Lighting Network developer Lightspark continues to roll out its Universal Money Address (UMA) to crypto users. Currently, six companies, including Xapo Bank, are supporting the new address format according to the UMA website. The early adopters also include crypto remittance services from Africa, Latin America, and the Philippines. The latest company to join was Coins.ph – a Philippine-based cryptocurrency exchange. Additional adopters are expected to include industry players like Bakkt and Zero Hash.

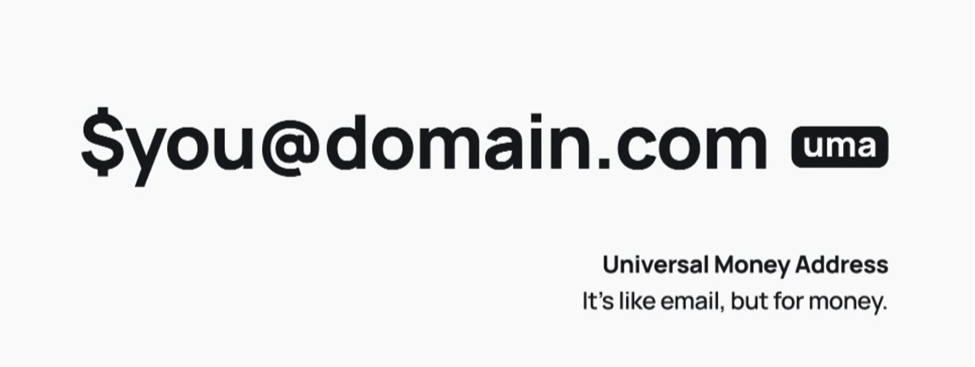

The Universal Money Address was introduced by Lightspark in October last year. It extends the functionality of the simplified LNURL addresses used in Lightning Network since 2020. Additionally, UMA supports legal aspects such as the Travel Rule and Compliance service integration, which are becoming more and more critical in the operations of crypto companies. At the end of December, the team tested the first cross-border transactions.

The authors position UMA as a universal messaging protocol, like TCP/IP, but for digital assets. Learning from early internet adoption cases, it replicates the e-mail address format to make it more intuitive for users. Instead of an account number or QR code, users would need to use something that looks like $observers@xapo.com. Lightspark has open-sourced the protocol and is working actively on driving its adoption. It focuses on corporate customers, providing them with a gateway to use Bitcoin’s Lightning network.

Lightspark is co-founded and led by David Marcus, who held top positions with PayPal and Meta’s Messenger division. In the latter role, he was involved with Meta’s digital currency Libra/Diem project. Christian Catalini, Jai Massari, and James Everingham, who are listed as co-founders, are also from the ex-Libra/Diem team.

The ‘Bitcoin maxi” choice of platform for this team is rather surprising. Christian Catalini and Jai Massari are known for their article discussing stablecoins and CBDCs in the context of the future of money.

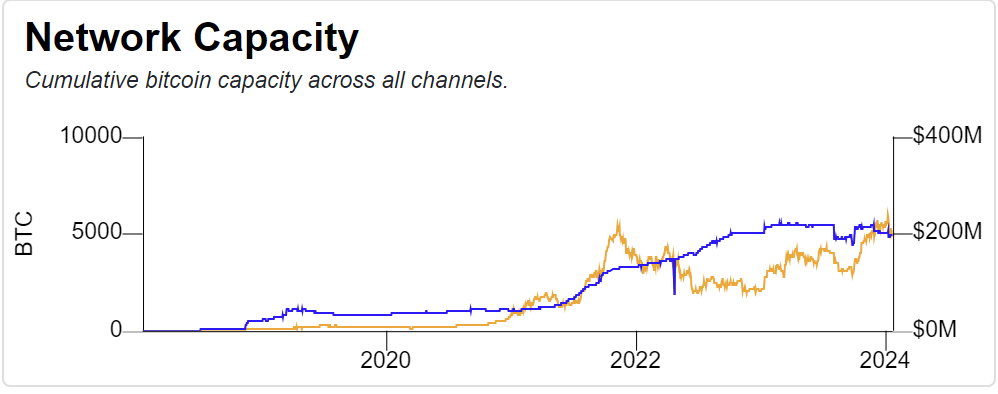

Since its launch in 2016, Bitcoin’s Lightning Network has seen rather moderate adoption compared to other crypto segments. The Channel Capacity, a liquidity measure of the network, is hovering around the $200 million level and its annual transaction volume is estimated at a $900 million. For comparison, Tether’s annual transaction volume is measured in multi-trillions of U.S. dollars. A recent scandal with a Lighting Network developer exposing security issues added more concern over the project’s future.

Nevertheless, David Marcus is enthusiastic about the Bitcoin payment network and predicted 2024 as a pivotal year for it.

I expect 2024 to be a landmark year. Bitcoin layer-1 high fees will push more transactions onto the Lightning Network, enabling more Bitcoin liquidity to flow to the faster, cheaper, private layer of choice for payments on Bitcoin. In hindsight, it’ll be the year the network turns a decisive corner.