The year 2022 has clearly not been the easiest for stablecoins, which attracted the attention of regulators around the world. The Hong Kong Monetary Authority (HKMA) has released a document in which the institution investigated the possible impact of crypto assets on traditional finance. Particular attention was drawn to stablecoins, namely, how the reserve assets of stablecoins in case of extreme market conditions can affect the traditional economy.

To clearly show the connection between the reserves of stablecoins and traditional finance, the HKMA examined the behaviour of USDT and its reserves from January 2020 to June 2022, the period that included, among others, the Terra collapse event.

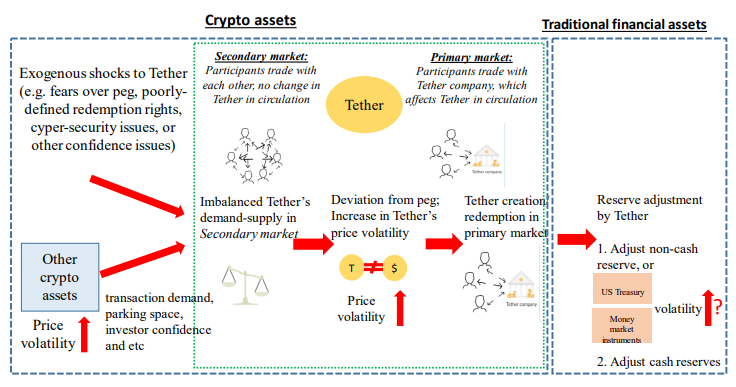

HKMA presented a scheme demonstrating that supply and demand of Tether (caused, for instance, by other crypto shocks) leads to, what they call, a “reserve adjustment” - changing of proportions of reserve assets as a result of the creation or redemption of Tether. During redemption more liquid reserve types such as cash will decrease in proportion and visa versa.

Then the study empirically proves that these “reserve adjustments” not only transmit waves to the traditional financial markets where Tether sources its reserve assets but also magnify those. To a larger extent, the effect is felt in money markets and to a comparatively lesser extent in the US Treasury market due to its size. The equity markets were also less affected, possibly, due to their less liquid nature.

In other words, the study revealed direct spill-over risks between crypto and traditional finance, with Tether playing an ideal conductor and magnifying role.

“Focusing on Tether, the largest asset-backed stablecoin, this study shows that its reserve adjustment magnifies the volatility spillover from crypto assets to money market instruments. This could be a channel through which risks borne by crypto assets could spill over to the traditional financial system. In extreme circumstances, failures of stablecoins or other crypto assets could result in large-scale redemptions of asset-backed stablecoins and a fire-sale of their reserve assets, potentially posing material impacts on the traditional financial system such as the money market identified in this study.” - the document reads.

Of course, as a result of the study, the HKMA has issued its own recommendations for regulators:

- In order for regulators to take timely measures to reduce risks at the time of a crisis in the market, it is proposed to standardize the reports of issuers of stablecoins on their reserves, as well as to make them regular for constant monitoring of the situation.

- For the most effective management of the liquidity of stablecoins, it is recommended to introduce restrictions on the composition of their reserve assets and "requiring well-defined redemption rights".

What we observe here is the development of a theory for a new financial asset class. Much of the experiments and findings are still ahead and we are excited to watch this process.