borders, announcing new partnerships and R&D programs.

Eva Senzaj Pauram

It's go big or go home this week, with two record breaking human achievements to start your Sunday. The "world's largest offshore wind farm" generated its first electricity for the U.K. national grid... although currently only one of the planned 277 turbines is

Jack Martin

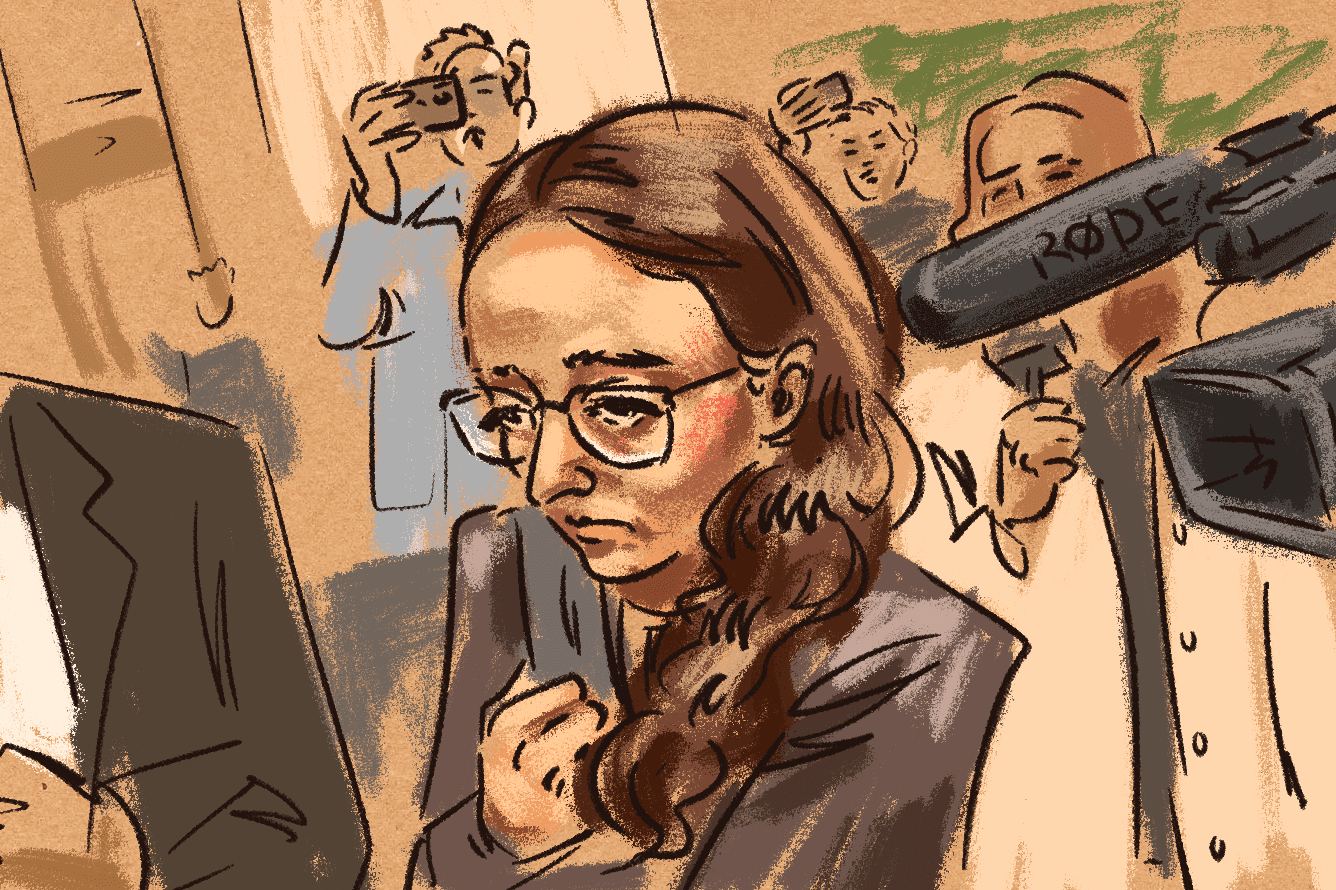

Another week of the Sam Bankman-Fried trial has passed. All eyes were on star witness Caroline Ellison, who claims that there was indeed a fraud and blames Bankman-Fried for setting it all up.

Sasha Markevich

The deadline for the SEC to appeal against the court’s ruling on the Grayscale Bitcoin ETF application passed without event yesterday. Last week its appeal against the preliminary Ripple judgement was denied. Could the regulator finally be accepting defeat in its war on crypto?

Jack Martin13.01.2026 YZi Labs invests $10M+ in privacy-focused decentralized trading platform Genius Trading. 13.01.2026 ETHGas plans an airdrop of its governance token, GWEI. 13.01.2026 Grayscale releases Q1 2026 “Assets Under Consideration” list: Tron, ARIA Protocol, Nous Research, Poseidon, and Double Zero added; Prime Intellect removed.

01.01.2026 EU crypto tax transparency directive DAC8 takes effect, requiring crypto-asset service providers to report user data to national tax authorities. 01.01.2026 MiCA comes into force in Spain. 31.12.2025 Ethereum smart contract deployments hit a record high in Q4. 2026 OUTLOOK Haseeb Qureshi (Dragonfly

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

01.12.2025 Telegram’s Pavel Durov announces Cocoon, a decentralized confidential AI compute network. 01.12.2025 SushiSwap CEO steps down as Synthesis invests $3.3M in the struggling DEX. 01.12.2025 Grayscale to launch the first Chainlink ETF in the US. 01.12.2025 Germany and Switzerland

29.10.25 Ondo Finance launches Ondo Global Markets on BNB Chain. 29.10.25 Ethereum Foundation launches portal to guide institutional adoption. 29.10.25 Securitize goes public via SPAC merger with Cantor Fitzgerald’s CF Acquisition Corp VIII. 28.10.25 Trump Media & Technology Group to launch

Kazakhstan launched a state-backed crypto reserve, Alem Crypto Fund, partnering with Binance Kazakhstan and starting with an investment in $BNB. SWIFT is building a blockchain ledger with 30+ banks using Consensys. Polish lawmakers passed a Crypto-Asset Market Act, aligning rules with the EU’s MiCAR. Vitalik Buterin opposes EU’s

Uniswap’s Unichain has boosted L2 volumes past $40B, but liquidity tells a different story. TVL has halved since July, exposing the limits of incentive-driven growth. Despite cheaper fees, users remain on Ethereum—where Uniswap continues to be one of the network’s largest revenue engines.

TON Strategy Company, formerly Verb Technology, has rebranded as a Toncoin treasury, holding $713M in TON and targeting over 5% of supply. By staking its holdings and adopting financial engineering akin to Strategy’s playbook, it aims to turn crypto reserves into shareholder returns