Citing its sources, Bloomber greported on January 26 that the world’s largest credit rating agency, Moody's, has begun work on a system for evaluating stablecoins.

💡 Moody's corporation engaged in comprehensive risk assessment and the awarding of credit ratings. The company has influence all over the world, operating in more than 40 countries. The company's staff exceeds 11 thousand employees. The International rating agency was founded back in 1909.

According to a source close to Moody's, who wished to remain anonymous, the company is working on a system for assessing the reliability of stablecoins, which will be based on checking the quality of their reserves. It is assumed that up to 20 stablecoins will partake in the evaluation system.

Another anonymous source spoke to Bloomberg about the stablecoin evaluation system, providing several details:

“The project is still in early stages and won’t represent an official credit rating, another person with knowledge of the plan said.”– the article writes.

It is not surprising that Moody's has been paying attention to stablecoins, with 2022 highlighting their popularity among users when stablecoins overtook Visa and MasterCard in the amount of payments. The regulatory authorities of many countries are also paying close attention to stablecoins. Some seek to create their own stablecoin, while others, like Moody's, are working on creating their own system for evaluating existing stablecoins.

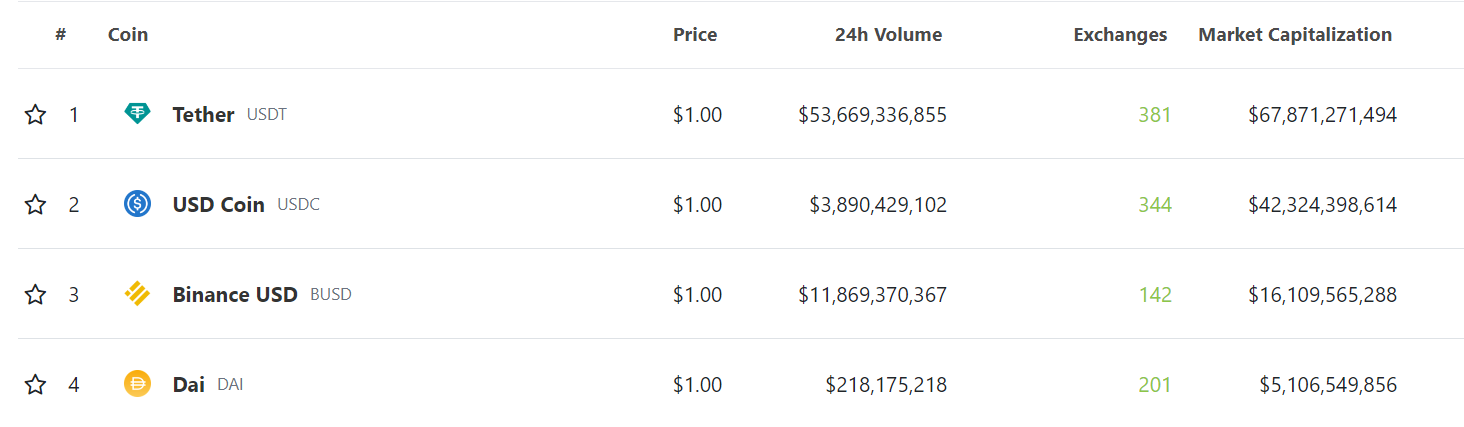

It is not yet clear if the proposed scoring system will include decentralized stablecoins as well. It seems absolutely logical that the quality of centralized stablecoin reserves is used as the main evaluation benchmark. However in the case of decentralized overcollaterized coins such as DAI from MakerDAO, which are backed by other crypto assets, or even worse by algorithmic coins such RAI, the criteria will be much more difficult to choose. If Moody goes into this area too, then they will need to compare the tools of both traditional and decentralzied finance in terms of reliability.

Recall that according to СoinGecko, today the total market capitalization of stablecoins is $137 billion, and the daily trading volume exceeds $69 billion. The most popular of which are still USDT and USDC.

It is worth noting that we have not found other systems for evaluating stablecoins from other companies.

We will wait for the official announcement of the project to create a stablecoin evaluation system from Moody's, as well as follow other sources. We will continue our observations and inform you about the news!