One of the memorable events of 2022 was the fall of Luna/Terra. It seems that this event has jeopardized not only algorithmic stablecoins, but also the entire industry. However, the Terra team continues to struggle for existence.

In October 2022, by the decision of the community, the incineration of excess LUNC tokens was started, but this was not enough. Thanks to a new vote within the Terra community, proposal #11242 received approval from 96% of users. Let's figure out what has changed.

Two of the main objectives decided upon within proposal #11242 are as follows:

- Disallow further minting of the tokens (these are minted now to distribute seigniorage rewards)

- Increase the gas fee five times. (this should help "increase the staking rewards of validators/delegators.").

According to a message on the forum, the following points motivated the team to make the update:

- In the last month, the number of tokens burned decreased. In particular, Binance reduced the number of burns;

- This led to only one billion LUNC tokens burned over a period of four weeks;

- Furthermore, approximately 100 million LUNC coins were re-minted as seigniorage rewards.

The forum message also stressed that after the increase in gas payments, its price in Terra Classic would still be lower than the new Terra 2.0 network.

At current market value, gas fees on Terra Classic is 18.42x cheaper than Terra 2.0. Even after increasing the gas fees by 5x, Terra Classic gas fees will still remain 3.68x cheaper than Terra 2.0.

The world-famous Binance exchange has announced that it will support the Terra Classic (LUNС) network upgrade.

#Binance will support the Terra Classic $LUNC Network Upgrade.https://t.co/QA6akTco97

