Israel’s central bank has made the biggest changes to its allocation of reserves in over a decade, adding the Chinese yuan alongside three other currencies to a stockpile that last year exceeded $200 billion for the first time ever. Adding new currencies will be accompanied by slashing dollar and euro holdings in a move to diversify the reserve allocations and lengthen the investment horizon, Bloomberg reported.

Starting this year, the currency mix will expand from the trio of the U.S. dollar, the euro and the British pound to include the Canadian and Australian dollars as well as the yen and the yuan. The additions mark a change in the Bank of Israel’s “whole investment guidelines and philosophy,” Deputy Governor Andrew Abir said in an interview.

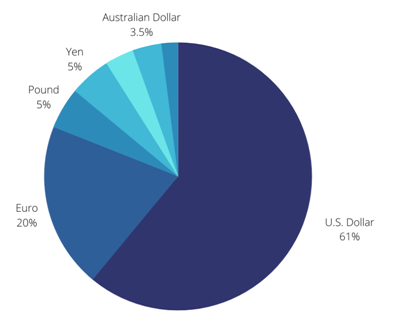

Following discussions held by the monetary committee last year, the pound and the yen will account for 5% and the currencies of Canada and Australia will have 3.5% each. Under the new approach, the yuan’s proportion is set at 2% for 2022, according to the Israeli central bank’s annual report published at the end of last month.

To make way for the new currencies, the central bank indicated that existing stocks of dollars and euros would become a lower total proportion of the country’s reserves. The euro’s share fell from 30 percent to 20 percent, while the dollar, which had previously accounted for two-thirds of Israel’s foreign currency stockpile, fell to only 61 percent. Conversely, Israel committed to purchasing more British pounds, bringing the level up to 5 percent.

New structure of Israel’s Reserves

Israel’s shift in the allocation of its holdings brings it closer in line with the rest of the world, though it has yet to invest in another of the main global reserve currencies, the Swiss franc.

Dollar reserves around the world have fallen considerably in recent years, largely due to the euro’s expansion. The past decade has also seen a steadily increasing global role of the yuan, although its role in global commerce has remained limited.