Justin Sun is one of a number of crypto luminaries who have stepped in to buy discounted CRV tokens from Curve.fi founder Michael Egorov. This has enabled Egorov to reduce the value of DeFi loans secured against the tokens, which were at risk of liquidation if the CRV token value had continued to fall. If the $100 million worth of loans had been liquidated this could have caused panic across the wider DeFi sector.

CRV, the DAO token of the Curve Finance Decentralized Exchange (DEX), started to freefall following a $50 million hack on the platform at the weekend. This left founder and largest CRV holder Michael Egorov in a rather exposed position, as he has over $100 million worth of DeFi loans, backed by his 427.5 million CRV tokens.

Token price dropped to a 7-month low of around $0.50 yesterday according to CoinMarketCap. Delphi Digital tweeted regarding a loan for 63.2M USDT on the Aave platform, backed by 305 million CRV. At a threshold of 55%, this position would have been eligible for liquidation if CRV had dropped to a value of $0.3767.

This risk created bearish sentiment among traders, who were concerned that the liquidated assets would then be dumped onto an already falling market. Without external support this could easily have become a self-fulfilling prophecy. If that had happened it could then have gone on to affect other DeFi platforms, many of which use CRV as a trading pair.

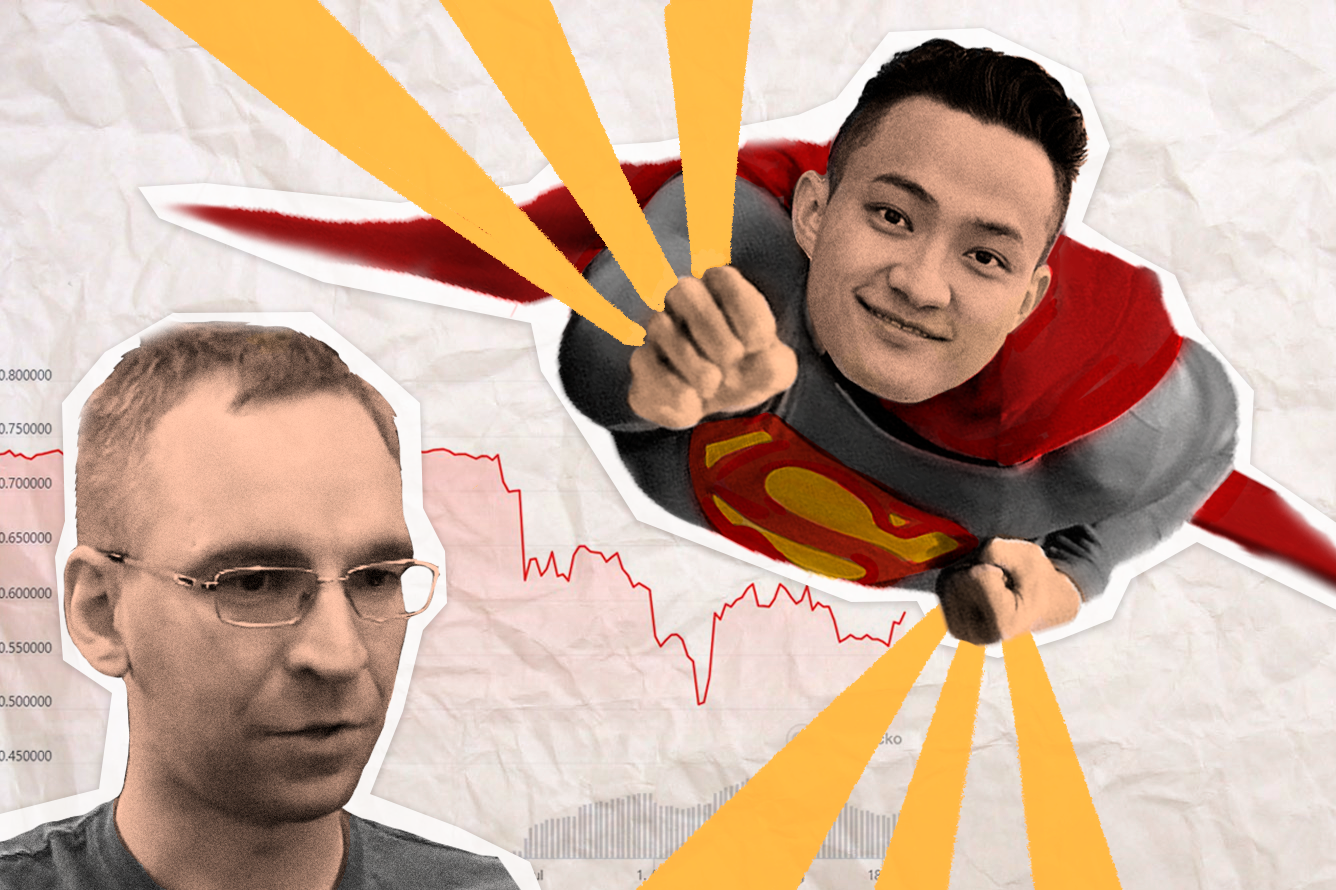

Such a collapse would not be in the best interests of anybody, so Justin Sun and a number of other prominent DeFi players stepped up to buy large chunks of Egorov’s CRV tokens. Obviously this wasn’t an entirely altruistic move, and the tokens were snapped up at a healthy discount on market price, but importantly, above the $0.3767 liquidation rate.

For example, Sun bought 5 million CRV (valued at around $3 million) for a reported $2 million in USDT in a direct OTC trade. The Tron CEO (and man of seemingly unlimited liquidity) tweeted that he was, “Excited to assist Curve!” and that joint efforts would introduce a stUSDT trading pool on the platform.

Others who bought in include crypto trader DCFGod, NFT collector Jeffrey Huang (aka Machi Big Brother), DWF Labs and Cream Finance. Nansen analyst, Sandra compiled a full list, but all told Egorov managed to sell around 50 million CRV at $0.40 per token, raising $20 million.

The principal value on Egorov’s Aave loan has since come down by over $9 million, giving him some much-needed breathing room, although he is by no means out of hot water just yet. And Sun, for his part, gets to act the crypto saviour again, which seems to be one of the things he enjoys the most.