Mastercard In The Priceless World Of Crypto

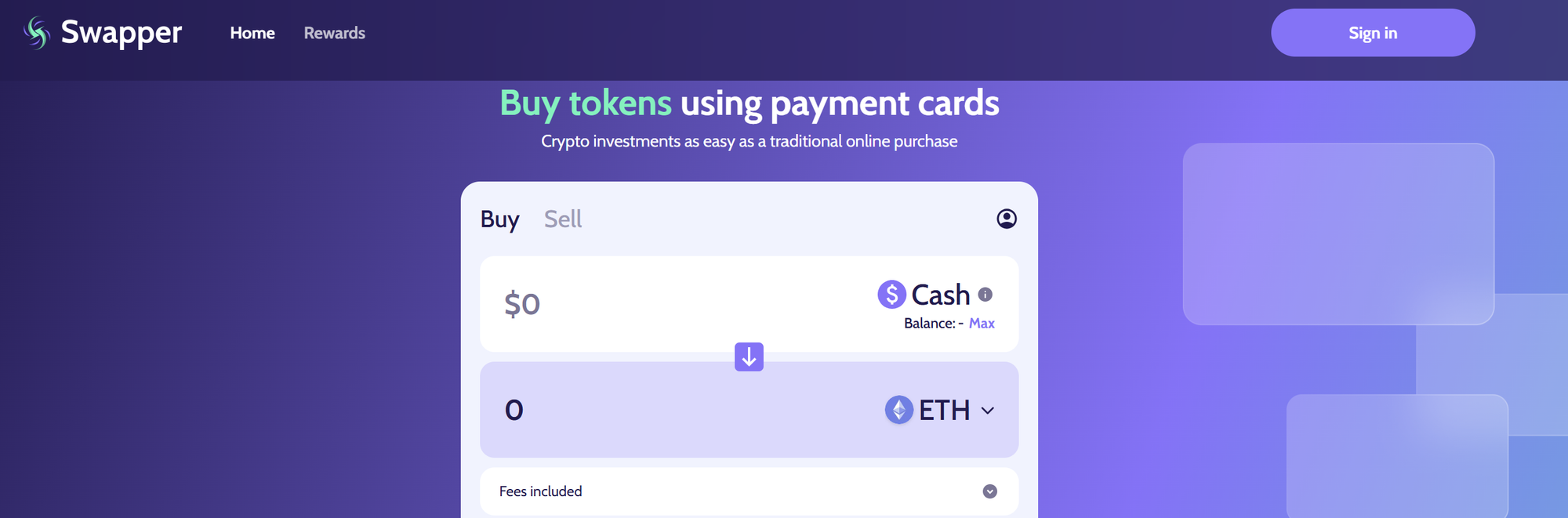

Mastercard’s crypto strategy has shifted from flashy announcements to practical integrations like Swapper Finance, enabling direct crypto purchases on DEXs. Yet, real-world traction for earlier initiatives like MTN or Crypto Credential remains limited, highlighting challenges of legacy adoption