Latest Articles

85 Articles

MoneyTech provides innovative blockchain solutions for financial services, focusing on improving efficiency and security in digital payments and lending systems.

MoneyTech provides innovative blockchain solutions for financial services, focusing on improving efficiency and security in digital payments and lending systems.

X (formerly Twitter) is slowly transforming into an "everything app" with the launch of X Money sometime this year.

A year-end overview of decentralized stablecoins with market caps between $50 and $500 million.

While DeFi yields are highly attractive to traditional investors, the DeFi market still carries risks, making the convergence of DeFi and TradFi a longer-term prospect.

Alexander Mardar

While DeFi yields are highly attractive to traditional investors, the DeFi market still carries risks, making the convergence of DeFi and TradFi a longer-term prospect.

Alexander Mardar

X (formerly Twitter) is slowly transforming into an "everything app" with the launch of X Money sometime this year.

Rebecca Denton

A year-end overview of decentralized stablecoins with market caps between $50 and $500 million.

Eva Senzaj Pauram

Tether should be on the verge of delisting due to new regulations, but major exchanges are still not communicating clearly with users.

Rebecca Denton

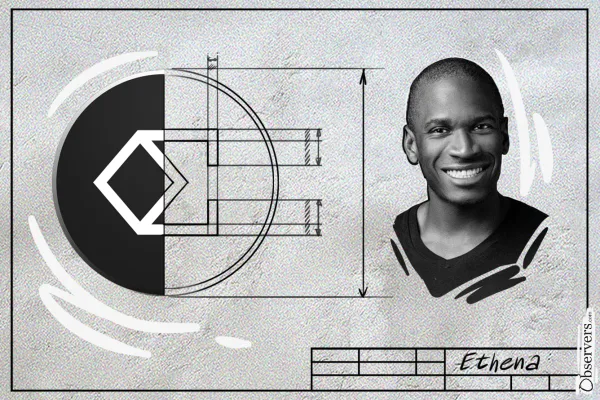

Arthur Hayes envisioned a stablecoin independent of the fiat banking system. Ethena, inspired by his ideas, still relies on centralized systems like USDT, falling short of full decentralization.

Alexander Mardar

What lies beneath the alliance of the two crypto behemoths?

Sasha Markevich

Over 41 million tokens have been minted ahead of New York's regulatory decision, while XRP surges past Tether and Solana to claim the third spot amid ETF filings and a new wave of meme coins.

Mathilde Adam

Is Donald Trump, or are dollar-pegged stablecoins standing in the way of non-western countries freeing themselves from the hegemony of the dollar?

Eva Senzaj Pauram