Crisis in Terra’s UST Stablecoin has started an unpleasant process: other stablecoins, like dominoes, are falling one after another. Are stablecoins becoming unstable?

The Cryptowinter has come. Bitcoin and Ethereum, the largest cryptocurrencies, are falling in price and dragging the entire market with them. But, recently, Crisis in Terra’s UST Stablecoin was added to all of this. Investors were greatly alarmed by the situation with UST, which led to the destabilization of other stablecoins.

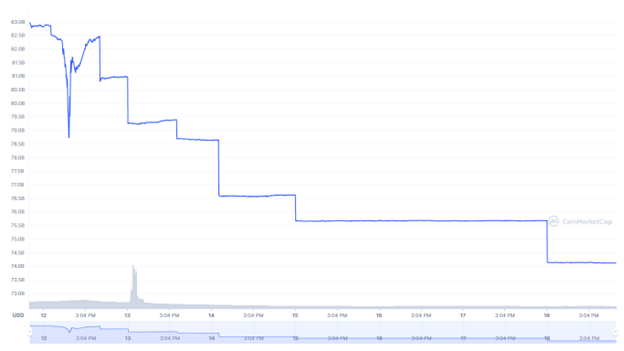

Even the largest player in the stablecoin market — Tether — was affected by the Terra crisis. Over the past week, users have withdrawn about $9 billion from USDT, thus reducing the capitalization of the token from $83 billion to $74 billion (-11%).

After the fall of UST, Neutrino USD (USDN), an algorithmic stablecoin within the Waves blockchain ecosystem, also began to fall. According to Messari, on May 12 at 5 AM UTC, USDN fell to almost 70 cents. Now the price has risen and is almost close to $1, but it is quite possible that the fluctuations may repeat, bearing in mind that before the USDN was falling sharply.

Most likely, the USDN drop is caused by user worries that the USDN is designed in the same way as the recently fallen UST. Users need to lock the WAVES token into Neutrino’s smart contracts to mint USDN, while USDN redemptions destroy the stablecoin to unlock WAVES supply, thus balancing supply and demand and keeping the stablecoin at the peg.

Problems with stablecoins were also observed before the Terra crisis. Coinbase users who own a stablecoin tied to the yen — gyen — have run into trouble. This stablecoin started trading on Coinbase in November, but quickly lost its peg to the yen and began to fluctuate greatly in price.

Due to fluctuations in the price, Coinbase stopped operations with gyen. Now, users are suing Coinbase for millions in damages.

“Investors placed orders believing the coin’s value was, as advertised, equal to the yen, but the tokens they were purchasing were worth up to seven times more than the yen,” the complaint said. “Just as suddenly, the gyen’s value plunged back to the peg, falling 80 percent in one day.”

The stablecoin market is shaking, and it’s frightening. But, I recommend not to panic and FUD. Keep calm and keep following us.

The total capitalization of the ten biggest stablecoins has grown from January 2017 to today by more than 900K% (from $0.02 billion to $181.73 billion).