— Binance (@binance) January 13, 2023

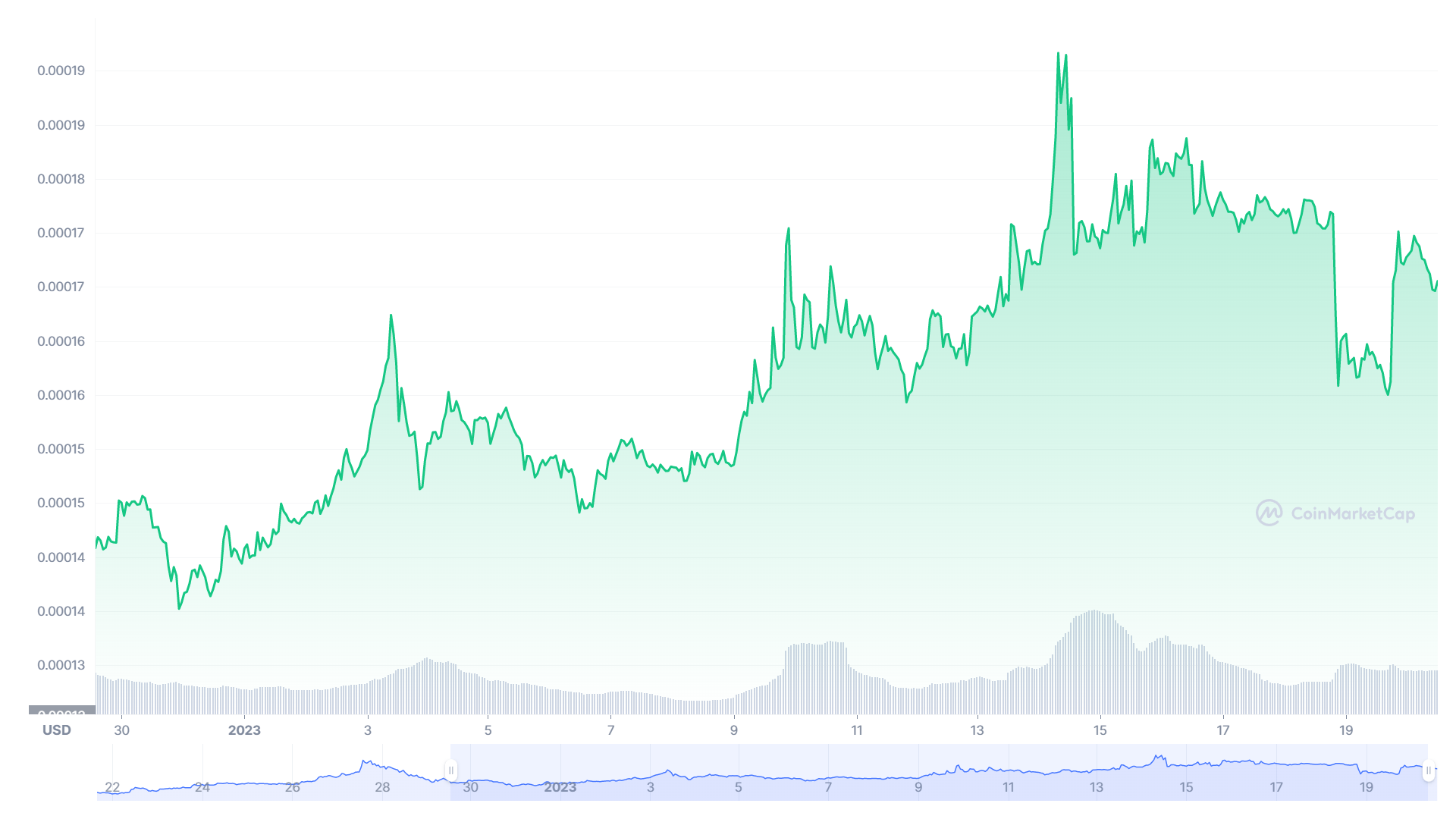

The update took place on January 14th. The support from Binance and subsequent update was likely a driving factor in LUNC’s recent retrending and price increase.

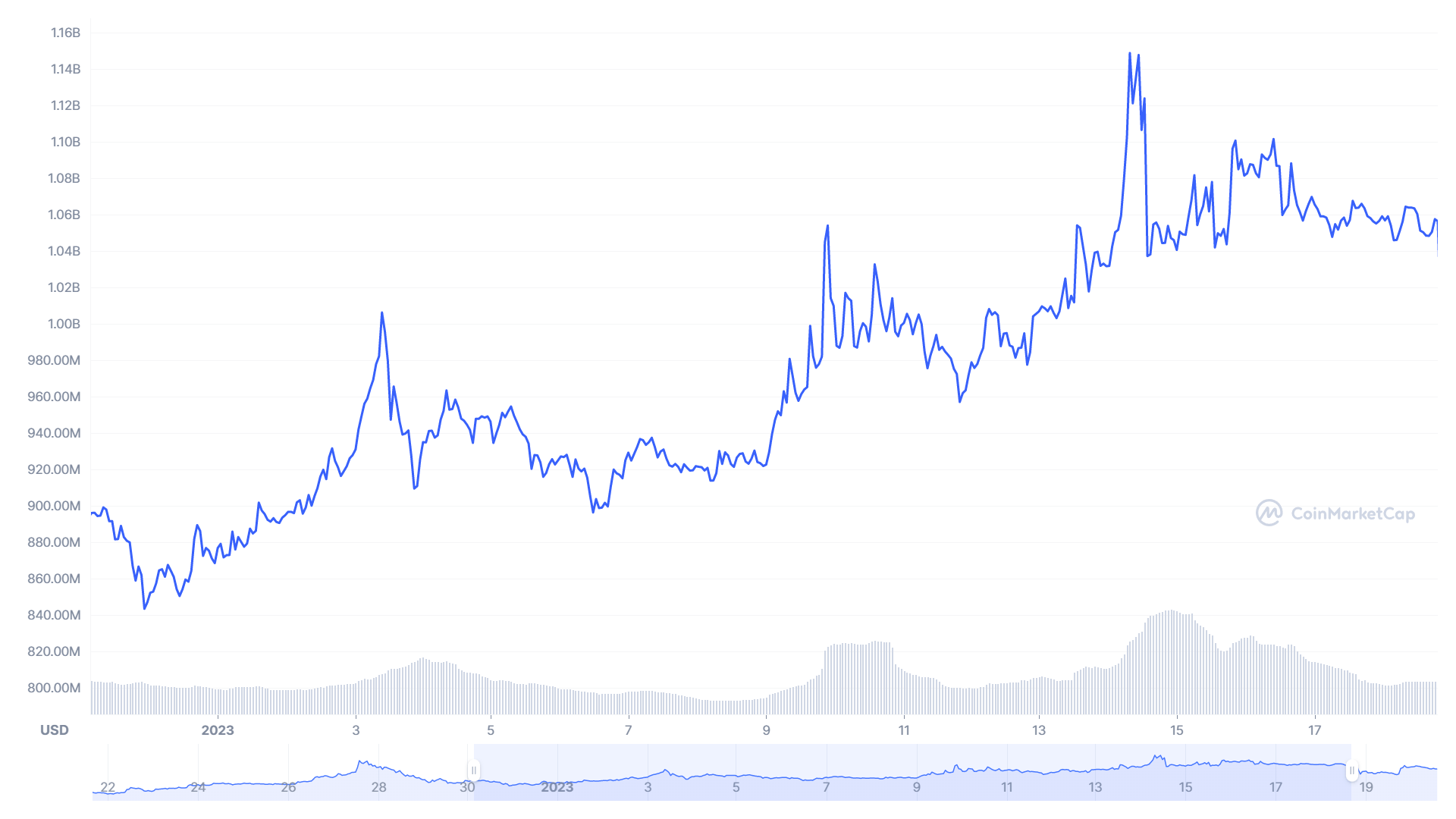

On January 14th the market capitalization reached $1.15 Billion, having surpassed the $1 Billion mark the day prior, as can be seen on the below chart.

At the moment, according to Coinmarketcap, LUNC's market capitalization has decreased and is currently just above $1.019 billion, and the daily trading volume is $163 million.

The last time there was a significant growth in LUNC, it had followed Binance showing its support to the Terra community. The support of the exchange clearly has a positive effect on the image of Terra, with users even recognising the growth of the token after Binance’s public approval.

LUNC after the tweet: 🔼🔼🔼

— 🥗 FΞLIX 🦇🔊 (@felixsim) January 13, 2023

Perhaps this is not surprising, as Binance accounts for more than 50% of the token’s trading volume.

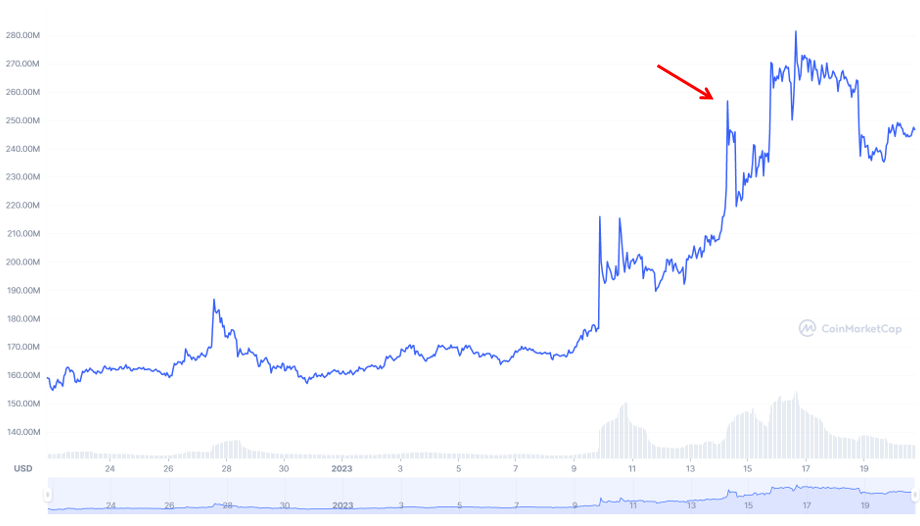

If we turn to the LUNA token, which replaced LUNC, then it also reacts to the news. On January 14, there were also positive changes in its market capitalization.

📢 Recall that LUNA is a new token that was launched on May 28, 2022 in the new Terra blockchain. The former coin of the ecosystem was named LUNC.

It is quite interesting, after so much time, to watch Terra's attempt to recover after its fall. It is also interesting to observe how the price of the token is affected by statements from reputable exchanges. Do you think the Terra team will be able to return the ecosystem to its former popularity? We will be glad to hear your comments!